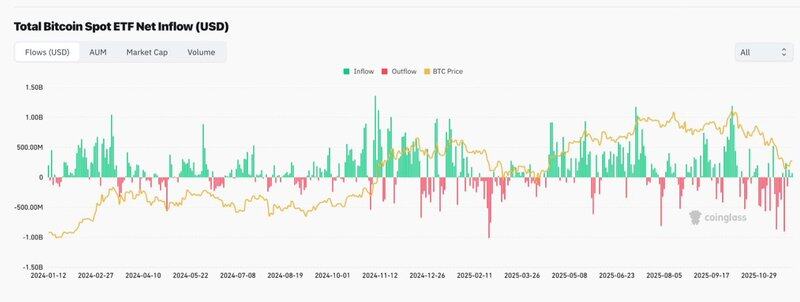

Spot Bitcoin ETFs just proved they are the new price-setters.

November’s sell pressure didn’t weaken their influence; it confirmed it.

U.S. spot Bitcoin ETFs posted $3.48B in net outflows for the month, their weakest since February.

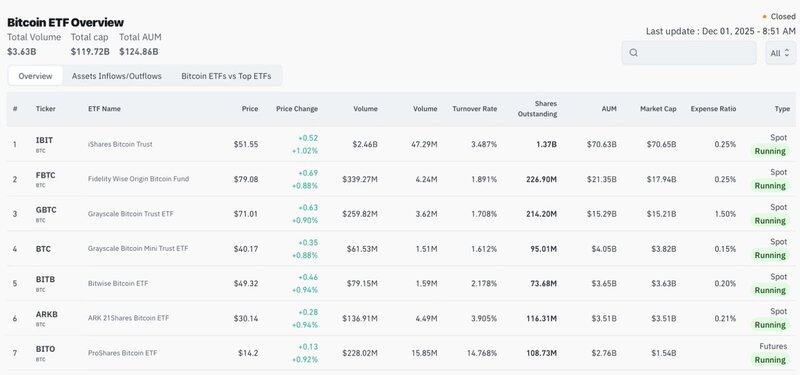

➣ Cumulative Bitcoin ETF net inflows: $57.7B

➣ Bitcoin ETF AUM: $119.4B (6.6% of BTC mcap)

➣ November Bitcoin ETF outflows: $3.48B

➣ November Ethereum ETF outflows: $1.42B (record)

➣ IBIT November outflows: $2.34B ($523M in a single day)

➣ New altcoin ETFs ($XRP, $SOL, $LTC): steady weekly inflows

The outflows triggered the $BTC dip, and that’s the point.

ETFs now drive the marginal price in both directions.

When they buy, $BTC rallies.

When they sell, $BTC corrects.

Dominance is not about always pumping the market.

It is about being the flow that the market must follow.

That is how a mature ETF regime asserts itself.

16.27K

16

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.