Behind the AI boom, how can short-term hype feed back long-term fundamentals?

Original title: AI Trends in the Trenches

Original Author: @Defi0xJeff

Original compiler: zhouzhou, BlockBeats

Editor's note:The AI Agent project has attracted short-term attention due to Genesis' pull-up, but institutions are more concerned about decentralised AI infrastructure such as $TAO, $GRASS, etc. Market trends show that storytelling + technology teams have more long-term potential. The strategy is to short-term speculation on the Agent project, roll profits into the DeAI infrastructure, and bet on teams that can tell good stories and do technology.

The following is the original content (the original content has been edited for ease of reading and comprehension):

has been about two and a half weeks since the bottom of the AI proxy market (about $4 billion market capitalisation), and the market is currently in a complete @virtuals_io bull market.

That's right...... Only Virtuals is on the rise at the moment. It's a lot like last October-November when Virtuals first launched its proxy tokenization platform, when it established itself as a pioneer in the "tokenization" of AI projects and was the first full-fledged player to offer a top-tier issuance network (provided you're willing to do a "fair launch").

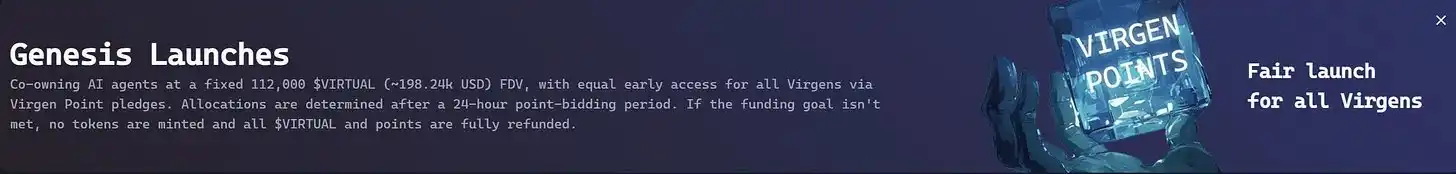

What's different this time is that they've just launched a new feature: Genesis Launch, a fairer way to distribute and give back to early supporters. This also leads to the first trend we want to talk about:

Fair Launch/Gamified Launch Platform

From the previous degen players rushing some messy tokens on pumpfun, to now it is almost a brand new project with a "guaranteed earning" 5-10x return.

Behind this is the introduction of a "points" mechanism to better bind the interests of all parties, coupled with a fixed-market capitalisation, fixed-supply launch model - each project starts at 112,000 $VIRTUAL (about $200,000 FDV). Each participant can receive up to 0.5% of the token share based on the points they earn. Points can be earned by holding/staking $VIRTUAL, holding major proxy tokens (they have an official list), and even actively discussing Virtuals on social platforms.

Virtuals has recently added a "cooling-off" mechanic that restricts quick selling, further enhancing the appeal of Genesis Launchpad – make you think twice before you sell.

The Genesis Launch platform has been a notable success, @BasisOS is the most successful example to date, with participants receiving up to 200 times the reward. Since then, Virtuals has almost always launched new projects with a return of 5x to 40x.

It is precisely because of the explosion of Genesis Launch that funds and attention have been refocused on the Virtuals ecosystem, raising the valuation floor of almost all agency projects on the platform.

However, despite the resurgence of market heat, the "scarcity of high-quality projects" is still one of the biggest problems in the Virtuals ecosystem - which leads to the second trend:

2. The heat and deal structure overwhelm the quality

As a speculator/trader, as long as you understand the structure of Genesis Launch, you can make money even for projects with average projects and mediocre teams.

Because a project that starts with a valuation of $200,000 is likely to pull a wave first and then smash it, especially if you know that the project has no "ghosts" and has not done a private equity round.

As a project party, if you have a relatively novel idea, you can issue coins first.

You don't need to make a product first, you don't need to figure out who your target users are, and you don't need to verify whether there is real demand in the market, let alone revenue and user growth. Directly create the maximum heat and start the rush (if you have a demo of course plus points, it doesn't matter if you don't, laughs).

As long as the project meets the basic requirements (a decent white paper, a product concept that makes sense, and the team doesn't look too collapsed), it can basically take off on Virtuals' Genesis Launch.

The most important lesson for investors here is to treat these launches as short-term speculative opportunities, not as medium- to long-term value investments.

Because nine times out of ten, these so-called "AI projects" are essentially packaged like AI shitters. I also gave a very typical example on my Substack, so if you are interested, you can check it out.

But because there are so many shitters now, opportunities for truly high-quality projects have emerged – whether it's the AI track, or other directions outside of AI. This leads to a third trend: