Who initially drove Lombard's TVL?

Lombard's growth didn't happen out of thin air. One reason it surged to the top of Bitcoin LST in a short time is its precise collaboration strategy; @veda_labs!

The founder of Lombard himself mentioned that when launching the project, the first person he called was @sunandr_, who is also a co-founder of Veda. The reason is simple; Vault has become a core tool in DeFi, significantly enhancing capital efficiency, and Veda is the most representative player in this area!

▰▰▰▰▰▰

What is Veda's role?

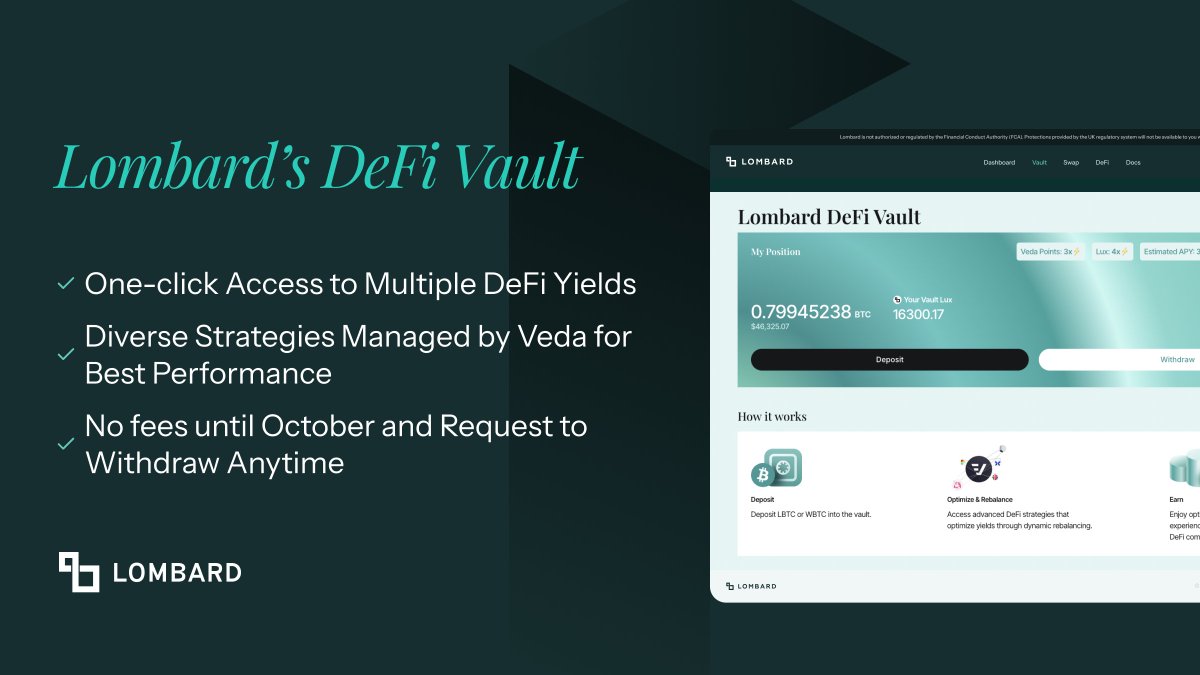

In the eyes of most users, putting LBTC into DeFi seems to have a high threshold, facing different protocols like Curve, Uniswap, Aave, Pendle, and needing to choose strategies and manage positions.

Lombard didn't throw this complexity directly at users but handed it over to Veda to handle, using DeFi Vault:

※ Users only need to deposit LBTC / WBTC with one click

※ The system automatically allocates to multiple protocols

※ The earnings finally return to the users, directly priced in LBTC

▰▰▰▰▰▰

What drives the data?

During the private testing phase, Lombard's DeFi Vault attracted $14.5 million in deposits in just 10 days!

Behind this is not only an efficient capital strategy (Curve/Uniswap for liquidity, Gearbox/Morpho for lending, Pendle for yield trading) but also additional incentives layered on top! This design creates a dual attraction of earnings and points, accelerating the influx of TVL!

▰▰▰▰▰▰

The driving force behind the scenes

Looking back, we find that Lombard's initial stage of TVL relied not on mere branding or speculative hype but on bringing in infrastructure like Veda as an accelerator!

Veda itself is a player with a solid track record, also playing a core role in @ether_fi Liquid, with TVL exceeding $1 billion. This means Lombard's Vault is not just a follow-the-trend feature but has established barriers from the start by leveraging the industry's top yield engines, leading to explosive growth and TGE!

▰▰▰▰▰▰

Points to ponder

The case of Lombard illustrates that TVL growth is not solely dependent on airdrops, marketing, or a single narrative. Choosing the right partners and abstracting complexity to hand over to infrastructure is often more critical than going solo!

This is also the true joy of "mouth farming"! Not only do you observe the project, but you can also see the underlying strategies. If one day I feel like starting a project, I will know how to do it and how to push TVL ~ So consider mouth farming as part of learning and enjoy the fun it brings!

Putting your LBTC to work in DeFi doesn't have to be complex...

We partnered with @veda_labs to offer one-click access to DeFi yields all from within the App.

LBTC and WBTC deposits get allocated across Curve, Uniswap, Morpho, Pendle, Aave to return a yield in LBTC.

🧵

17.5K

155

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.