. @rezervemoney explained like you’re 10 (or older)

Quick data check ↓

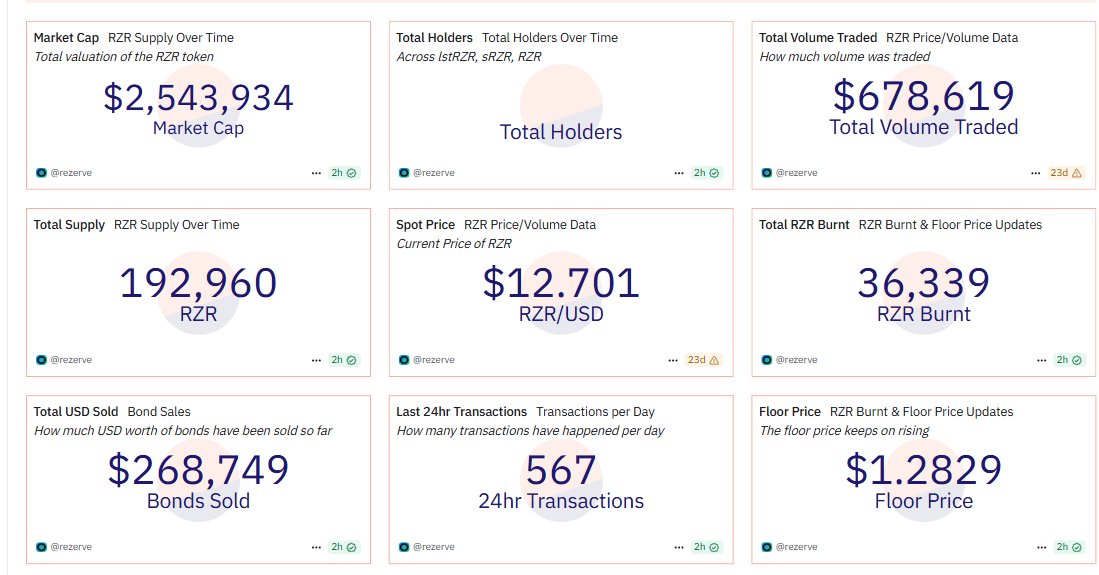

➛ $2.54M market cap

➛ 192,960 RZR supply

➛ $12.7 spot price

➛ 36,339 RZR burnt

➛ 567 daily transactions

Core idea ↓

➛ RZR sits in Sonic pools and earns real fees + native reward tokens (shadow / beets)

➛ lstRZR = liquid-staked RZR with a built-in premium (30% buyout on staking page)

➛ lstRZR auto-compounds every 8 hours → headline APYs balloon because of frequent compounding + premium accounting

➛ the team doesn’t stake their share into reward emissions → more yield is allocated to users

→ short-term emissions + auto-compounding + premium math create headline APYs that move fast

Risks to watch ↓

• reward token prices + emissions schedule

• TVL flows and premium unwind

• impermanent loss on the underlying LP

TL;DR: real yield mechanics, real risk.

Great for yield hunters read the staking page and emissions schedule before diving in.

5.19K

64

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.