You read the thread on bundlers.

Now layer 10 more edges on top of that.

Bundling → latency → MEV → spoofing → multi-wallet routing → swap fees → platform fees → liquidity pulls → volume painting → chart painting

Retail buys through “friendly” trading apps → public RPCs with 300–600ms latency.

Meanwhile, pros run custom servers hitting 20–30ms.

That gap is everything. With it, you can:

- Front mirror every buy before it lands

- Offload into flow while keeping candles green

- Spin volume out of thin air

- Paint the chart into any shape you want

On Solana, with the right infra, charts aren’t a reflection of demand.

They’re a canvas and one player holds the brush.

This is why we are adding AI layers to place your trades on the memepool for you and never on the front end UI execution.

⚠️ You’re not losing to other traders. You’re losing to math + latency.

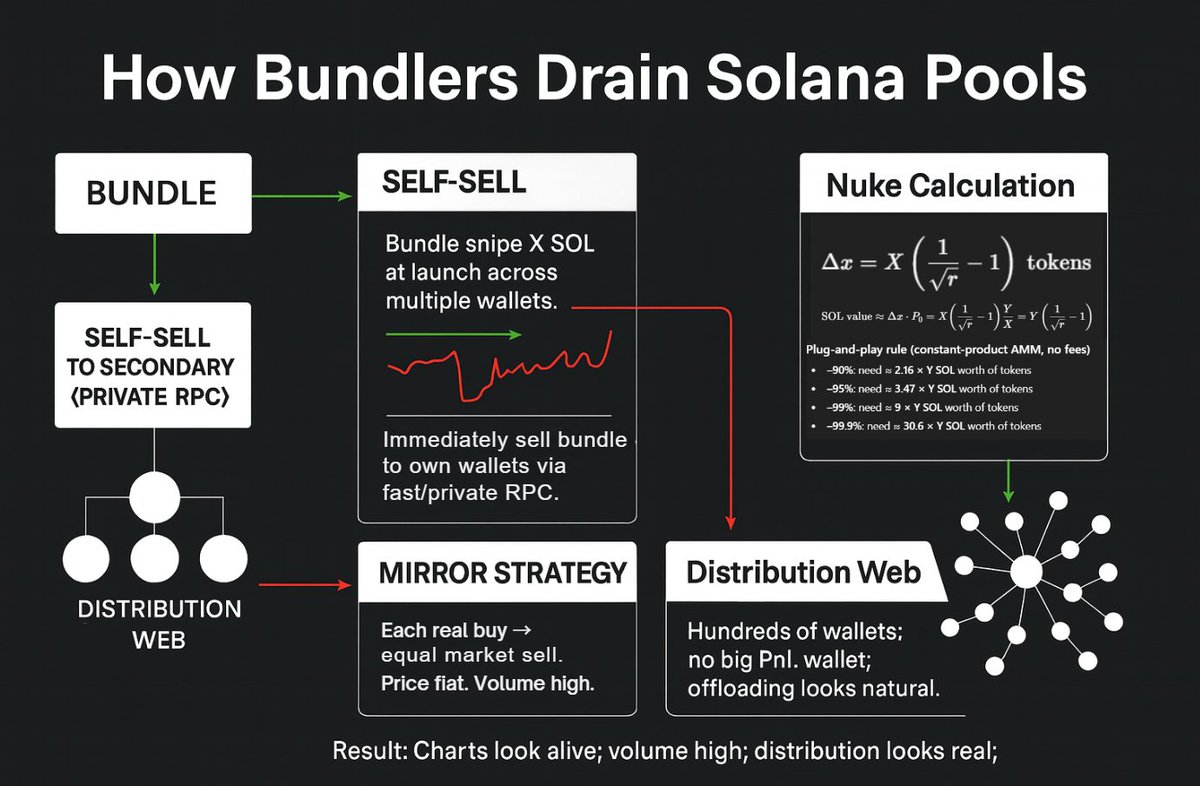

On Solana, bundlers are the invisible house. They bleed every buy, nuke charts in seconds, and you’ll never see them. Here’s how 👇

1. Bundle Entry

At launch, bundlers bundle snipe with X SOL across multiple wallets.

They win the first block.

The second the chart goes live, they sell the bundle to their own secondary wallets via private RPCs.

Onchain? It looks like early “organic buyers.” In reality? One entity holding all the cards.

2. Fake Distribution, Real Drain

From here, they run a mirror loop:

Every incoming real buy → they instantly sell an equal amount into the pool.

Price stays flat, volume looks “healthy,” distribution looks organic.

Bundlers offload without a footprint. To retail it looks like demand. In truth it's a heavy bleed

3. The Math of Nuking

In an AMM, price impact is deterministic:

Main formula: Δx = X * (1/√r – 1)

X = base side reserve (the token you’re dumping)

r = P_after / P_before (target price fraction)

Examples (no fee constant product pool):

–90%: Δx ≈ 2.16 × X

–95%: Δx ≈ 3.47 × X

–99%: Δx ≈ 9 × X

(optional) –99.9%: Δx ≈ 30.6 × X

👉 On a thin LP, nuking to 0% only costs a few % of total supply.

If the pool’s quote side has 100 SOL, a –99% nuke needs about 900 SOL worth of the token dumped into it.

–95% ≈ 347 SOL worth.

–90% ≈ 216 SOL worth.

Bundlers can cycle this size easily, over & over.

4. Why They’re Invisible

100s of wallets → no giant PnL address, just “randoms making small wins.”

Self trading bundles → tokens recycled internally, no obvious dump.

Latency edge → private RPCs + relays ensure they front run the chart every time.

5. The Result

Charts look alive.

Volume looks high.

Distribution looks real.

But every buy you place is instantly siphoned to the house.

This is the Solana edge no one talks about:

Bundlers calculate exactly how much supply is needed to nuke, recycle, and bleed infinitely.

Retail sees memes. Bundlers see math.

Once your server is live and there is 0 risk except minor transfer and snipe fees you'd run this 24/7.

This is exactly what they are doing.

🧵 End.

6.07K

95

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.