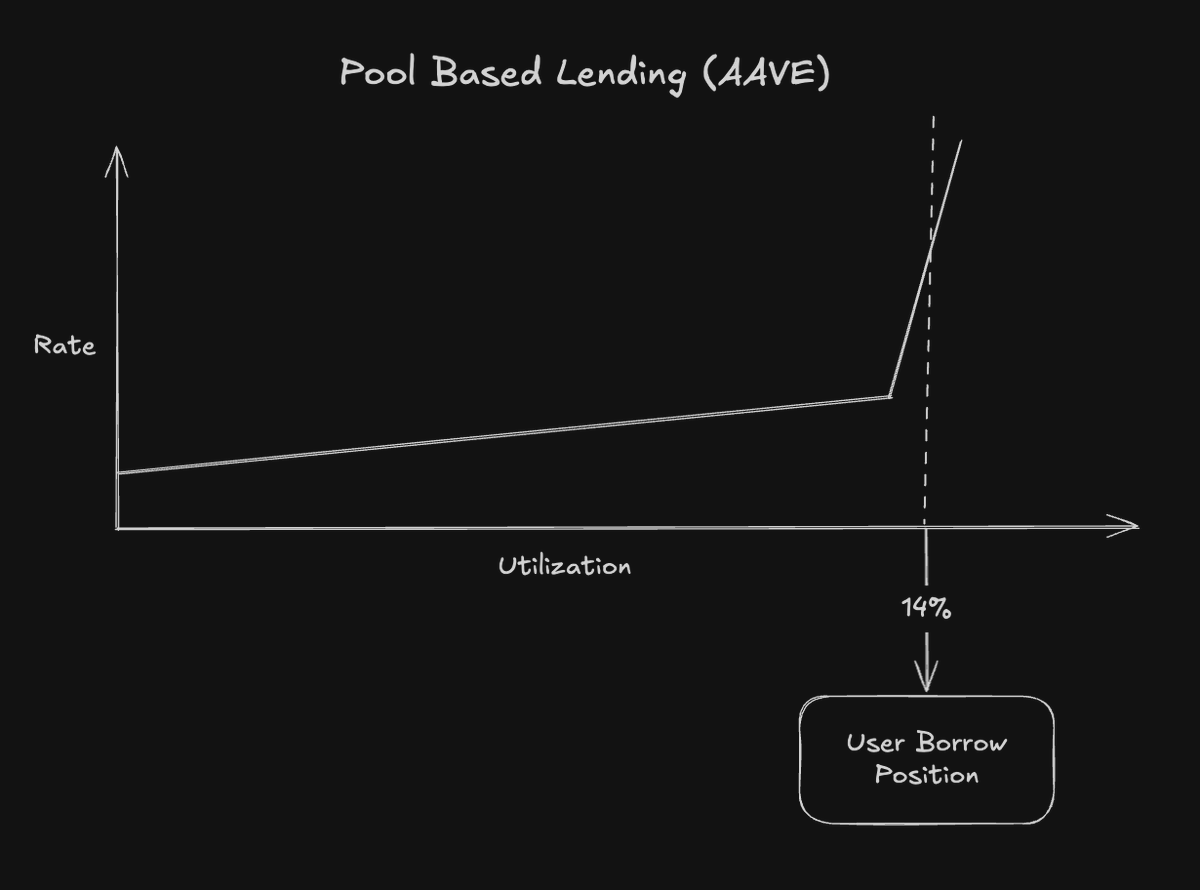

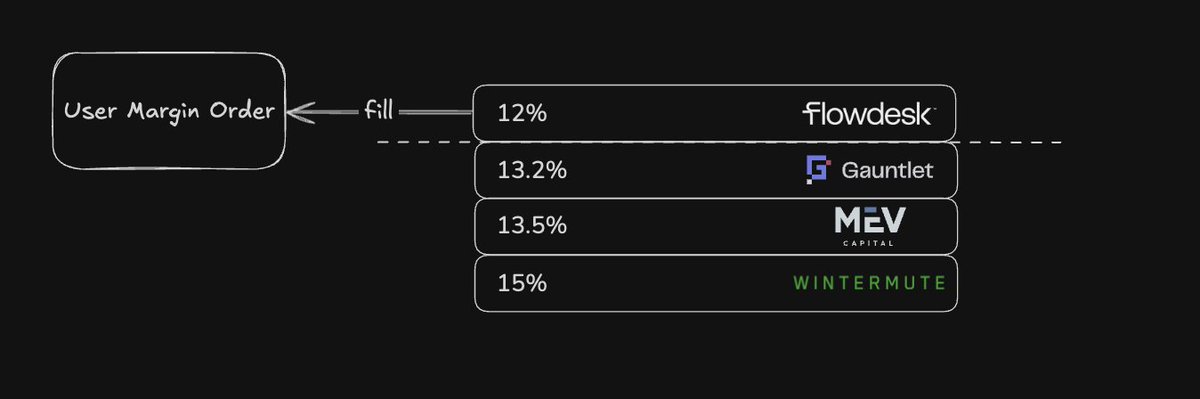

So how does Agra work and what is it really? Compared to existing onchain credit platforms, Agra underwrites risk differently. AAVE, Morpho and others price your collateral with static risk parameters + utilization curves. Everything is pre-set and slow to evolve. This is the Uni V2/V3 of credit. Agra uses a fundamentally different model. We use auctions to price collateral in realtime. This is a CLOB for margin and credit! Agra fundamentally is an exchange for _______ backed securities. We enable trading of DeFi backed collateralized debt positions. The first of its kind. We have built THE toolkit for sophisticated risk managers to underwrite risk of any collateral type in DeFi, whether its a perp position on hyperliquid or a looped PT token on a credit market. We will support it. This has huge implications for the market structure moving forward and something I am deeply passionate about. We like to present Agra as a prime brokerage but really it is much much more. A...

5.32K

58

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.