Your job is to understand why Hyperliquid works the way it does today. And then forecast how that might change in the future. So, if you read the tweet below and got triggered with "hyperliquid is not web3" you're doing it wrong. My take: 1. Hyperliquid launched less than a year ago (genesis event) 2. It does not have its own wallets, token standards, or token issuance platforms (it's all coming) 3. On Solana or Ethereum, you just load up a wallet with USDC, connect to an app and you're off and running 4. On Hyperliquid, you have to bridge USDC first Now. Zoom out. Ask yourself: 1. How is Hyperliquid producing more revenue than Ethereum and Solana without any token standards, wallets, or native token issuance? 2. Why does hyperliquid have one of the most powerful online communities in crypto? 3. What happens when builders flock to HyperEVM (this is happening today) and anyone can access those apps with an EVM-compatible wallet? 4. What happens when native asset...

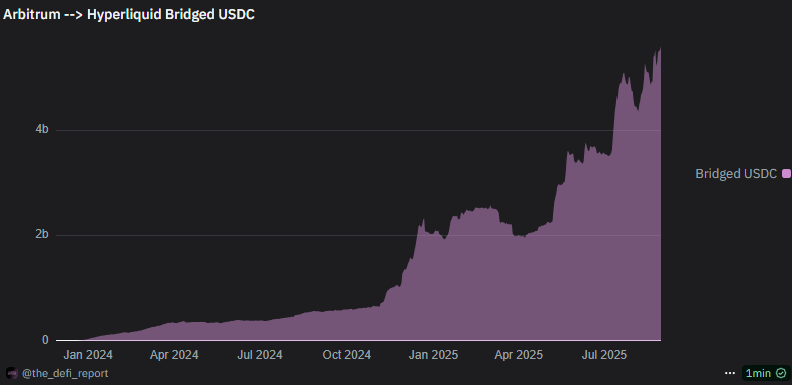

If you want to use Hyperliquid, you have to bridge your assets in via Arbitrum. The assets stay on Arbitrum. And Hyperliquid mints you a credit (backed by your asset on Arbitrum) so that you can use Hyperliquid. Therefore, withdrawals on Hyperliquid only work if they honor your balance and instruct the bridge to release funds back to you. Unlike Arbitrum's relationship with Ethereum, there is no Ethereum-enforced guarantee. You have to trust Hyperliquid here. ---- Furthermore, Hyperliquid only has 21 validators today, which are "permissioned in" based on stake (barrier to entry via capital) ---- Is Hyperliquid pure DeFi? It's non-custodial and fully transparent. But you still have some trust assumptions and barriers to running a node. So, no. It's not pure DeFi. And I think that's to be expected at this stage. The team launched less than a year ago with 4 validators. They have 21 now. Let's see how committed they are to decentralizing as they scale. ---- P.S....

6.9K

19

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.