BTCFi Alpha File #08: August 23

BTCFi is not a single-protocol story.

It’s an ecosystem story; execution layers, credit markets, and security models competing to become the rails for Bitcoin yield.

For fifteen years, Bitcoin was the end of the road. You bought it, you held it, maybe you moved it.

BTCFi already changing that.

Now, it asks: What rails will turn $BTC into productive collateral?

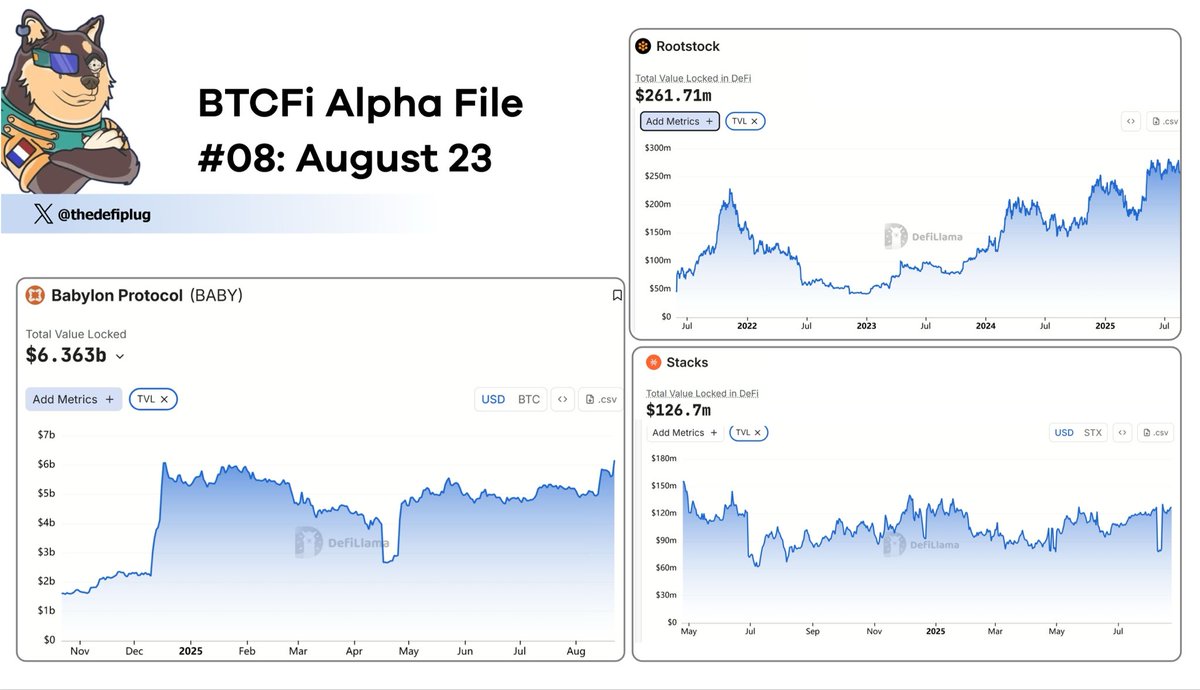

From where I’m sitting, three ecosystems stand out right now: Babylon, Stacks, and Rootstock.

But these aren’t interchangeable. Each carries a distinct philosophy:

-> One is turning $BTC itself into the security budget of other networks.

-> One is building an application layer where users interact with $BTC natively.

-> One is extending Ethereum’s DeFi design onto Bitcoin rails.

Before you choose winners, you need to understand how different these models really are. ↓

1️⃣ Babylon (@babylonlabs_io)

Babylon is arguably the most important conceptual shift in BTCFi.

Instead of building another app layer, it asks:

“What if $BTC could be pledged directly as economic security for other networks?”

• $BTC Staking: Users delegate $BTC to validators securing external chains. Misbehavior = slashable $BTC.

• Restaking for AVSs: Just like EigenLayer, but with Bitcoin. AVSs (Actively Validated Services) can rent Bitcoin’s trust base.

• Yield for idle $BTC: Instead of sitting cold, $BTC earns from providing cryptoeconomic security; a new fixed-income primitive.

Babylon’s angle?

It’s not DeFi apps. It’s Bitcoin as collateral for the entire multichain world.

2️⃣ Stacks (@Stacks)

Stacks is the most visible BTCFi ecosystem because it behaves like Ethereum circa 2019: an app layer anchored to Bitcoin.

- ALEX: the DeFi hub for Stacks. It runs AMMs, lending, perps, and structured products. Think of it as the Curve + Aave of BTCFi.

- Zest Protocol: institutional-grade $BTC credit pools. Lenders supply $BTC, counterparties borrow against it, with emphasis on compliance and risk filters.

- Bitflow: a DEX aggregator purpose-built for Bitcoin DeFi. By routing trades across Stacks protocols like ALEX, Arkadiko, and Velar, it guarantees users the best swap rates. It also supports stablecoin trading with lower slippage and real BTC yield opportunities.

Stacks’ pitch?

Build the user-facing BTCFi apps that abstract away custody complexity and deliver a familiar DeFi experience that's all anchored to Bitcoin finality.

3️⃣ Rootstock (@rootstock_io)

Rootstock has been live since 2018, making it the veteran of BTCFi. It’s EVM-compatible, which means developers can port Ethereum DeFi infrastructure directly.

- Sovryn: the flagship. A full DeFi suite with lending, and margin trading, all BTC-settled. It’s already processed billions in volume.

- Tropykus: an emerging lending protocol focused on LatAm markets, bringing localized adoption on Rootstock rails.

- Stablecoin issuance: RSK’s role as an RWA and stablecoin layer makes it a bridge for $BTC-backed stable liquidity.

Rootstock’s edge?

It doesn’t need to reinvent DeFi. It reuses EVM tooling but aligns it to $BTC collateral and security.

24.35K

119

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.