In the past 20 days, $bio @BioProtocol has surged from $0.06 to $0.325, with a peak increase of over 5 times. This is not merely driven by market sentiment, but rather by structural changes brought about by the launch of Bio Protocol V2 and the initiation of the Ignition Sale.

1. Over 10% of the circulating supply has been staked in 20 days.

August 5: Bio Protocol V2 launched, introducing Ignition Sales, Staking, and BioXP.

August 7: An additional 88.6M BIO was staked, triggering the first wave of price increase.

August 20: An additional 39.8M BIO was staked, leading to the second wave of market movement.

As of August 25: A total of 177.7M BIO has been staked, accounting for 10.64% of the circulating supply.

2. Ignition Sale: A dual engine of low FDV + BIO staking.

The mechanics of Ignition are somewhat similar to Virtuals:

Low FDV, fixed price sales: The first phase aims to raise $77K in BIO, releasing 37.5% of the initial supply, corresponding to an initial valuation of ~$205K FDV. The maximum per user is set at 0.5% to prevent excessive concentration.

BioXP + BIO staking as dual thresholds: Quota allocation is determined by staked BIO and BioXP, directly linking holdings with activity.

Point expiration mechanism: BioXP settles daily, expiring after 14 days, forcing users to remain engaged.

Liquidity engine: Funds raised go directly into the AMM pool, ensuring liquidity in the secondary market.

The mechanism's effects are clear: to participate in the new offerings, one must buy and stake BIO. The locked-up scale accumulates, tightening the circulating supply and providing structural support for the price.

3. BioXP: Turning short-term impulses into long-term staking and community engagement.

BioXP is not a token, but a points/reputation system that determines Ignition Sale quotas:

How to earn: Stake BIO, stake ecosystem tokens (BioDAO, BioAgent, IP-Tokens), participate in governance, and engage in social interactions.

Decay over time: Points expire after 14 days, requiring continuous activity to retain them.

Quota allocation: Ignition Sale quotas are distributed based on the proportion of BioXP.

BioXP transforms "short-term impulse for new offerings" into "long-term staking and community engagement," creating a positive ecological flywheel.

4. Just last night at 7 PM (25th), the first project Aubrai officially went on sale.

Aubrai is the world's first decentralized scientific intelligence entity, co-developed by VitaDAO and BIO, aiming to tackle humanity's greatest threat—aging. It attempts to double the remaining lifespan of middle-aged mice, and if successful, it will be the "AlphaFold moment" in longevity research.

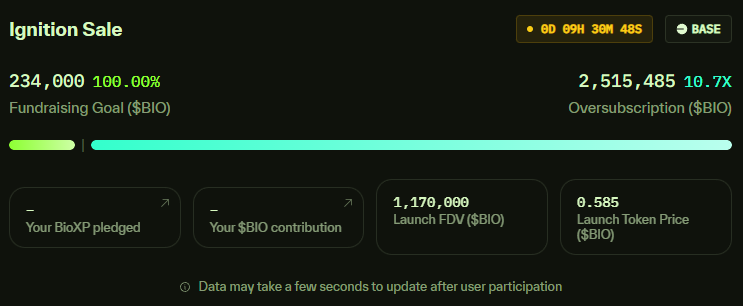

Total token supply: 2,000,000 tokens

Ignition sale: 20% (400,000 tokens)

Liquidity pool: 6%

Funding target: Approximately $269K FDV (total fundraising of 234k $BIO, 1 $AUBRAI = 0.585 $BIO)

Maximum per wallet: 10,000 tokens

Pool creation mechanism: Automatically enters AMM upon success, initial FDV ~ $896K

It is worth mentioning that Bio has previously launched several science-related DAO projects, typically valued in the millions. This time, Aubrai is an upgraded version combining AI Agent characteristics, with a low FDV launch (~ $269K FDV) + initial pool FDV of $896K, already providing participants with about a 3.3 times initial increase (refer to the official tweet from August 22).

Assuming BioXP is proportionally divided based on staked BIO, if a user stakes $10K worth of BIO (approximately 37,174 BIO, price $0.269):

Total staking pool: 177.7M BIO, accounting for ~0.021%

Expected allocation: approximately 418 AUBRAI

Secondary market price multiples:

At 5x, FDV is $1.345M.

At 10x, FDV is $2.69M.

At 50x, FDV is $13.45M.

At 100x, FDV is $26.9M.

Note: Actual results are influenced by oversubscription multiples, BioXP weights, and secondary market trading, but under the low FDV model, the potential return space is highly attractive.

Currently, Aubrai has been on sale for only 14 hours, already oversubscribed by 10.7 times. Sales will end tonight at 7 PM, followed closely by TGE, so stay tuned.

5. The ongoing Ignition Sale will determine the upper limit of $BIO.

Short-term: The sales performance of Aubrai will directly impact the price. The enthusiasm and capital participation exceed expectations, further amplifying the demand for BIO staking.

Mid-term: The key lies in the sustainability of the Ignition Sale. If subsequent projects maintain a low FDV and high growth narrative, the flywheel can operate long-term.

Long-term: The expiration mechanism of BioXP forces capital to be long-term bound to the ecosystem, but if project quality declines, it may also accelerate capital outflow.

In other words, the upper limit of $BIO depends on whether the Ignition Sale can continue to ignite.

NFA, ArkStream Capital is honored to be an investor in Bio Protocol, witnessing the continuous iteration and excellent delivery of the product alongside the science-enthusiast co-founder @paulkhls. We will accompany the project's growth throughout, helping to accelerate the ecological flywheel!

Show original

9.86K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.