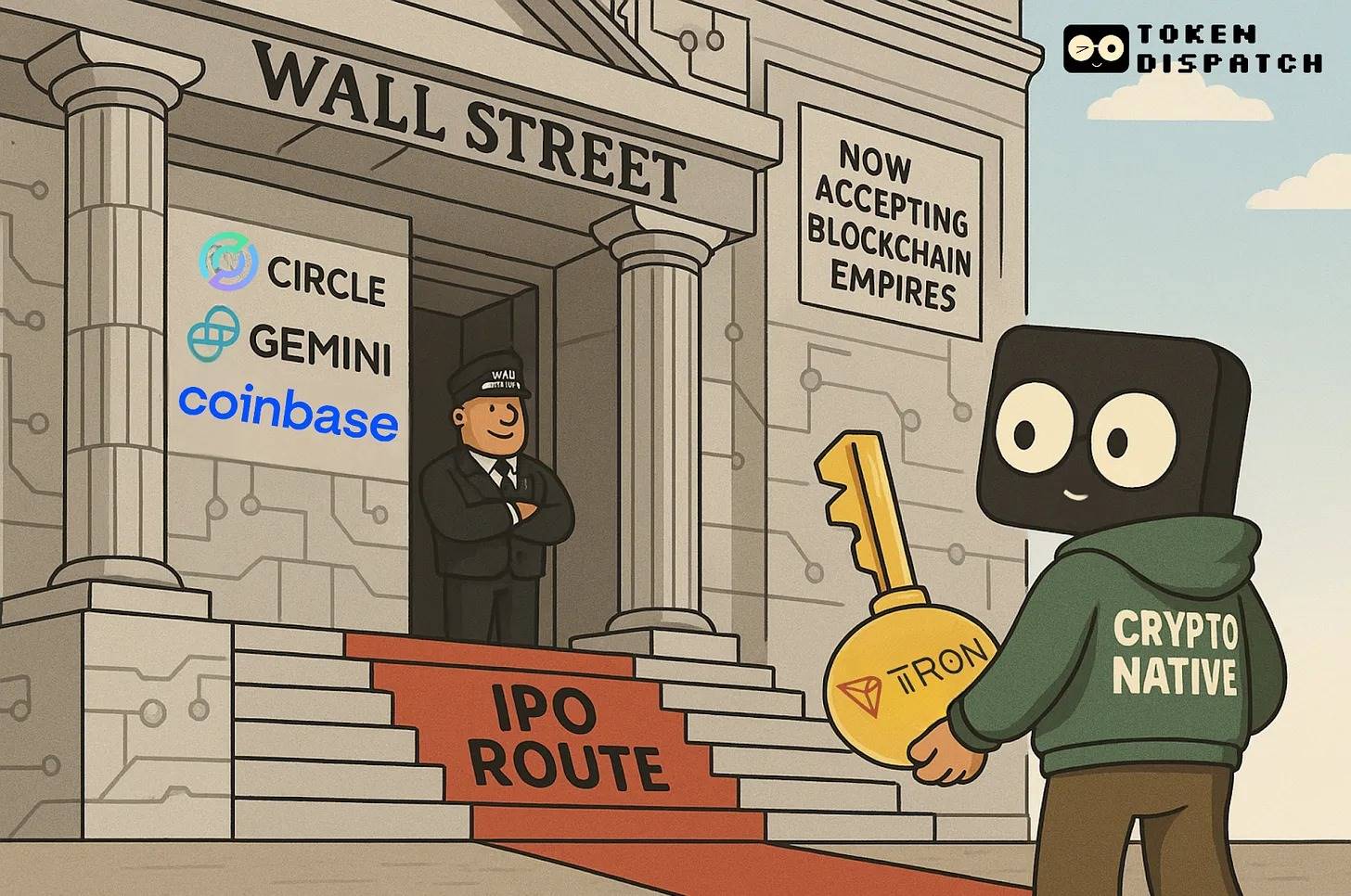

Cryptocurrencies are courting Wall Street

Words: Prathik DesaiCompiled

by: Block unicornForeword

Tron founder Justin Sun took his blockchain empire public through a reverse merger with NASDAQ-listed toy company SRM Entertainment.

Why would a man who started his career disrupting traditional finance now line up at the gates of Wall Street with an IPO prospectus in hand?

Welcome to the big identity crisis for cryptocurrencies in 2025.

– >

– >

rush to Wall Street

fever began with Circle. This month, when the stablecoin giant went public, its shares soared 168% on its first day. The offering was oversubscribed by 25 times: 850 million shares were demanded by the public, while only 34 million shares were actually issued.

– >

– >

Source: TradingView

Circle currently has a market capitalization of over $33 billion, three times the $9 billion to $11 billion it reportedly made from Ripple...