After the Genius Act, clarify what the bill should focus on

Written by: Zuoye

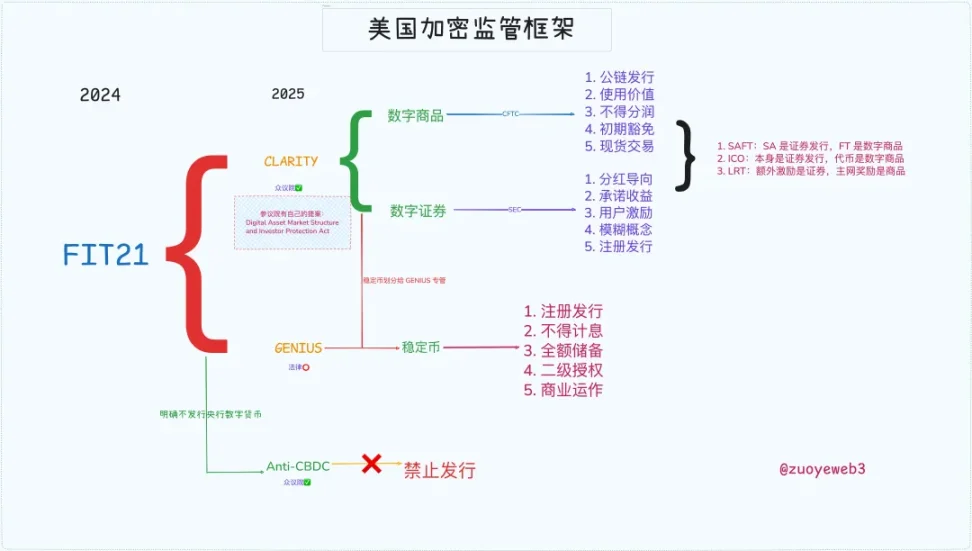

Crypto Week triple hit, the genius bill deals with stablecoins, which has become law, and the anti-CBDC bill and the CLARITY clarity bill are still in the legislative process.

Unlike the Genius Act, CLARITY defines the fundamentals of cryptography and allocates authority, especially public chains, DeFi, token issuance, as well as the powers and responsibilities of the SEC and CFTC, and it is closely related to the FIT21 Act of 2024.

Caption: U.S. crypto regulatory framework, image source: @zuoyeweb3

Accordingly, the United States has built a complete regulatory framework extracted from past practice, and only by understanding history can the future be clear.

Financial liberalization, the wild new west

Minting rights and inflation, the Fed sticks to the former in the name of controlling the latter, and Trump abandons the latter in the name of amplifying the former.

The Genius Act ushered in the era of free stablecoins, and the independent minting rights that Powell insisted on were divided and returned to Silicon Valley upstarts and Wall Street old money, but it was not enough, Peter Thiel wanted the absolute freedom of libertarians.

In 2008, when the financial crisis put financial derivatives in the spotlight, Obama urgently needed professionals to help him restrain the $35 trillion futures contract market and the $400 trillion swap market.

As a result, Gary Gensler was nominated as CFTC chairman and the Dodd-Frank Wall Street Reform and Individual Consumer Protection Act was introduced in 2010 to bring derivatives markets into the existing regulatory system.

Gary claimed that "we must domesticate the Wild West", and this is the first time Gary has defeated the market from a regulatory level.

History is a cycle, and in 2021, Obama's comrade-in-arms and then-President Joe Biden once again nominated Gary Gensler as SEC chairman in an attempt to circular a new western frontier - cryptocurrency.

There are two focuses:

1. The SEC has no dispute that BTC/ETH is a commodity, but it considers it an illegal securities offering for other tokens and IXOs, including SOL and Ripple.

2. In response to the exchange's high leverage practices, Gary believes that this is "inducing" users to launch special regulatory actions against onshore and offshore companies such as Coinbase and Binance.

In 2021, the SEC approved Bitcoin futures ETFs, but the spot ETFs proposed by Grayscale and others have always tightened their teeth.

But unfortunately, or not, in 2024, after the SEC lost part of the IXO lawsuit against Ripple, the SEC finally approved the Bitcoin spot ETF, and MicroStrategy was able to play the currency stock-bond cycle with a bright future.

This time, cryptocurrencies represent the wilder side, conquering the SEC, CFTC and the White House as well as Congress, but also the Federal Reserve and Wall Street, and the era of undefended has arrived.

As a small footnote, SBF successfully sent himself to prison in 2022 by donating tens of millions of campaign funds to Biden, which may be an important reason for Gary's strict stance on the crypto industry.

Clarity Act, crypto has a legitimate name from now on

Trump's favor will be reciprocated, and the crypto industry will be bright from now on.

In 2025, as a relic of two Democratic presidents, Trump chose Fired Gary as soon as he took office, and chose Paul Atkins, with whom he had been friends since 2016, to succeed him, and began complete laissez-faire.

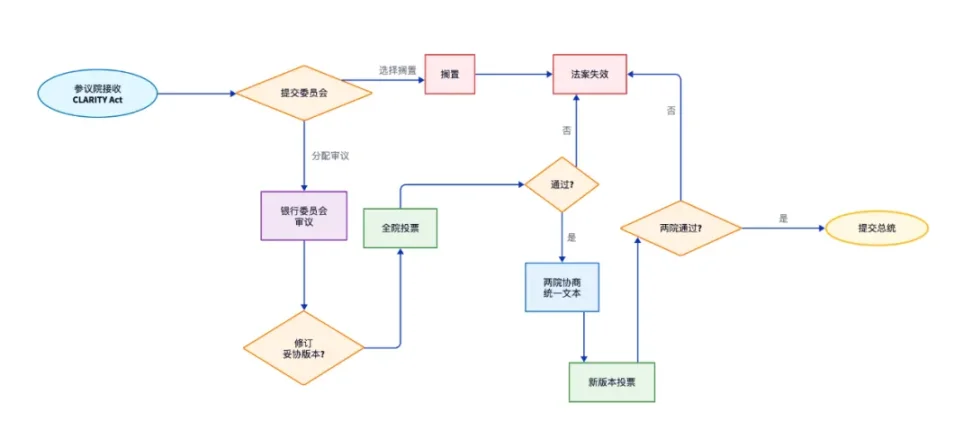

The clear bill is proposed in this context, but it must be stated that the clear bill is still in the legislative process, and it has completed the House process and needs to pass the Senate review.

The Senate also has its own Digital Asset Market Structure and Investor Protection Act, but with a Republican-dominated agenda, crypto-friendliness is inevitable.

Photo caption: Clarify the follow-up process of the bill, image source: @zuoyeweb3

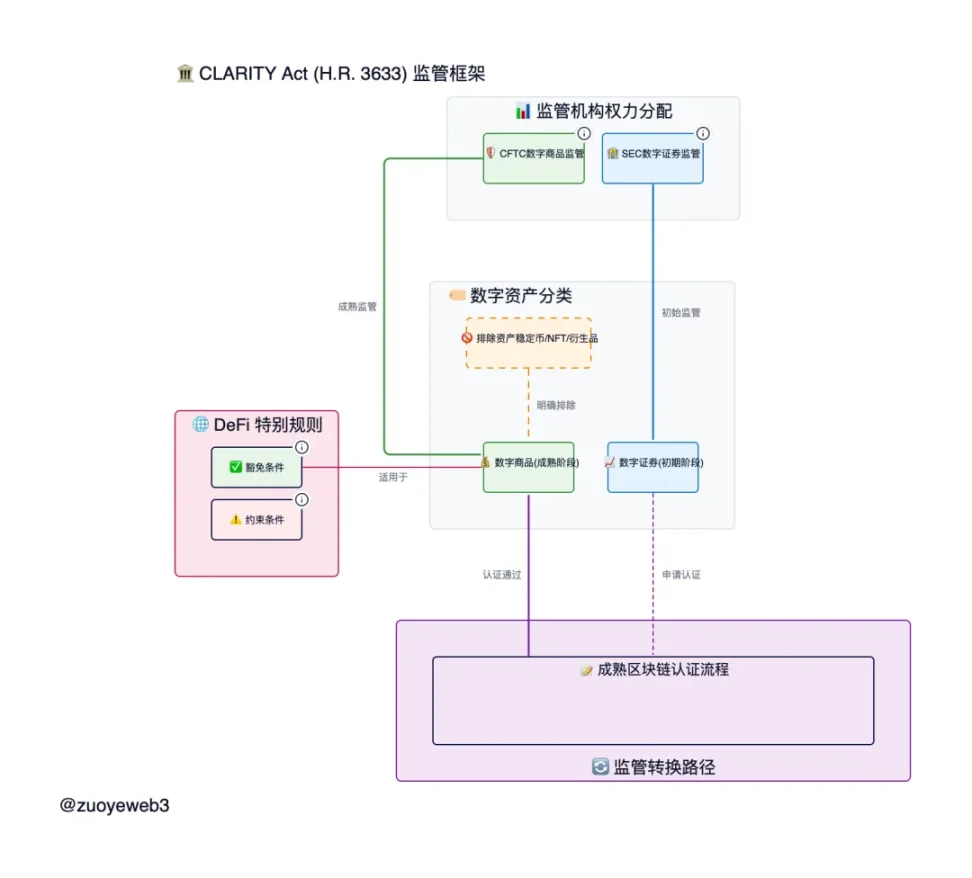

The current clear bill is designed to frame digital commodities, digital assets and stablecoins, preferably limiting stablecoins to the form of payment, followed by digital commodities managed by the CFTC and digital assets handled by the SEC.

Photo caption: CLARITY Act regulatory framework, image source: @zuoyeweb

1. CFTC wins big: Clarify the status of ETH and CFTC, blurring the boundaries between SEC and asset issuance.

ETH is a commodity, and true decentralized public chain tokens are commodities, and their transactions belong to the CFTC, and financing such as IXO and SAFT is still managed by the SEC, but there is an exemption of $75 million, and the token after issuance is exempt from penalties if it becomes decentralized within four years.

2. Digital goods are digital in form and commodities in content.

Keeping up with technological developments, we will no longer roughly divide the form of "physical goods" and "virtual assets", and recognize the existence of digital commodities, as long as they have practical value for public chains, DeFi, and DAO protocol operation, and they are no longer securities.

But! NFTs must be assets, not commodities, because they are different, only have "hype" or appreciation value, and cannot be used as a unified exchange intermediary similar to currency.

This definition is still too abstract, in essence, it is clear that the bill distinguishes between the token issuance process and the token operation process, the following three cases are the cases I classify, if there is a problem, please correct it:

-

IXO issuance is a security, and issuing tokens is not if the conditions are met

-

Airdrop points are securities, but airdrop tokens are not if they meet the conditions

-

Exchange distribution is not a security, but the promised income is

Meeting the conditions refers to the definition and basis of digital goods, and promises to convert to a decentralized protocol in the future, and does not need to be traded through intermediaries, but it should be noted that participating in the project itself is an investment, and if it is expected to obtain benefits, it is participating in asset issuance.

It is unclear how to define it in the future, but many past cases can find the basis for division:

-

ETH is a digital commodity, but using SAFT to finance projects is a digital asset issuance that is managed by the SEC, but if it is converted to a fully decentralized protocol in the future, it will be a digital commodity and will be handled by the CFTC.

-

ETH native staking is also a commodity, which is a "system behavior" that maintains the PoS characteristics of the public chain, but it is unknown whether tokens issued by third-party DeFi staking protocols can be considered commodities

-

Ethereum is a blockchain, but many L1/L2 issued by SAFT or IXO have four years to complete decentralization, with a single centralized control token or voting ratio of no more than 20%

The Clarity Act is indeed very detailed, setting the framework for joint supervision by the SEC and CFTC, and digital commodities take into account the different characteristics of both virtual securities and physical commodities, and do require a joint process between the two.

epilogue

The Clarity Act is an important part of crypto regulation in the United States, basically defining the core issues of tokens and public chains, clarifying the definition of digital goods, and the rest is naturally assets, such as NFTs, stablecoins, and tokenized assets (RWA).

However, the operation of DeFi is still in a blurred area, although the Clear Act has amended the definition of the Securities Act, but DeFi is too important, just like the Securities Act, the crypto market also needs a special DeFi Act, not crowded with stablecoins, public chains, and tokens.

This is not an inch, just as the Tornado Cash case is still ongoing, and the fate of one of the co-founders, Roman Storm, will become a litmus test for judicial reversal legislation.