Can Bitcoin Price Hit ATH Amid This Soaring BTC Institutional Interest

Key Insights:

- Bitcoin price is holding above $106,500, a long-term support confirmed by multiple rebounds since March.

- Analysts identify $110,545 as the breakout level needed for BTC to enter a new price discovery phase.

- Monthly support zones at $102,464 and $104,685 create a foundation for a possible rally to fresh highs.

Bitcoin price formation has persisted to consolidate at high levels above important technical and on-chain support areas, as several signals suggest continuation of a long-term bullish trend. With the leading crypto topping over $108,000, analysts say that the mid-term picture is becoming defined by the institutional purchases and the rotation of holders.

Recent positive impulse has placed BTC near the $111,000 mark, which begs the question whether a new peak is in the offing not long from now. The last breakout above historical resistances put Bitcoin price in position to start a second round of discovery phase.

Bitcoin Price Prediction: Reaccumulation Range and Technical Supports

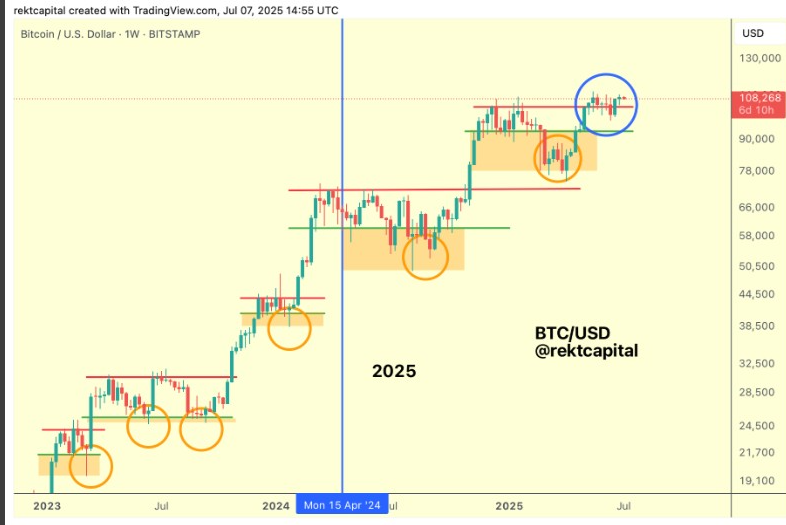

According to technical analyst Rekt Capital, Bitcoin price has maintained its position above the $104,400 Range High. This level previously acted as resistance in the ReAccumulation range.

Over the past seven weeks, BTC price has retested this zone multiple times, suggesting that it has now turned into a structural support. Weekly and monthly chart data also confirm the presence of confluence zones around $102,464, $104,685, and $107,244.

These higher-timeframe supports are now considered essential in sustaining the asset’s potential second price discovery uptrend.

On the monthly chart, Bitcoin price recently closed above the $102,464 Range High and followed it with a clean retest, leading to July’s upside candle formation. The ability of BTC price to hold this zone has now attracted renewed trader confidence.

Analysts believe that maintaining support across this stacked region could serve as a foundation for a new high above $111,000.

At press time, the top crypto was trading at $108,800, up 2.39% over the past 7 days. Its market capitalization stood at $2.16 trillion, while 24-hour trading volume surged 17.45% to $47.61 billion.

Institutional Accumulation and Bullish Market Setup

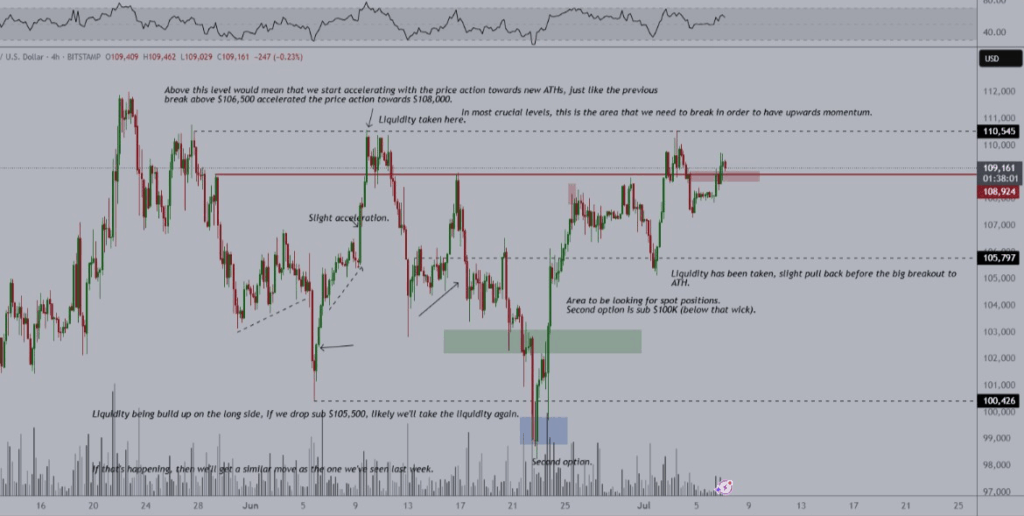

According to analyst Michaël van de Poppe, Bitcoin price action on the 4-hour chart presents an ideal setup for breakout. The asset is trading just below $110,500, a resistance that has historically capped rallies.

A recent liquidity sweep above $110,545 triggered stop-loss orders, followed by a clean retest of the $109,000–$110,000 area. This trend indicated that traders are actively defending these levels, while buyers continue positioning for a breakout.

These zones now act as key re-entry levels for institutional and retail spot buyers. With market structure showing liquidity buildup, analysts have outlined that clearing the $110,545 may result in breaking new all time highs.

Long-Term Holders Begin Rotating

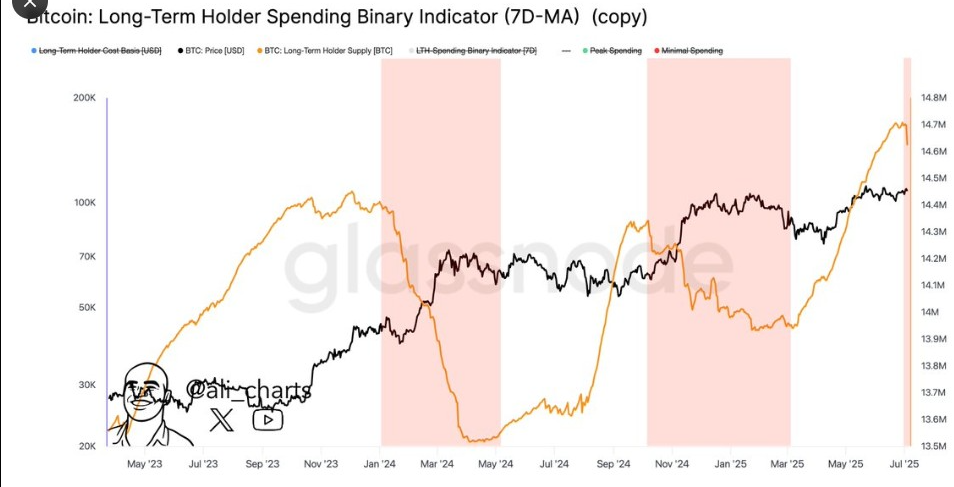

Additionally, Glassnode’s Long-Term Holder Spending Binary Indicator, as shared by Ali Martinez, has revealed that some seasoned holders have begun taking profits. This trend followed a peak in the long-term holder supply metric and a decline afterward, signaling rotation rather than panic selling.

In past cycles, similar reductions occurred just before temporary cooling phases.

This shift may be driven by Bitcoin price gains since early March. These profit realizations may not signal a reversal but show that strategic exits are happening in this cycle. Ali Martinez emphasized that these trends align with bullish structures, provided BTC price remains above key support.

Higher-Timeframe Confirmation and Short-Term Range

Bitcoin price is currently locked in a short-term consolidation range between $104,400 and $111,000. The most recent weekly close marked Bitcoin’s highest on record, narrowly above the previous final resistance.

According to Rekt Capital, this suggested an early stage breakout, although a clean retest may involve volatility. More so, the invalidation of a previous lower high has now turned into fresh support, reinforcing the bullish setup.

If BTC price manages a sustained break above $110,545 with volume, traders expect momentum to carry the asset toward new all-time highs.

At the time when BTC adoption by institutions has been on a rise, Bitcoin strength has been in unison with the accumulation pattern of Metaplanet. The company based in Japan purchased 2,205 BTC worth $238.7 million, and the total number of the crypto owned by the company exceeded 15,555.

Metaplanet is currently seeking larger targets of being the fourth-largest holder of corporates of Bitcoin at the end of the year.

The post Can Bitcoin Price Hit ATH Amid This Soaring BTC Institutional Interest appeared first on The Coin Republic.