Tokenized stocks might finally have their breakthrough moment

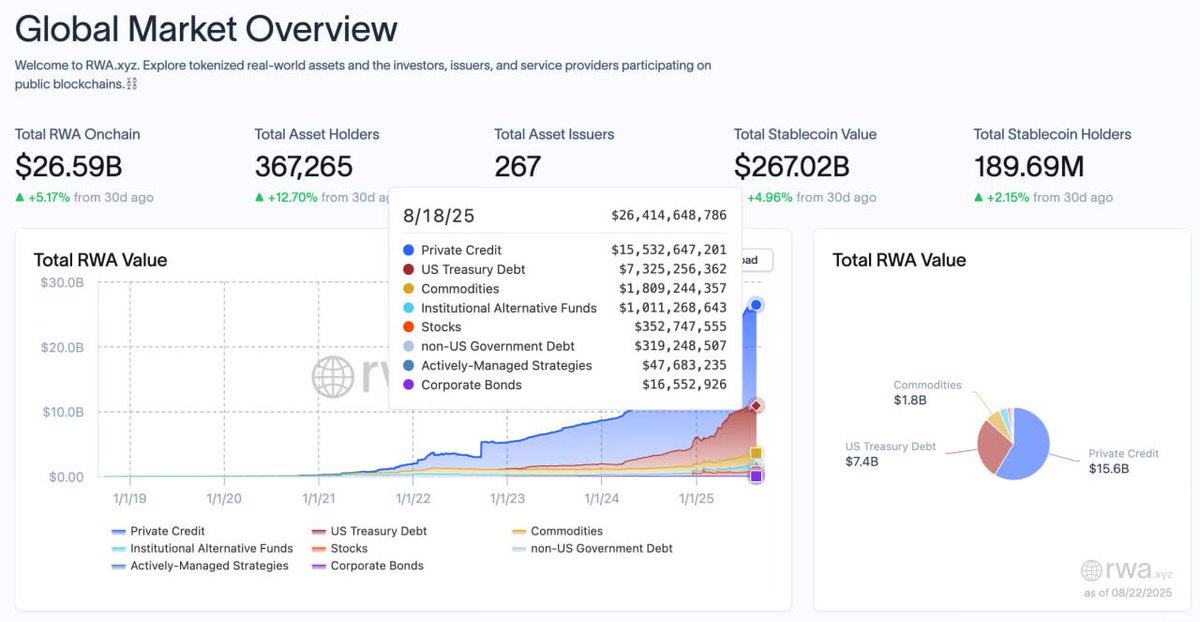

Look, RWAs onchain sit around $26B today, but tokenized stocks barely make up $300M of that.

The issue isn’t demand, it’s just that no serious player has really pushed it.

Study how tokenized US Treasuries went from ~$100M at the start of 2023 to ~$7.4B today.

That wave only kicked off once heavyweights like Ondo Finance stepped in.

Now @OndoFinance is trying to pull the same playbook on stocks.

They already run ~$1.4B in tokenized RWAs, making them the 3rd largest RWA protocol, capturing ~10% of sector TVL.

That mix of scale and credibility is exactly what could actually pull real flow into tokenized equities imo.

Gonna be interesting to see how fast tokenized stocks take off.

7.41K

56

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.