Ring the bell - it is time for a comparison!

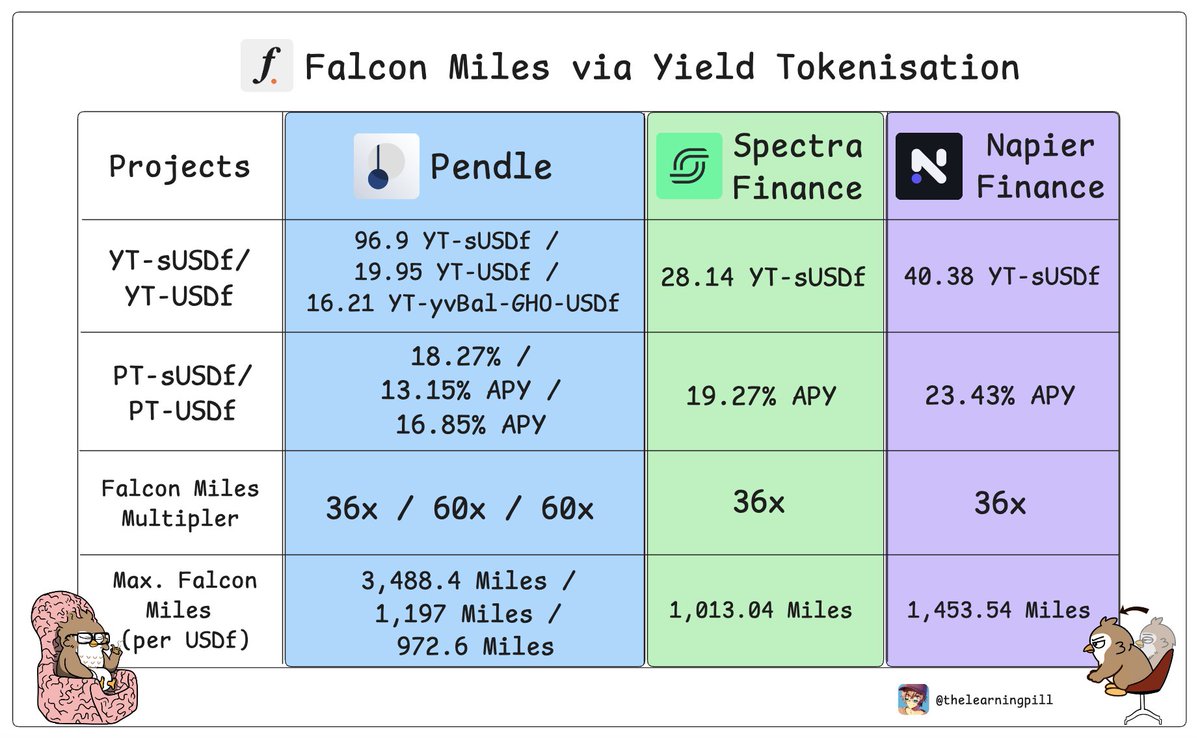

We've been looking at three different projects that all reward miles multipliers for the @FalconStable Miles Program:

@pendle_fi, @spectra_finance, and @NapierFinance

All three offer YT/PT/LP options for USDf, but which one should you actually use? 👇

Let's break it down by looking at the key stuff that matters:

➟ YT returns - how much leverage can you squeeze out?

➟ PT returns - what's the upside on principal tokens?

➟ depth of liquidity- can you actually get in and out o favourable terms?

The quick answer?

For PT: Go with @NapierFinance PT-USDf - it's returning 23.43% APY

For YT: @pendle_fi YT-sUSDf is the clear winner here, giving you 96.9 YT-sUSDf per 1 sUSDf (means you can leverage heavier for points)

From a liquidity standpoint: @pendle_fi still trumps w deep liquidity (up to $41M in liquidity for sUSDf)

10.68K

79

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.