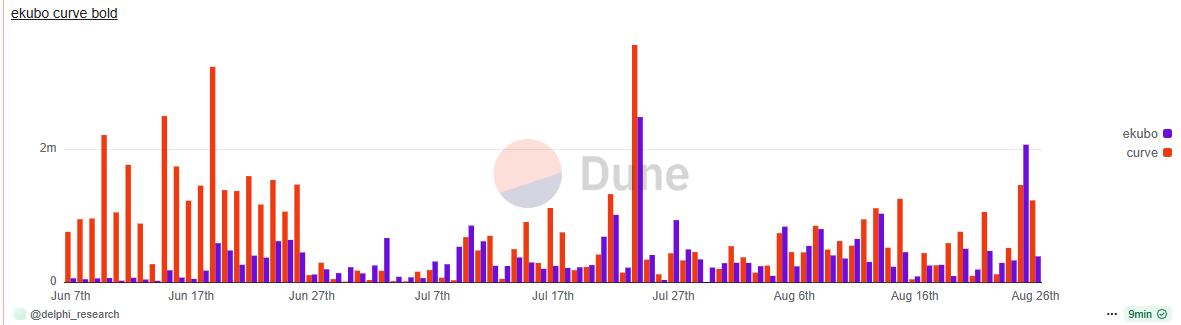

To echo this, the massive Curve PIL vote block and overall entanglement has likely hindered early growth of BOLD.

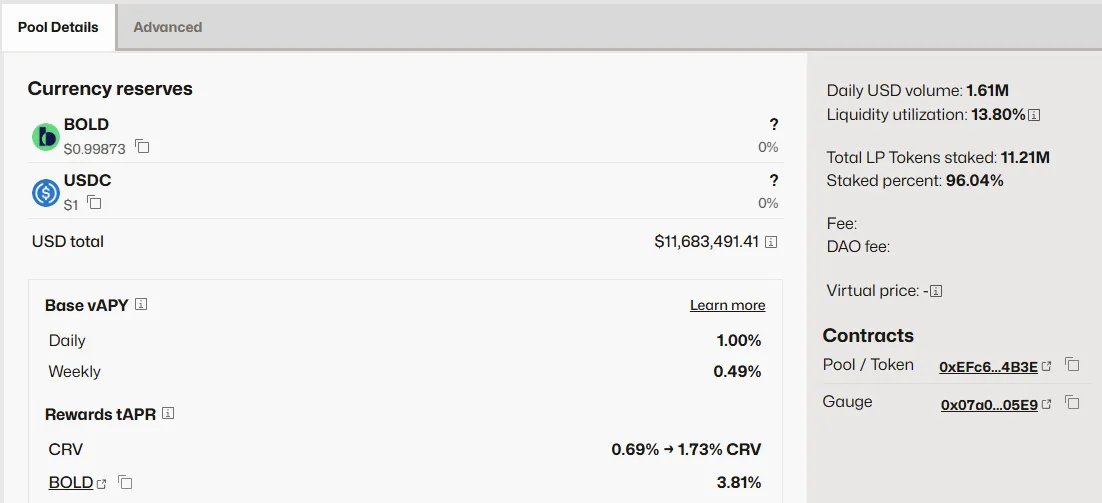

- Curve pool: 11.7M TVL, 55% of volume, 5.5%-6% yield, (1% native 1.2% vecrv stuff)

- Ekubo pool: 1M TVL, 45% of volume, 16% yield (5% native) not listed on coingecko🤔

If 20% of Curve's PIL voters (10% of total votes) switched to Ekubo, it would decrease curve's APR by 1% (15% of total APR), while Ekubo’s APR would grow by ~7% (45% of current APR).

Voters make more (via bribes) and LPs make more and better peg stability with lower cost all else equal.

The increase in efficiency frees up a major portion of incentives to drive BOLD growth, perhaps through gamified borrow interest rebates (defi-native negative rates would be a hell of a narrative👀 + 0% interest borrowing is what drove v1 growth)

something to consider if you are incentivizing liquidity or running a points program!!

Ekubo is further strengthening our alignment with Liquity.

After the DAO approved $10,000 in bribes over ten weeks, they have approved an additional $13,000 over thirteen more weeks.

Additionally, the DAO has passed to incentivize the EKUBO/BOLD pair.

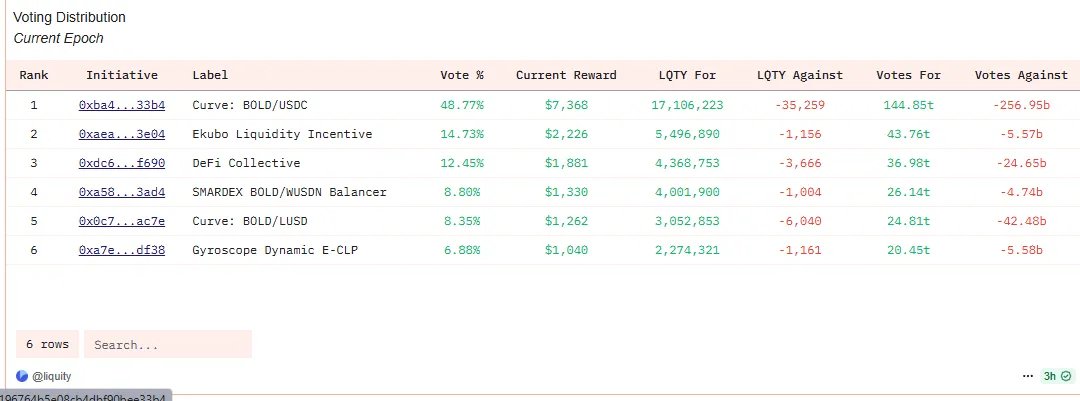

Currently, Ekubo receives 14.77% of PIL rewards, second to Curve at 48%.

When comparing the two pools, the VOL/TVL of Ekubo is 1.37 versus .36 from Curve. Second, the volume per $1 in rewards is 1048 for Ekubo versus 515 from Curve.

It is in the interest of $LQTY holders to continue migrating their votes away from Curve to Ekubo.

The future of Ethereum DeFi is the new guard: @EkuboProtocol <> @LiquityProtocol

848

7

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.