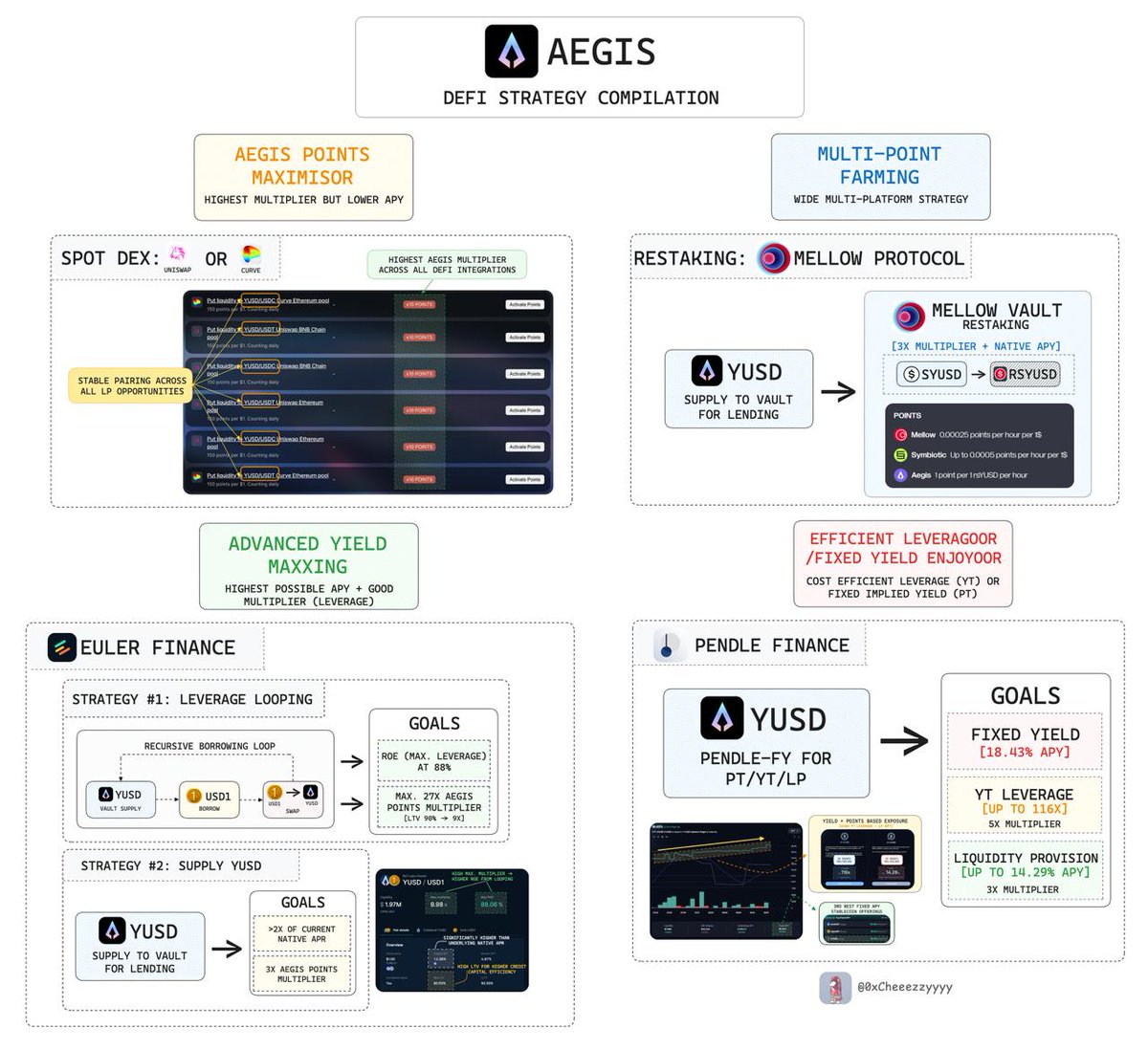

Was diving across @aegis_im's DeFi opportunities on maxxing points + yields and here's a compilation of various DeFi strategies to take advantage of on $YUSD $sYUSD: 1⃣ Points Maxxing: LP via @CurveFinance @Uniswap in stablepairs that offer (proxied) single-sided exposure which means minimal IL risk → highest 10x Aegis Multiplier (but low underlying APY) 2⃣ Multi-points Farming: Deposit $sYUSD into @mellowprotocol for restaking → Mellow points + @symbioticfi points + Aegis (points + native APY) 3⃣ Efficient Leverage/Fixed Yields: Zap-in to @pendle_fi for PT-sYUSD (14.6% fixed implied APY), LP for up to 16.3% APY or YT-sYUSD (for 116x leverage on Aegis points + native yields exposure) 4⃣ Advanced Yield Maxxing: This is the classic old looperinooo on @eulerfinance via: $YUSD collateralisation on @BNBCHAIN → Borrow USD1 → Swap to more YUSD → Repeat ^This amplifies the native APY + Aegis points exposure effectively, offering a classic leverage play. Whichever strategy you choose...

5.24K

52

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.