We now have $300B+ in stablecoin TVL, yet $2.2B was stolen in 2024.

No institution will move trillions on-chain under those risks.

Web3 security is now the backbone of everything. 🧵🔽

Institutions have made serious moves in web3, via ETFs first and by deploying assets directly on-chain.

But one central brake on deploying serious capital is security.

The technical complexity combined with frequent vulnerabilities keeps them on the sidelines.

The institutions are coming (real).

Massive fintech giant Interactive Brokers leads a $104M Series D investment in Zerohash at $1B valuation.

They are planning to launch a stablecoin product & go deeper into crypto.

With the tailwinds around a more positive U.S. regulatory landscape, this is the first of many banks to expand their digital asset products.

We are onboarding TradFi by the day now. Huge news.

Just last year alone, DeFi losses exceeded $2B, which at the time was over 3% of DeFi TVL.

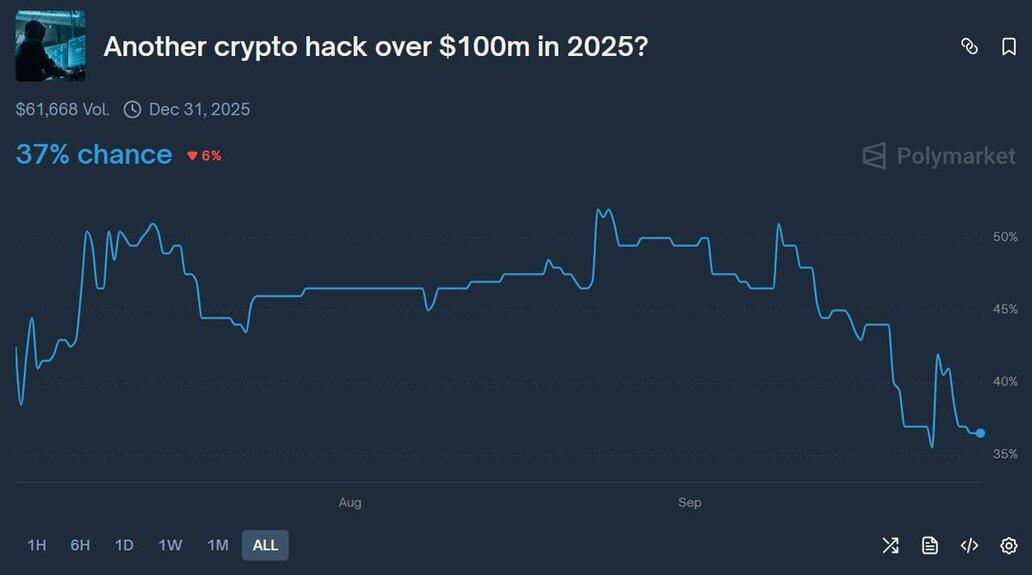

Prediction markets like @Polymarket put ~40% odds on another $100M+ hack in 2025.

It’s hard to imagine investment funds risking trillions under those conditions.

This is where @immunefi makes the difference.

It’s the web3 security layer already protecting 95% of DeFi TVL.

They safeguard $180B+ in assets, have prevented $25B in potential hacks, and have paid $125M+ to whitehat researchers.

No one else matches that record.

They pioneered crypto bug bounties and scaled them to record size, paying the largest in history, $10M for a single exploit.

60,000+ researchers hunt bugs on the platform, and 30+ have become millionaires from their findings.

It’s not just a bounty board.

Immunefi runs a full security infrastructure stack, audits, monitoring, and on-chain response tools that major protocols like Ethereum, Lido, Aave, Chainlink, and Arbitrum rely on every day.

The results speak for themselves, $25B+ in user funds saved and countless catastrophic exploits averted.

Backers include Samsung, Polygon, Electric Capital, and Framework Ventures.

If you’ve used DeFi, you were likely protected by Immunefi without even realizing it.

Institutions are already making serious moves into web3 with RWAs, DeFi, BTC, and stablecoins.

But the final unlock is trust.

Immunefi has positioned itself as the default security layer for all of web3, with the potential to unlock the last institutional phase.

That’s why all eyes were on Sep 30 at Token2049 Singapore, where the $IMU token was officially announced.

Its purpose is to align the interests of the three key stakeholders: protocols that need security, researchers who provide it, and end users seeking safe yield.

The future of Immunefi is now here.

We’ve officially announced the Immunefi Security OS: end-to-end, enterprise-grade security infrastructure to stop hacks before they happen, powered by the Immunefi Token (IMU).

Once live, the token will align incentives across protocols [that need security], researchers [that provide it] and end users [that seek safe yield] on the basis of the fundamental idea of…doing well by doing good.

The token has not been released yet. We will make an announcement sharing TGE date, including the tokenomics. So don’t get scammed.

The Security OS is a single command center that aggregates all security products in one place and integrates them with each other.

What that means: every time you use one product, all other products improve in effectiveness for you. It’s an intelligent, living ecosystem.

The command center has bug bounties, audit competitions, audits, PR reviews, monitoring, multisig transaction review, and more.

And today, we announced two major products:

1. The Immunefi Firewall, Powered by Dedaub

It’s a protocol-controlled firewall that blocks exploits in real time without breaking composability/DeFi integrations.

It has a 96% exploit blocking rate, tested across a dataset of 525 hack and 20.9K benign contracts. If this firewall had been in place across the industry at the beginning of this year, web3 would be a very different place today.

The firewall also is designed for DeFi’s lego-like ecosystem, making it a completely unique product. It surgically blocks bad actors without halting legitimate transactions, which continue uninterrupted through a seamless onchain integration.

And for protocols that love optionality, the firewall is totally configurable for each protocol’s logic and risk profile. Protocol teams maintain granular control over what gets allowed or blocked, unlike generic solutions where you’re stuck with default settings.

It’s incredibly easy to integrate with most smart contract protocols and will be deployable across Ethereum mainnet, major L2s, Avalanche, and more coming soon.

Every team needs this. DM for early access. Spots limited.

2. Immunefi’s Code Review Agent

The Immunefi Code Review Agent plugs right into your GitHub to provide security reviews for all your pull requests.

Most importantly, it’s powered by the world’s largest and private dataset of live web3 vulnerabilities.

➡️ Real-time reviews: Uses Immunefi’s ever-growing dataset to pinpoint actionable issues based on real web3 vulnerabilities.

➡️ Learns intelligently: As you accept and decline recommendations, the Code Review Agent learns from your feedback and improves its pattern recognition.

➡️Pairable with human reviews: Activate human reviews, the Code Review Agent or both.

➡️ Privacy conscious: Secure your code from human access with AI code review-only options.

➡️Scalable and fast: Reviews can occur concurrently across multiple repositories and PRs while balancing speed and quality.

—-----------------------------------------------

The new journey of Immunefi begins today as the security rails bringing trillions onchain.

We have the trust, the data, and the distribution.

Together, we will make web3 safe.

Protocols will be able to stake IMU to gain priority access to advanced security tools, while researchers will earn IMU rewards based on the quality and impact of their discoveries.

End users will benefit from yield opportunities directly tied to secured protocols.

In this way, IMU becomes a productive asset: it protects, rewards, and fosters collective vigilance.

The token’s issuance will follow a progressive schedule with a capped supply, designed to encourage long-term commitment and limit purely speculative behavior.

You should keep an eye on Immunefi, they hold a central role in Web3 and cover a really important area.

Follow them closely and stay alert for their latest announcements, they might drop other alpha you can benefit from.

That's a wrap!

Mention some CTs friends:

@0xJok9r

@belizardd

@AlphaFrog13

@zucl1ck

@Mr_Lumus

@poopmandefi

@defiprincess_

@Hercules_Defi

@Only1temmy

@TweetByGerald

@0xAndrewMoh

@Haylesdefi

@DeRonin_

@kem1ks

@cryppinfluence

@0xDefiLeo

@alphabatcher

@DOLAK1NG

@splinter0n

6.16K

26

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.