Crypto "Shark Effect": How Does LBank Build a Narrative Loop in Emotional Arbitrage?

With the Bitcoin breaking through a new high of $110,000 in the early hours of this morning, US President Trump issued a special message to celebrate, and a new round of Bitcoin bull market led by institutional funds and long-term capital is accelerating. The frenzy of the market is no longer just the passionate speculation of retail investors, but a process of emotional restructuring and asset repricing driven by macro funds.

On May 21, CoinGecko released a list of the "Top 10 Crypto Trading Platforms in the World", in addition to the regular Binance, OKX, Bybit and other "traditional giants" continue to dominate the list, an unexpected but reasonable name appeared - LBank. This trading platform, which has been working silently on the "cold bench" for a long time, has broken through the encirclement and officially ranked among the top 10 in the world with its accurate bets on the meme market and the first place in the global 100-fold coin asset ratio with its precise bets and strong execution.

This is not an accidental hit, but a structural victory driven by crypto-native culture. What LBank represents is not only a counterattack by the platform, but also a triumphant repetition of meme as a new cycle of capital flow.

Institutional Victory: From Edge Player to Mood Amplifier

It's not for nothing that CoinGecko's report specifically mentions LBank as the "core engine that drove the explosion of the meme market" for being the fastest listing and the first liquidity. According to statistics, in Q1 2025 alone, a total of 366 new assets will be listed on LBank, of which 51% are meme coins. The average daily trading volume of meme assets accounted for 7.42%, an increase of more than 50% over the same period last year. Behind this data is not blind paving, but a "strict selection" that has been carefully screened.

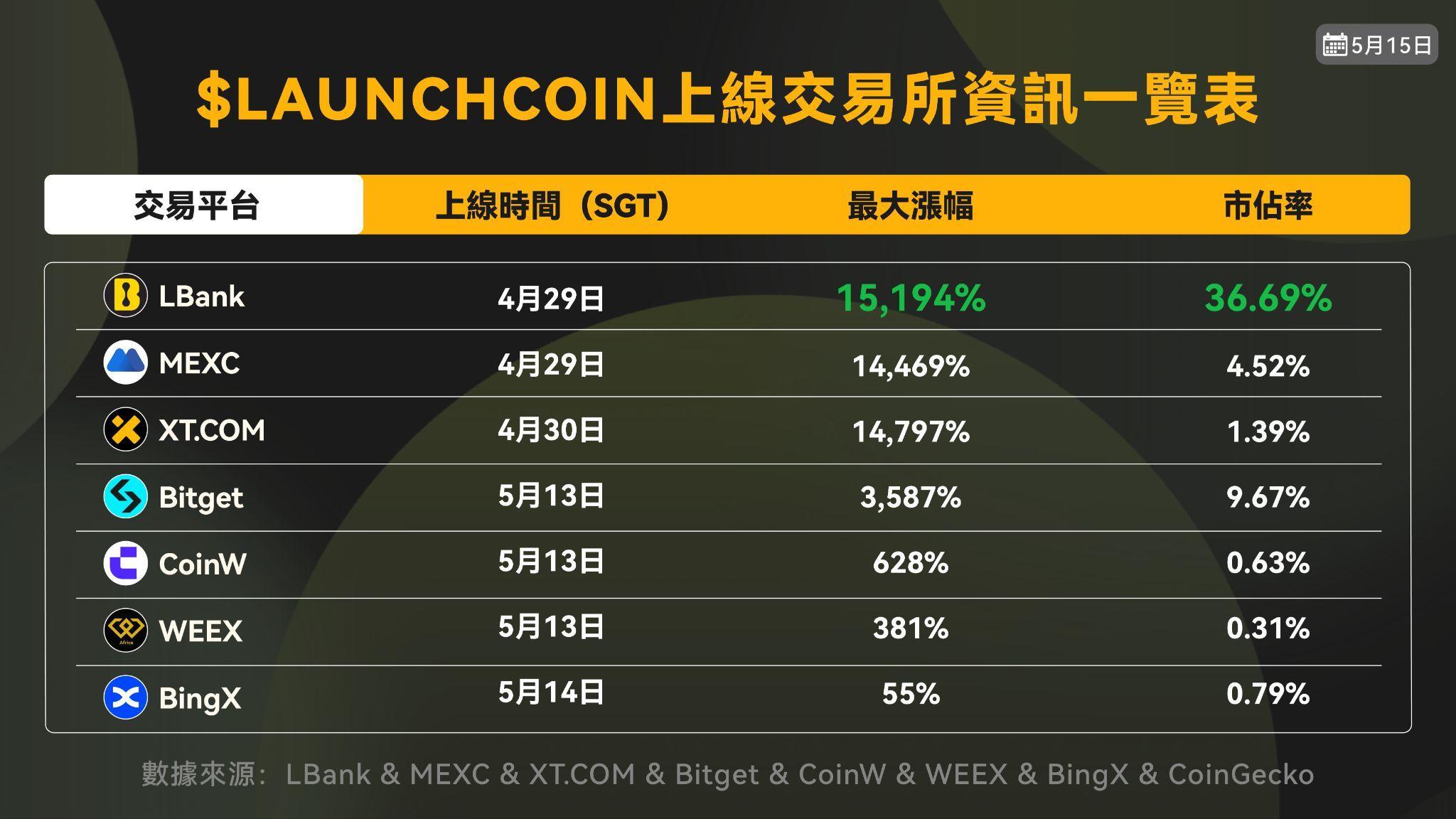

Especially in the context of the recent fierce battles in the on-chain ecosystem such as let'sbook, Pump.fun, and Believe, LBank accurately captured the emotional highs and took the lead in launching popular meme projects such as LAUNCHCOIN, GOONC, and startup, successfully reproducing the hundredfold myth. Among them, MEMEs such as LAUNCHCOIN (+15, 194%) and DUPE (+13, 367%) have risen fiercely, increasing dozens of times in a single week, not only swiping the community, but also allowing a group of users to complete the "first step of wealth freedom".

Not only that, but its listing speed has surpassed that of Binance Alpha, Gate Alpha, Bitget Onchain and other web3 products, most of which are listed on LBank for several months, and the longest time difference is even as long as 6 months. Among them, REX, as the third phase of LBank's Launchpool product, increased by 1, 623% at the beginning of its launch, and launched Bybit perpetual contract on January 9, 2025, and Binance Alpha on May 17, 2025, which fully demonstrates LBank's absolute advantage in high-quality asset discovery and early market capture.

Invisible "liquidity circuit breaker": LBank is a sober person in the bubble cycleWhen

various exchanges fell into "infinite involution" and relied on market makers to create the illusion of on-chain activity, LBank has quietly completed the transition from "the edge of the cryptocurrency circle" to "the preferred platform for meme". This time, it did not copy the Web2 traffic play, but bet on the user's emotional cycle and cultural consensus, and used high-frequency debut + high-quality screening - cutting into the forefront of the emotional cycle with a faster pace.

Its data shows that in Q1 2024, the trading volume of meme coins on LBank accounted for 47% of the total, much higher than the industry average of 12%. This not only reflects the platform's continuous investment in meme assets, but also shows its high stickiness and enthusiasm among the user group, and stabilises the fundamentals in the deep water area of meme.

Take recent hot meme projects as an example:

-

The market share of Believe series LAUNCHCOIN is as high as 36.69%, accounting for almost one-third of the entire market;

-

The classic spoof project RFC once hit 38.12% of the market share;

-

Pre-sale concept projects such as PAIN (27.2%), Abstract TROLL (16.57%), and SHELL (15.52%) also demonstrated LBank's meme liquidity depth.

In order to further strengthen user confidence, LBank has also launched a "transaction compensation" mechanism and set up a $100 million user protection fund to cover high-risk and high-volatility meme assets with extremely high security thresholds and safeguard measures.

Rather than being the "king of the coin platform", LBank is more of a "sober person in the illusion of liquidity". At a time when many platforms rely on "market maker PUA" to achieve the illusion of prosperity and frequently stage "liquid circuit breakers", LBank has retained users in the bubble by relying on real transactions and real emotional reactions. This strategy not only improves the "detonation probability" of LBank's assets, but also completes the cold start of retail consensus when the institution has not yet intervened.

Awards: Value perception is being revaluedFrom

an "altcoin minor" to a "global meme pricing market", LBank is gaining mainstream recognition in the market. To date, LBank has won a number of crypto accolades:

2024.06.05 |Wiki Finance Expo "Best Altcoin & Meme Coin Exchange"

2024.12.24 |Crypto.News "Best Exchange"

2025.03.18 |CoinGape "Best Meme Coin Investment Exchange"

2025.04.01 |UToday "Best Exchange 2025"

2025.04.16 |CoinGecko Reveals LBank's Core Competitiveness: Industry-Leading Listing

Speed2025.04.22 |Forbes Follow LBank: Using Memecoin as a Bridge to Reshape the Global Financial

Channel2025.05.02 The Wall Street Journal mentions LBank on dubai TOKEN 2049 Booths & Offline Events During

thePeriod2025.05.21 |CoinGecko: LBank has become the world's No. 1 exchange in terms of asset ratio of 100 times more

than that, the story of LBank continues to ......

At a time when exchange competition is becoming more and more like a "market-making illusion manufacturing", LBank has taken a reverse path: creating structural trends with emotional understanding, blocking narrative highs with extreme listing efficiency, and then using real liquidity to fulfil users' wealth expectations.

As Twitter user @b 66 ny put it, "Whoever can leverage the narrative in the first place will be able to take on the transaction flow that starts with the narrative." This

is not only the microcosm of LBank's strategy, but also the betting logic of "speed + resonance" for crypto users in the new cycle. LBank, on the other hand, apparently understands the underlying rules of this bet.

In the midst of turmoil and differentiation, the most worth betting on is not the platform with the largest market capitalisation, but the person who understands the user's desire and emotional feedback mechanism best. And LBank is becoming the "one who knows best".