So @maplefinance has quietly become the largest onchain asset manager with over $3B in assets under management.

➠ Users deposit USDC/USDT

➠ Get yield bearing syrupUSDC in return

➠ Maple lends to institutional borrowers

➠ Interest flows back to depositors

They’re getting good traction👇

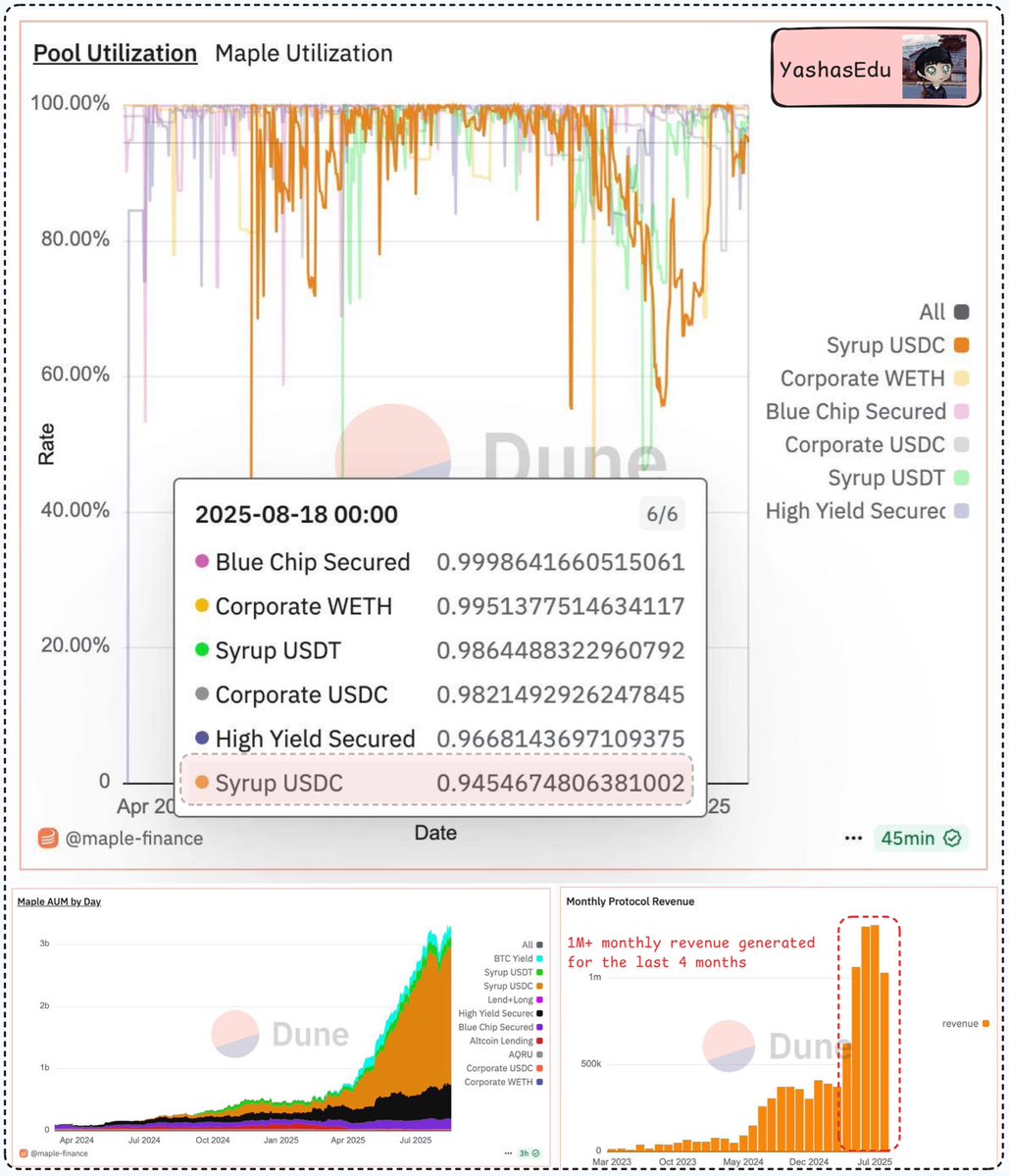

> Monthly revenue over $1M for three consecutive months

> Pool utilization above 90% (high demand)

> Annual recurring revenue jumped from $5M to $15M in Q1

We’re looking it from the institutional lending angle. While most DeFi focuses on retail users, @maplefinance created a bridge to TradFi through structured lending to institutions.

Tho $SYRUP benefits from this revenue growth, the real story is building sustainable yield in a market where most projects struggle to generate consistent income.

9.36K

183

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.