Can DeFi Season Come Back with the Launch of Yield Basis?

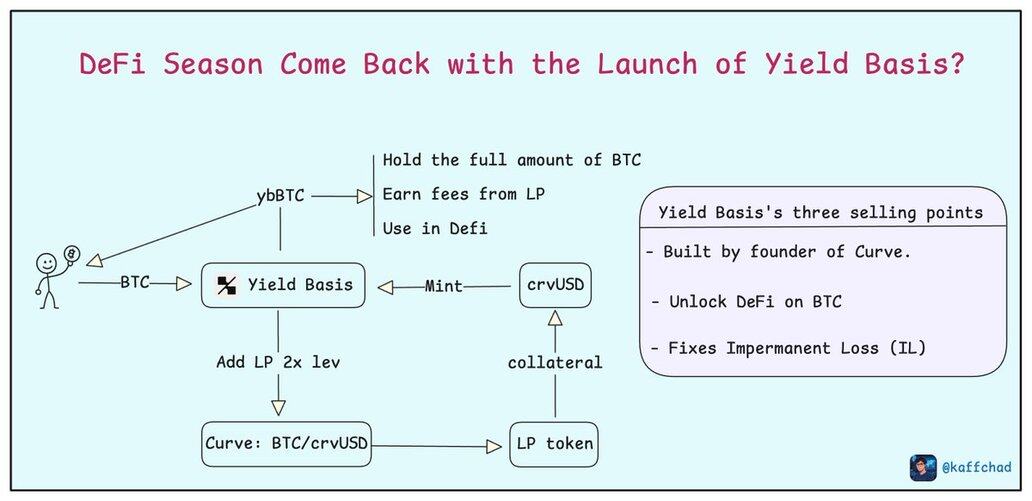

I think the three selling points of @yieldbasis are:

– Built by Michael Egorov (founder of Curve, OG of DeFi infrastructure).

– Unlock DeFi on BTC: $2.3T+ market cap, but only 0.3% staked in DeFi.

– Fixes Impermanent Loss (IL) at the Root: LP BTC without impermanent loss while still earning Curve fees.

✨ So, how does it solve the impermanent loss problem?

1/ Why IL?

In traditional AMMs, when you LP with BTC + stablecoin:

– If BTC goes up, the pool sells some of your BTC to rebalance → you profit less than if you just hold BTC.

– If BTC goes down, the pool buys more BTC → you hold more BTC while it’s falling, resulting in a loss.

This is called Impermanent Loss. Some protocols have tried to solve IL with token incentives but ended up with killing the chart.

2/ How Yield Basis (YB) Removes IL at the Root

You deposit BTC in Yield Basis and receive ybBTC.

→ YB borrows crvUSD equal to the amount of your deposited BTC.

→ YB adds BTC/crvUSD into Curve with 2x leverage and receives LP tokens.

▫️ Why 2x leverage?

This makes your position akin to being 100% exposed to BTC, not split between BTC and stablecoins → it’s like depositing in a one-sided liquidity pool.

👉 The Result:

– Your LP value moves 1:1 with BTC price → no IL.

– And you still earn trading fees from Curve.

You receive ybBTC (which represents your deposited BTC):

– Hold ybBTC → hold the full amount of BTC + earn fees from LP.

– With ybBTC, you can even earn more by staking, lending, or engaging in other activities in the DeFi space.

The token $YB just finished its sale on @legiondotcc and Kraken at a $200M FDV. $YB is now trading at a $900M FDV on the premarket → ~5X so far.

But I don’t care much about the price; what makes me keep an eye on YB is how it aims to bring #DeFi summer for BTC holders.

Other protocols built on top of ybBTC may emerge soon!

18.78K

177

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.