1/ Prime, Core, Frontier strategies on @MorphoLabs — what's the difference?

Every vault adheres to our rigorous curation framework, yet each deploys capital across different markets tailored to specific risk profiles.

Access vaults on the Gauntlet App:

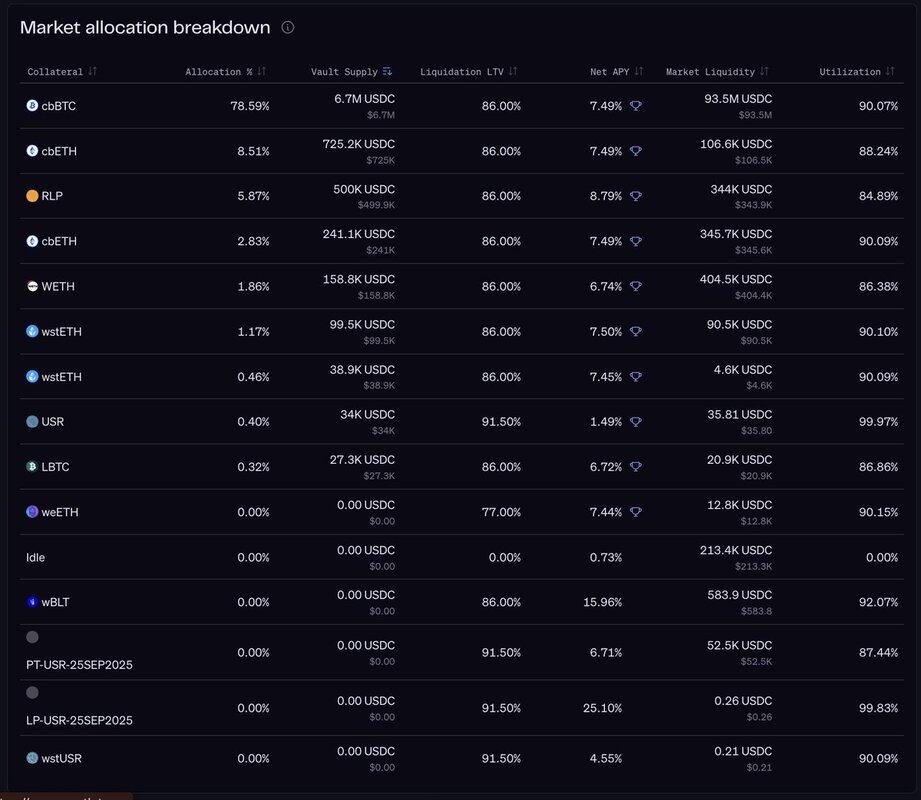

2/ Prime Vaults: conservative, risk-adjusted yields

These vaults allocate supply to maximize risk-adjusted yield while targeting minimal risk of insolvent debt even under extreme market conditions.

Read more:

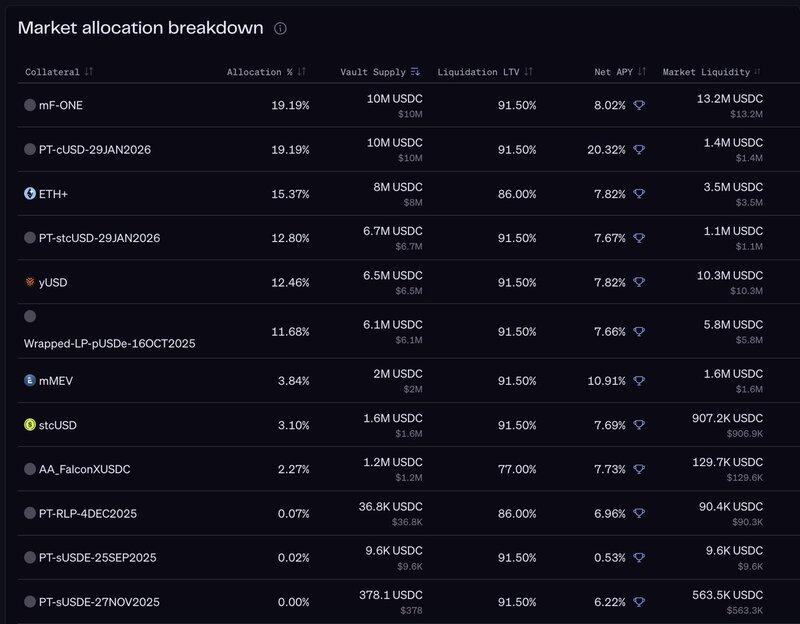

3/ Core Vaults: higher risk-adjusted yield

These vaults allocate to a blend of large and lower-cap collateralized markets, while ensuring exposure to any one asset remains within acceptable bounds.

Whereas there are similar markets to Prime, we allocate to a wider range of markets in Core.

Read more:

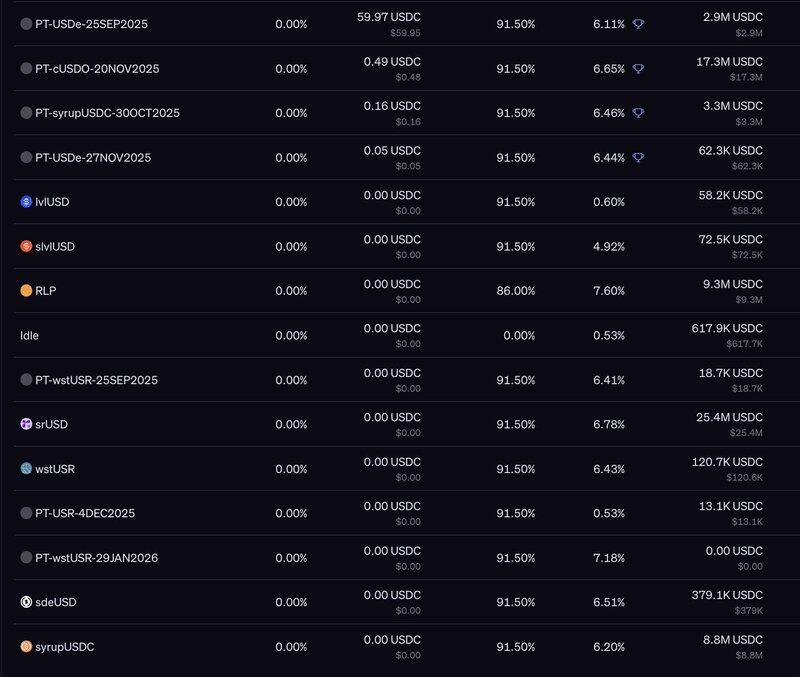

4/ Frontier Vaults: best risk-optimized yields

These vaults allocate supply to higher volatility markets that may face liquidity risks in exchange for the potential for greater supplier returns.

USDC Frontier on Mainnet lists 25+ markets.

Read more:

2.01K

16

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.