Coinbase's stock price is about to break a new high, and Americans are going to "speculate" pensions?

Author: 1912212.eth, Foresight News

The crypto market has recently ushered in a big rebound, with BTC even breaking through $123,000 to hit a record high, and Ethereum achieving four consecutive weekly gains, successfully breaking through $3,600, and market participation sentiment has rebounded significantly, with the total market capitalization soaring to an all-time high of $3.8 trillion. At the same time, the intersection of the crypto market and the US stock market is also experiencing a significant rally.

Coinbase Global (COIN) stock price hit a high of $415.96 this week and is now just a stone's throw away from its all-time high of $429, when it hit a low of $142 three months ago. Coinbase, the world's largest crypto exchange, has doubled its revenue to $6.6 billion in 2024, and although it declined significantly in the Q1 quarter of this year, the revenue crypto market picked up in Q2, and its revenue performance may pick up.

U.S. stocks and crypto exchange Robinhood also hit its all-time high of $106.64, an increase of more than 3 times from a low of $30 in April this year.

Strategy (MSTR), as Bitcoin's "shadow stock", has a stock price of $442 and has now risen to a record high of $126.8 billion. In March of this year, its bottom was just $231, an increase of nearly 1 times. Strategy is currently among the top 100 publicly traded companies in the U.S. by market capitalization, having a market capitalization of less than $2 billion five years ago. As of July 13, Strategy had 601,550 BTC in its holdings, totaling approximately $72 billion and an average cost of $66,384. MSTR stock price rose as a result.

Other mining stocks such as Marathon Digital (MARA) and Riot Platforms (RIOT) also rose 5%-10% during the week, respectively, stimulated by new Bitcoin highs. Although Tesla (TSLA) is not a pure crypto stock, its Bitcoin reserves (about 10,000 coins) have also indirectly boosted its stock price, with a cumulative increase of about 20% in 2025.

In addition to the sharp rise in the crypto market, what are the positive factors behind it?

Trump will allow pensions to invest in cryptocurrencies and gold

The Financial Times reported that Trump is preparing to open up cryptocurrencies, gold and private equity to the $9 trillion US pension market, a move that will spur a fundamental shift in the way Americans manage their savings. According to three people familiar with the matter, Trump is expected to sign an executive order as soon as this week to open up alternative investments beyond traditional stocks and bonds for 401k retirement plans. These investments will involve a wide range of asset classes, from digital assets to metals, as well as funds focused on corporate acquisitions, private loans, and infrastructure transactions.

This shift was motivated by stimulating economic growth and innovation. The Trump administration believes that traditional retirement investments have low returns (5-7% annualized on average), while assets such as crypto have performed strongly over the past decade. The biggest benefit of this policy is the injection of funds and the legalization of the market. First, even 1-2% of the $9 trillion retirement market allocated to crypto could bring in tens of billions of dollars in new funds. Second, policies will accelerate institutional adoption and mainstreaming of crypto. Pension funds are long-term holders, and their entry will reduce market volatility and provide more stable liquidity.

This will directly drive up the prices of mainstream cryptocurrencies such as Bitcoin, Ethereum, and XRP. Historical data shows that similar institutional inflow events, such as the approval of Bitcoin ETFs, have caused BTC prices to rise by more than 30% in a short period of time. This incremental funding will amplify the bull effect, drive Bitcoin prices higher, and spur the return of altcoin season.

The Fed is expected to cut interest rates in the second half of the year

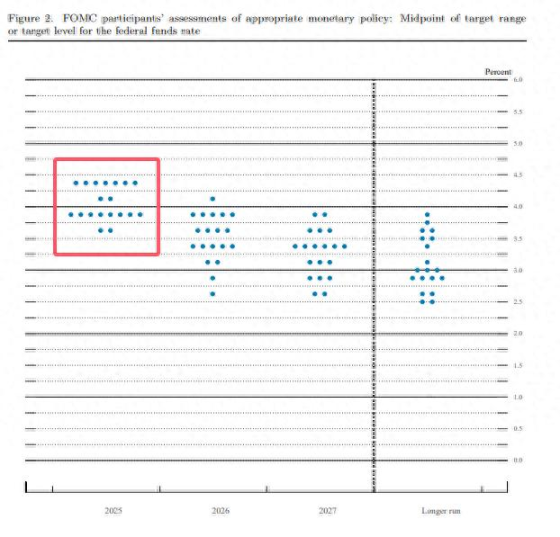

This is reflected in the Fed's latest economic forecast released in June. Forecasts at the time showed that 10 of the 19 officials in attendance expected at least two rate cuts by the end of the year, while 7 believed no rate cuts until 2025, reflecting different internal judgments on the inflation outlook.

(Fed June SEP mid-dot plot)

This divergence directly affects the market's policy expectations. Data on Polymarket shows that the probability of a 50 basis point rate cut this year is currently only 35%, while the probability of not cutting interest rates has risen to 18%, reflecting the market's pessimistic expectations for interest rate cuts.

Despite recent hawkish remarks from a number of officials, investors have not completely given up hope for interest rate cuts. The market sees a slightly higher than 50% chance that the Fed will decide to cut interest rates at its September policy meeting. According to CME FedWatch data, the probability of a 25 basis point rate cut in July is 4.7%, and the probability of keeping interest rates unchanged is 95.3%. The probability that the Fed will keep interest rates unchanged by September is 33.9%, the probability of a cumulative rate cut of 25 basis points is 63.1%, and the probability of a cumulative rate cut of 50 basis points is 3%.

Fed's Daly said that two rate cuts this year is a reasonable expectation. Trump also continued to publicly express his dissatisfaction with Powell on social media, putting pressure on him to cut interest rates.

When the Fed's rate cut is about to be determined, risk assets will be ready for a bigger wave of gains.