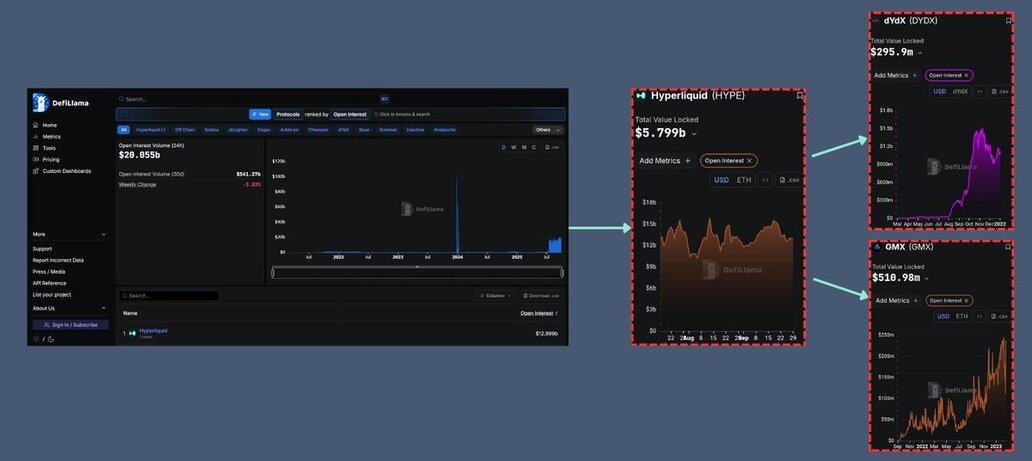

Perpetual futures open interest (OI) has become the most reliable indicator of systemic trust and liquidity in DeFi. Unlike TVL, which can be inflated by incentives, or volume, which is often short-lived, OI reflects capital committed and risk sustained. High and sticky OI signals structural adoption of a venue, and its reflexivity often compounds into ecosystem-wide growth. 1/ OI as the Core Liquidity Signal 1. Capital Commitment: OI measures collateral actively posted in perp markets; a proxy for how much risk traders are willing to hold. 2. Trust in Execution: Traders only leave collateral in venues with strong risk engines, solvency guarantees, and deep liquidity. 3. Reflexivity Loop: Higher OI generates more fees → fees attract market makers → liquidity improves → OI expands further. This feedback loop makes OI the heartbeat of DeFi: a leading indicator of liquidity health across ecosystems. 2/ How OI Shaped the Last Cycle 1. @dYdX (2021–22): OI growth signaled the first...

15.83K

130

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.