In Jan 2024, @MorphoLabs broke the mold and created the first scalable permissionless lending protocol

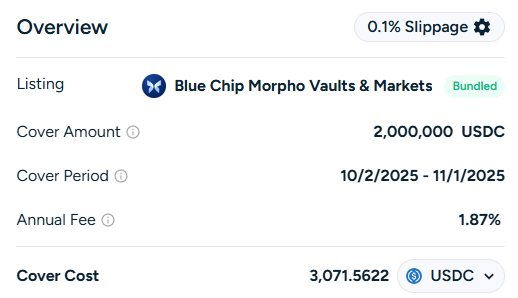

Lower risk vaults & markets are now priced at sub 2% for coverage, which makes Morpho one of the lowest priced lending protocols available on @NexusMutual

Not all vaults & markets on Morpho are created equal; they carry different risk profiles based on the collateral assets + oracles used in each lending market

Hugh & I have been discussing oracles at length & how they influence risk in a lending market

That's why we split Morpho into two core listings:

- Blue Chip Morpho Vaults & Markets

- B-Tier Morpho Vaults & Markets

That being said, it's incredible to see Morpho's growth given everyone else who came before them had limited success in scaling permissionless lending.

If you would have told me in 2022 that permissionless lending protocols would scale TVL and loan origination into billions of dollars in 2025, I would have called you crazy.

Past experiments like Rari blew up due to security issues, while other novel models couldn't scale P2P lending and capital fragmentation became too big of an issue to overcome.

The isolated markets approach combined with Morpho Vaults is what makes it work. The only friction point for end users is having to rely on curators and knowing the difference between a quality curator and less trustworthy curators. Ultimately, you handle that at the interface level.

In comparison to Aave, which has a strong brand and is known for their risk curation and strong track record with risk service providers, Morpho is neutral and relies on the reputation of curators. I imagine we'll see more curators build their own interfaces for bespoke products like Gauntlet has.

From a risk perspective, you can acheive lower pricing for individual Morpho markets or vaults with a low risk profile. The real challenge is creating a listing that bundles together multiple vaults and markets, keeping it updated, and blending the price across the vaults/markets included in the listing, while still making it easy to understand for end users.

There's still more work I need to do here on how permissionless lending protocol listings are presented to end users, but I look forward to solving that problem in the near future.

1.75K

4

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.