excellent analysis, agree with the 26 bottom, but also would be interesting to see price action around the AFs average buys around 23.

Back in April, we bottomed just slightly lower than the AFs avg price

Willing to allocate spot around this area and hold thru any short term vol.

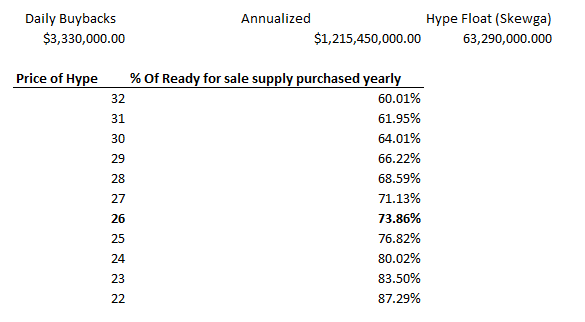

Here's my thoughts on HYPE short term flows. I was tracking these metrics pretty much daily for the last year.

When price was around 9-13, buybacks were 70-80% of float.

I think a big part of that was forced tax selling.

Now we are approaching team unlocks and capital gains.

I don't think team unlocks are an immediate concern, because the team sold a very small amount of supply (11m) so far despite having access to 2b.

The sales should not be 200m a month (assuming every unlocked token is market sold immediately), probably closer to 6m+ (assuming Jeff is true to his word and holds his HYPE).

I think capital gains selling could create a similar environment to tax selling, but capital gains selling isn't forced like tax selling was. These sellers are able to pick the exact price they want to sell.

So I don't think we will get to 80% of float being bought back per year. But assuming a similar environment to April's forced tax selling, it would be around 26 bucks as a "floor".

I have been watching staked HYPE closely. I excluded the big Paradigm staking event (as those tokens would not hit the market short term). Based on that, staking is basically in free fall. This is a good sign to me (since we know from studies of stuff like GMX and HYPE that unstaked = likely sold quickly within a month), so this means there is less future selling.

In terms of buying, Atlas Merchant Capital did tell us that they are highly confident the DAT deal will close by December 2nd, 2025. That would introduce around 265m of short term net buying.

Keep in mind I did not try to forecast future revenue or anything. This is just based on current flows / revenue.

1.46K

7

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.