<DAT New Model: Previously, companies part-time traded cryptocurrencies, now Wall Street is all in on DeFi from the get-go>

Chamath dropped a bombshell yesterday. He submitted an S-1 to the SEC to establish a SPAC: American Exceptionalism Acquisition Corp. A (NYSE: AEXA), raising $250 million, focusing on four major sectors: energy, AI, DeFi, and defense.

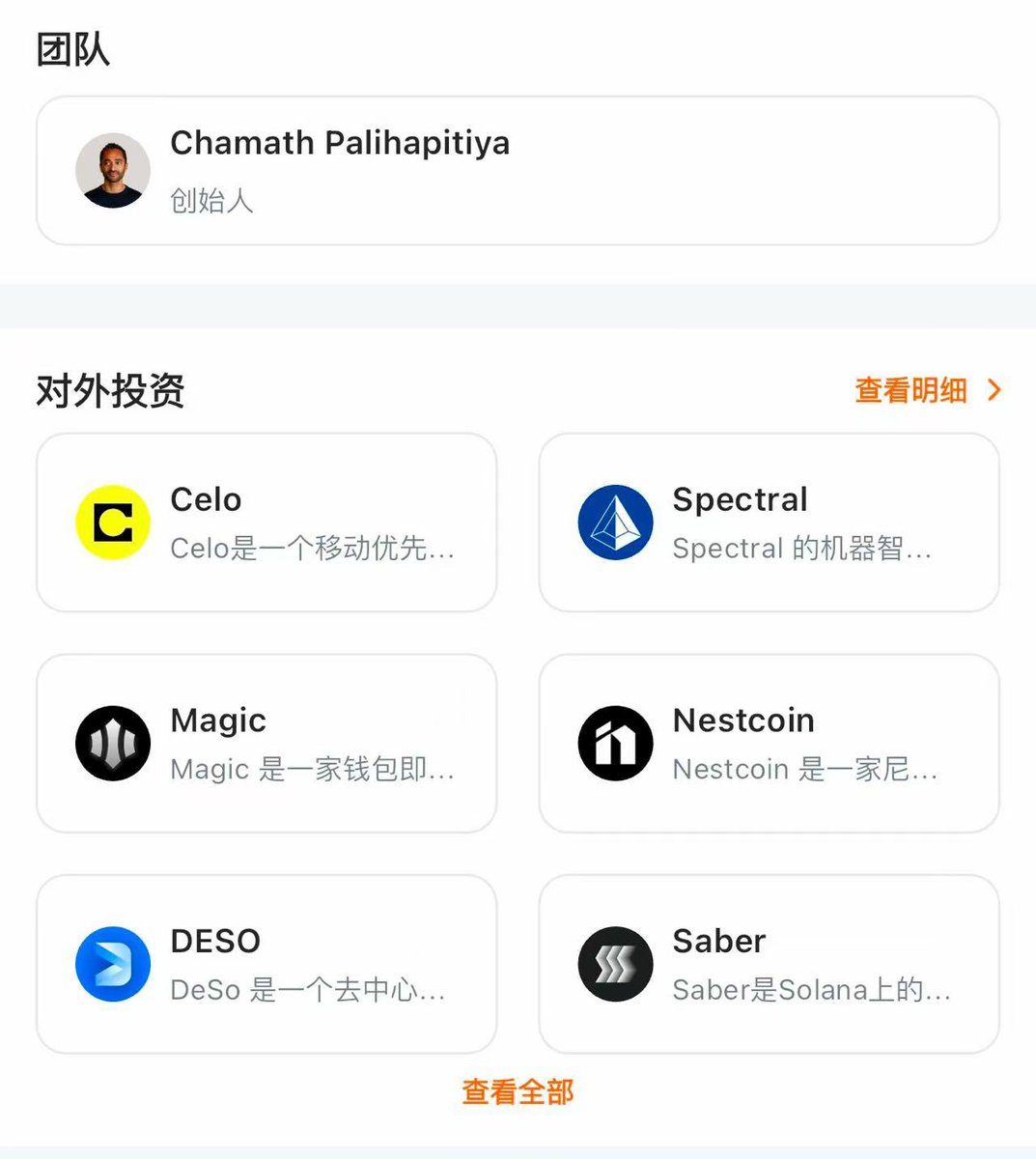

To give some background, Chamath is a king of SPACs, with VG, Opendoor, Clover, etc. from 2020-2021 (back then, he was involved in SPACs in the web2 space). His resume is quite impressive, being a former executive at Facebook and the founder of @socialcapital, with a total return of 997% from 2011 to 2019.

This time, AEXA could be a new turning point for the DAT (crypto stocks) play. The biggest difference is:

- Previously, DAT was like a boss who took the company's profits (which could also be from PIPE funding) to trade cryptocurrencies. People thought it was valuable because he had BTC on his books.

- AEXA is more like a group of people pooling money to start a legitimate investment company, clearly stating: this money is not for anything else, but to invest in companies doing DeFi business. (In fact, besides DeFi, there are also sectors like AI, defense, and energy.)

Previously it was "companies part-time trading cryptocurrencies";

now it is "everyone pooling money to focus on investing in DeFi".

So, to summarize the structural highlights of AEXA:

- AEXA's funding path is not about the company buying cryptocurrencies on its books, but directly connecting to the DeFi ecosystem through SPAC mergers/investments. For the first time, compliant funds are flowing into the blockchain openly. (Specific participation methods have not been disclosed.)

- Founders hold 30% Class B shares, which unlock only when the stock price rises by 50%, 75%, and 100% → strong alignment of interests.

No warrants provided → Traditional SPACs generally come with warrants, and this cancellation means a "purer equity structure," which can alleviate short-term arbitrage pressure after the merger.

As Wall Street's top-tier capital explicitly writes DeFi into SPAC fundraising documents for the first time, the signal significance is strong. The caliber of the individuals involved + the prospectus directly naming DeFi + the innovative equity structure gives this DAT a whole new realm of imagination:

The foreseeable development of crypto stocks proves that this round of the bull market driven by American-style DAT still has great potential.

Show original

5.63K

17

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.