Bitcoin Cash Among Top Gainers But Will It Maintain The Trajectory?

Bitcoin Cash has surprisingly emerged as the best-performing crypto among the top 100 coins by marketcap in June. It managed to edge out the competition by a significant margin but can it sustain the trend?

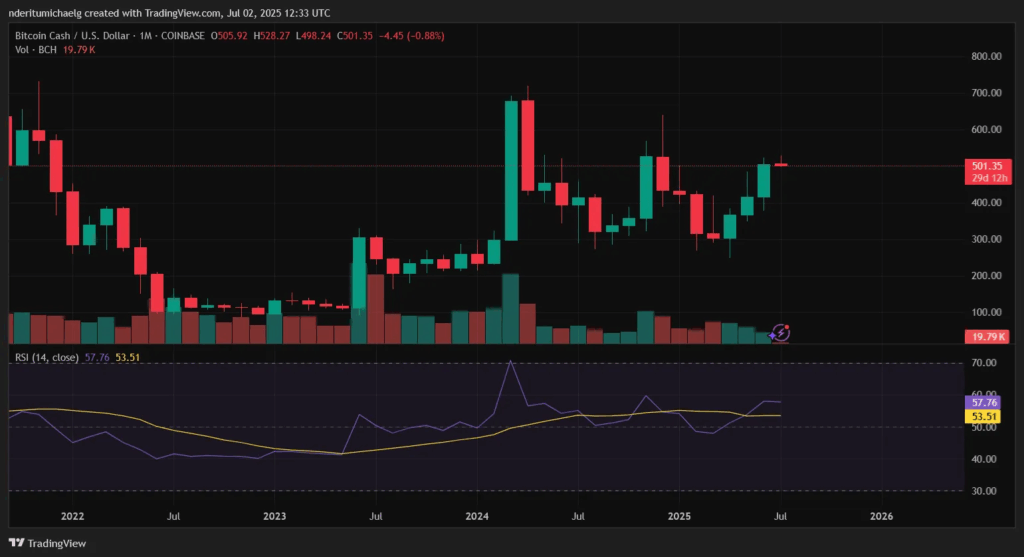

BCH price achieved an impressive 21% rally from its opening to closing price in June. For context, BTC only pulled off a 2.38 percent during the same 4-week period, while ETH was down by 1.71%.

The bullish momentum that Bitcoin Cash experienced in June was a continuation of its previous 2 months. The cryptocurrency experienced an aggressive recovery in the last 3 months.

The latest rally saw it push as high as $528, meaning it doubled from its $249 low in April. BCH pulled off an impressive 114% gain in Q2 2025. In other words, it recovered to levels previously tested before its bearish performance in Q1 of the same year.

Whether the cryptocurrency could maintain more upside or pivot in favor of the bears remained unknown. However, some observations may offer insights into its next potential outcome.

For example, price formed a bearish divergence with the RSI. The latter signaled declining momentum and the pattern usually underscores a price pivot.

Zooming out on the BCH price chart revealed the potential formation of a descending trend line. A retest of the same trend line may occur near the $550 price tag, which means that Bitcoin Cash had room for more upside at its press time price level.

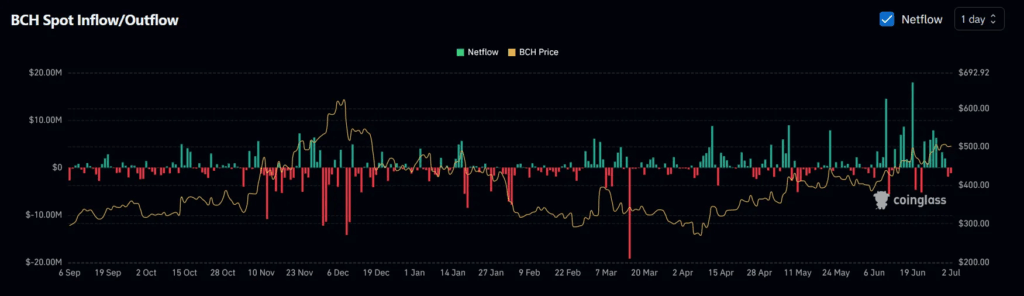

Spot Inflows Maintained Dominance in June

BCH on-chain data revealed that it managed to maintain a robust rally courtesy of healthy liquidity flows. Spot flow data revealed that spot inflows were dominant during the month, which was in line with the buy pressure.

The data also revealed that there was limited selling pressure, which may have aided in the upside. It did, however, reveal a cooldown in inflows, as well as some sell pressure, albeit limited.

Meanwhile, the derivatives segment yielded an open interest surge during the last 4 weeks. Open interest surged from as low as $285 million to over $591 million during the same period.

However, it was relatively low compared to the likes of Bitcoin and Ethereum.

Volumes in the derivatives segment were notably high in June as more traders jumped on board. This could potentially yield more price volatility since a surge in open interest may lead to more liquidations. But despite the surge in derivatives activity, prices still maintained an overall uptrend.

The bullish outcome highlighted an unwillingness to sell, which might be explained more by the cohort of holders invested in Bitcoin Cash.

Bitcoin Cash Long-Term Holders Deep in the Money but Still Unwilling to Sell

BCH bullish price action in June did highlight an unwillingness to sell, which was a reflection of holder activity. According to IntoTheBlock, long-term holders accounted for 98% of investors who have been holding BCH for over 12 months.

Only 2% of the coins in circulation were acquired in the last 12 months. This confirmed that long-term holders were the most dominant cohort of holders, and they maintained the same long-term focus, hence the weak sell pressure.

Moreover, large holders accounted for 39% of the BCH coins in circulation. As for profitability, 82% of holders were profitable at press time while 17% were out of the money.

The decline in short-term holders could potentially allow Bitcoin Cash to continue holding on to most of the value gained in the last 3 months. It was also still heavily discounted from its 2021 peak even after its recent upside.

The post Bitcoin Cash Among Top Gainers But Will It Maintain The Trajectory? appeared first on The Coin Republic.