NFTStrategy - When tokens become a "machine for buying NFTs"

NFTStrategy is an emerging model in the NFT/DeFi market, expanding from the idea of PunkStrategy. Inspired by MicroStrategy's strategic $BTC reserve model, but with a fresh flywheel.

- This model simply understands as a flagship NFT reserve fund, they issue tokens and use transaction fees to buy and reserve those NFTs, corresponding to Punk with $PNKSTR, Pudgy Penguin with $PUDGYSTR,... of course, it will be a bit more complex.

=> Instead of holders having to buy expensive NFTs, now they just need to participate through the "strategy" token, indirectly activating the self-buy - self-sell - self-burn loop.

1. How it operates

- Each token transaction will deduct a portion of the fee (for example, 10%). This fee accumulates into ETH in the fund.

- When the fund has enough ETH, the protocol will automatically buy the floor NFT of the collection (BAYC, Moonbirds, Meebits…).

- The NFT is then relisted at a higher price (usually +20%).

- When sold successfully, the ETH obtained will go back to buy and burn the strategy token => making the token scarcer, benefiting the price.

=> A portion of the fee is also shared back to the NFT collection owner => a win-win for both sides.

2. Notable numbers

- There are wallets that have earned 181 ETH (~813k USD) in just a few hours by triggering NFT buy/sell in the system.

- PunkStrategy (the original model) has grown from a market cap of 1 million USD => now 135 million USD.

- Major collections like BAYC, Pudgy Penguins, Moonbirds… have their own strategies.

3. Strengths

- Helps ordinary people participate in the blue-chip NFT market without needing to buy directly.

- Tokens have higher liquidity compared to holding NFTs.

- The buyback & burn mechanism benefits token holders when NFTs are sold successfully.

- The NFT community is supported because the floor always has automatic buying flow.

4. Potential risks

- If the market has low liquidity, the accumulated fees may not be enough to buy NFTs => slow rotation.

- Triggers can be "eaten up" by bots or whales.

- The floor price of NFTs can drop sharply, making it hard to sell the purchased NFTs.

- The launch phase often has extremely high taxes (sometimes up to 95%).

5. Quick participation steps

- Prepare a wallet + ETH.

- Go to nftstrategyfun, connect your wallet.

- Choose the collection you want to participate in (BAYC, Meebits…).

Swap to get the strategy token (accept the fees).

- Monitor the NFT buying process, wait for the buyback & burn mechanism.

- Sell the token on the exchange when expectations are met.

6. My perspective and actions

- NFTStrategy is not a "free lunch". This is a smart loop, creating continuous demand for NFTs, while turning tokens into a pump - burn machine.

- But it is also like a timing and volume game: in a lively market, profits can be made quickly, while in a quiet market, it’s easy to get stuck.

- Anyone who wants to try should start small, choose collections with strong liquidity, and closely observe trigger behaviors. This is both an opportunity and an experiment of the new mechanism of NFT x DeFi.

- I bought a lottery ticket when my friends shared it a few weeks ago, bought it and was in the red, but now it's x4.

- You guys can refer and do your own DYOR research!

TREND POKEMON CARD RWA IS PUMPING X10 after 2 days

This trend is quite interesting, my friend. Let me summarize quickly for you to have a clearer perspective:

1. The main story: RWA for Collectibles (Pokemon TCG, CS:GO skins)

- This is a branch of tokenization, but instead of focusing on real estate or bonds (traditional markets), it targets collectibles & gaming items - where the community is already very large and has a strong "fanatic" nature.

- Pokémon is a trillion-dollar brand (IP value > Star Wars + Marvel combined), plus CS:GO skins have a trading history of billions of USD on the black/offchain market.

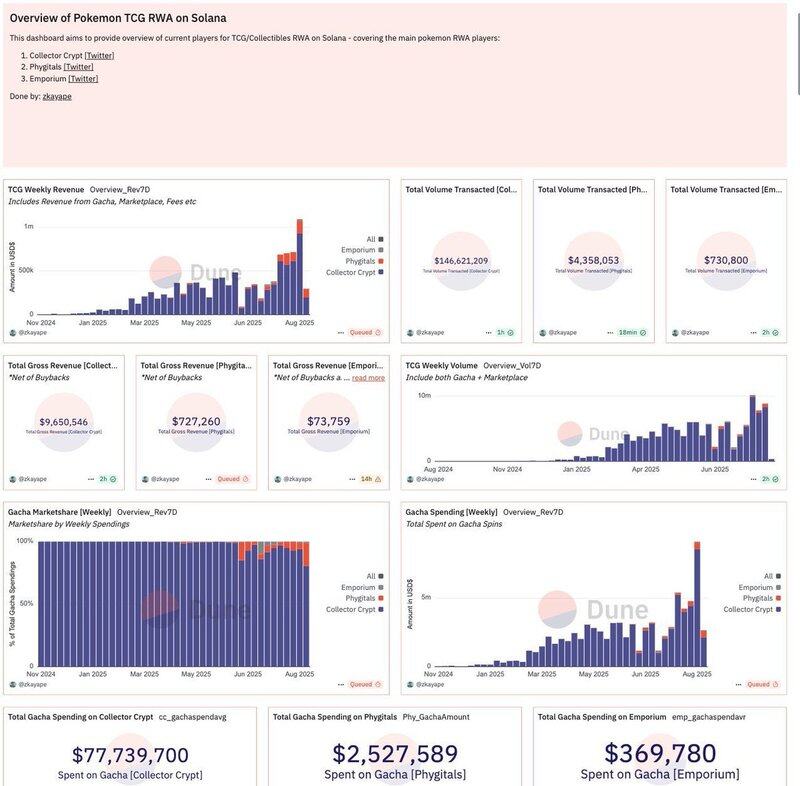

2. Actual data on Solana (Pokemon TCG RWA):

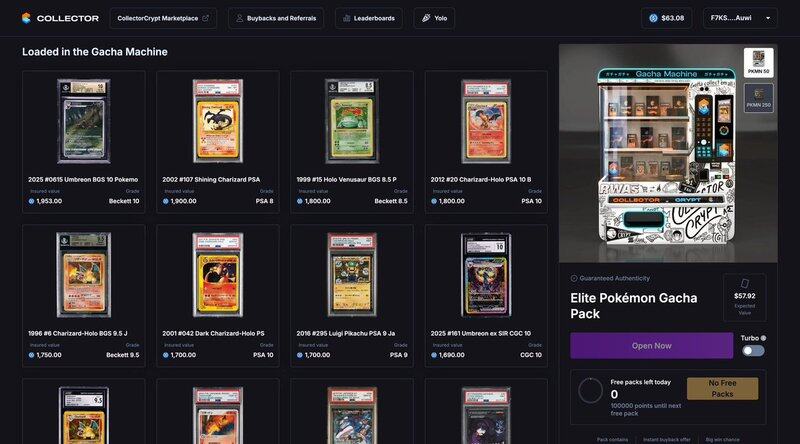

- Collector Crypt is leading: $146M volume, $77M spent on gacha.

- Other competitors like Phygitals ($4.3M volume) and Emporium ($0.7M volume) only hold a very small market share.

- Clearly, Collector Crypt = "Stake/Ebay" for Pokémon cards.

3. Token $CARDS (Collector Crypt):

- Market cap jumped from $23M => $85M in just one day.

- Increased 210% in 24h, price ~$0.19.

- Risks: Dev has the right to change tokenomics and block sells (similar to early-stage degen projects).

- Commitment: all proceeds from token sales are used to buy real Pokémon cards to back the ecosystem. => If true, it resembles an on-chain treasury backed by real collectibles.

4. Comparing the trend with traditional RWA:

- RWA like bonds (Ondo, Maple, Backed) => aimed at institutions.

- RWA collectibles (Pokémon, CS:GO skins, sneaker NFTs) => aimed at retail, gamers, Gen Z.

=> This is a piece that can onboard retail into crypto easier than bond/tokenized T-bills.

5. Notable projects:

- Have tokens:

@HuchFi (CS:GO skins)

@Collector_Crypt (Pokemon TCG - CARDS)

- No tokens yet:

@ripdotfun

@Courtyard_io

@phygitals

6. Conclusion:

- This could be the narrative of RWA retail/gaming this season. If on-chain bonds are the gateway for institutions, then Pokémon cards/CSGO skins are the gateway for retail.

- But you should note, the token lacks a clear governance structure + high dev control => risk of exit scam.

- In your opinion, does this narrative of RWA collectibles have enough strength to compete with RWA bonds, or is it just a "side hype" for retail fomo?

NFT Strategy - How to make money & things to note

After each token launch, the starting fee is 95% and then decreases by 1% every minute => after about 90 minutes it returns to the standard level of 10%.

- All accumulated fees will be pooled to buy NFT floor.

- NFTs purchased can be flipped for +20%, and the profit will be used to buy & burn tokens.

*Tax distribution:

80% => NFT purchase pool

10% => Burn tokens

10% => Founder collection

=> Token holders benefit from buyback & burn, and because the NFT pool always has buying pressure. NFT collection owners benefit from royalties. The entire NFT market benefits from continuous buying pressure on the floor.

*How to make money:

- Flip tokens right after launch (choose strong collections)

- Accumulate NFTs before the strategy runs (the protocol will auto-buy)

- Hunt for undervalued strategic tokens (STR)

- Hold $PNKSTR - because each new launch pumps buy & burn for it

- Keep a close eye on news & launches from @token_works to not miss any opportunities.

5.31K

8

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.