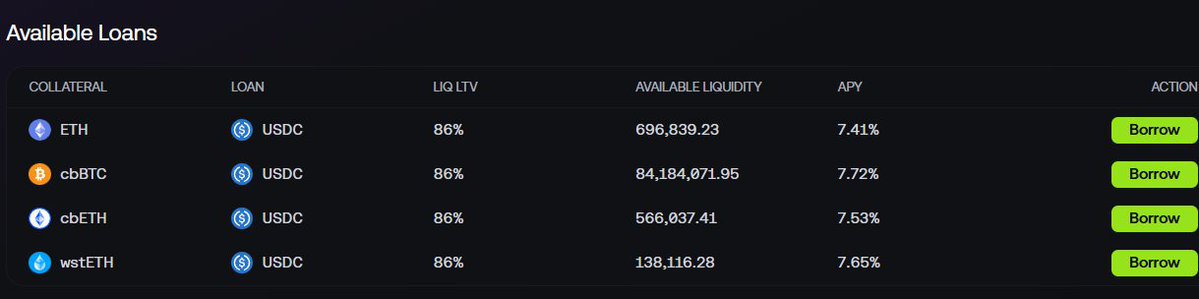

Did you know you can borrow USDC and use it for collateral trading by depositing ETH, cbBTC, cbETH and wstETH

Earning, Borrowing, and Lending on Avantis

Unlike protocols such as Aave or Compound, Avantis doesn’t offer direct peer-to-peer lending and borrowing.

Instead, it uses synthetic leverage: traders gain exposure via perpetual contracts, while “earning” opportunities come from providing liquidity, trading rebates, and incentive programs.

That said, integrations with partners (e.g., Morpho) extend Avantis into lending-like territory, enabling USDC borrowing and collateralized strategies.

6.76K

16

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.