Which of the four major public chains @Aptos @arbitrum @NEARProtocol @PythNetwork is worth holding long-term? As a coin holder, what do you think??

Old Cha will take the time this afternoon to check all the data and show you!

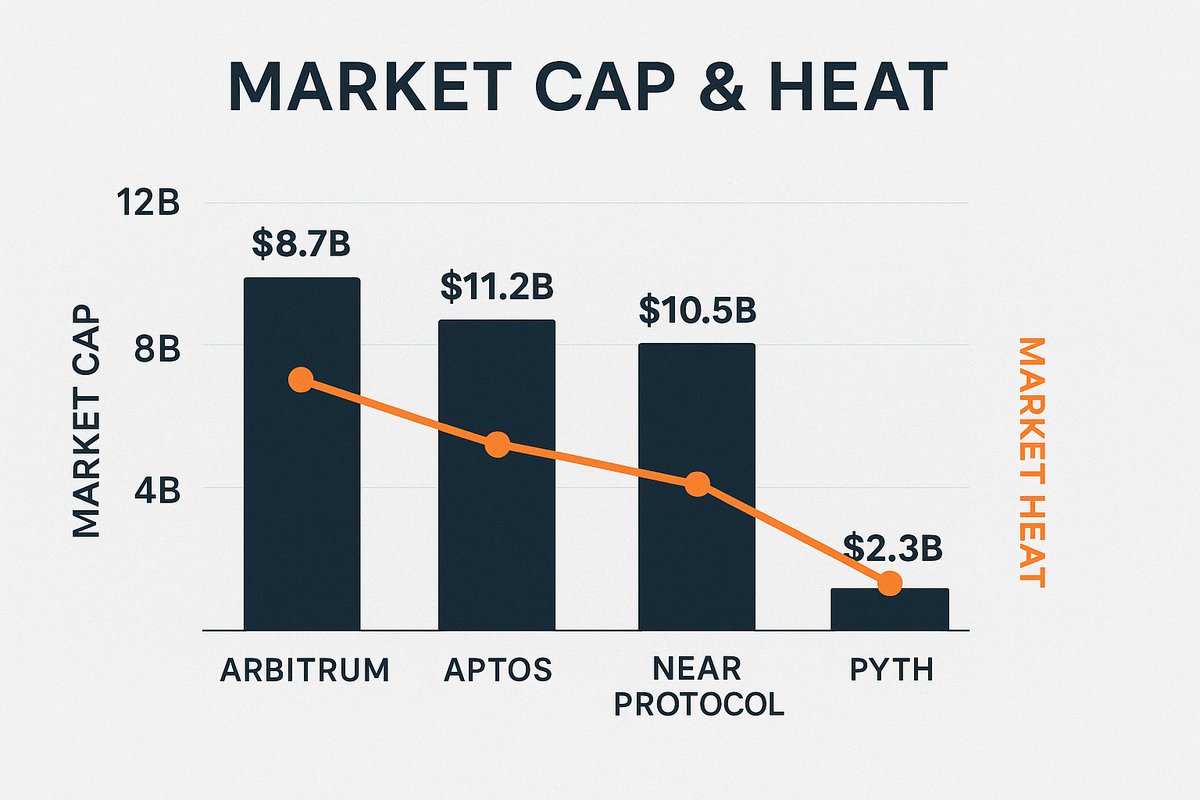

Of course, let's first look at their respective positions:

Aptos, Pyth Network, NEAR Protocol, and Arbitrum. Their positioning and development paths will determine how far they can go in the future.

First, let's talk about Aptos, which is backed by the former Libra team. Its technical foundation is solid, and the Move language is considered a differentiated innovation. However, the problem is that the ecosystem's heat and application explosion are still insufficient; it's more about potential than reality.

Pyth Network, on the other hand, is completely different. It is not a traditional public chain but a decentralized oracle network. With the growth of DeFi and on-chain trading volume, the market for data feeds is expanding, and Pyth directly hits the nail on the head. Its value may not lie in how high its market cap is, but in whether it can become an industry standard.

Next, NEAR Protocol, which I think is the most "pragmatic" among the four. It focuses on application ecosystems and user experience, such as account abstraction and on-chain experience optimization, which are crucial for user growth. However, NEAR lacks a breakout point like Ethereum's DeFi Summer.

Finally, Arbitrum, which is the closest to the concept of a "nation" among the four. It firmly grasps the Ethereum scaling track, with a large ecosystem and funding pool. Now it needs to solve issues related to governance and capital utilization efficiency; if handled well, it could become the most stable value carrier.

Here are the latest data for these projects for Old Cha to take a look at:

In-depth analysis of the four major public chains/infrastructure projects: value, narrative, and risk.

In the current crypto market, the value judgment of public chains and infrastructure often depends not only on market cap but also on TVL, ecosystem activity, technical narrative, and competitive landscape. Below is a comparative analysis of Arbitrum, Aptos, NEAR Protocol, and Pyth Network.

1. Arbitrum @arbitrum

(L2, Ethereum scaling hub)

Data: TVL ≈ $3.26B; circulating market cap ≈ $2.50B; Mcap/TVL ≈ 0.77 (<1, relatively "cheap").

Technology: Launched Stylus (WASM contracts), expanding the developer community; BOLD fraud proof implementation enhances security; Orbit builds L3 overflow ecosystem.

Investment logic: Value similar to "on-chain economic zone" cash flow discounting: Sequencer revenue × ecosystem activity × data cost. After EIP-4844 reduces data costs, activity and revenue elasticity increase.

Arbitrum remains the core liquidity center for Ethereum scaling, with a reasonable relative valuation, but growth depends on the share battle with Base and Optimism and the sustainability of application hits.

2. Aptos @Aptos

(L1, representative of the Move ecosystem)

Data: TVL ≈ $0.86B; circulating market cap ≈ $3.22B; Mcap/TVL ≈ 3.76.

Technology: Features Move language + Block-STM parallel execution, recently introduced the Raptr route (Prefix-Consensus) to optimize throughput and reduce latency.

Investment logic: Valuation depends on the landing of high-concurrency scenarios (social, gaming, asset issuance). Risks include ecological cold start, developer competition, and token release pressure.

Aptos has strong technical potential, but its valuation is relatively high compared to L2, and it needs to wait for large-scale application realization.

3. NEAR Protocol @NEARProtocol

(L1, chain abstraction narrative)

Data: TVL ≈ $0.395B; circulating market cap ≈ $3.42B; Mcap/TVL ≈ 8.66 (significantly overvalued).

Technology: Promotes Chain Abstraction (cross-chain unified experience) and FastAuth (email/MPC recovery), while providing data availability to Ethereum Rollup through NEAR DA.

Investment logic: Value capture through two lines: ① its own L1 ecosystem; ② B2B revenue as a cross-chain abstraction layer/DA layer.

NEAR is considered a "high story, high optionality" asset. If chain abstraction is successfully implemented, its valuation can catch up with fundamentals; otherwise, there is a risk of narrative realization falling short.

4. Pyth Network @PythNetwork

(Cross-chain oracle infrastructure)

Data: 125+ data providers, 1,930+ price sources, connected to 107+ blockchains, cumulative transaction volume $1.77T+, TVS ≈ $20.9B; circulating market cap ≈ $0.70B.

Technology: Uses Pull Oracle + Pythnet aggregation + Wormhole cross-chain to enhance data real-time and coverage.

Investment logic: Value anchored in data usage scale and fee capture efficiency; the broader the coverage and the higher the usage frequency, the more governance and staking form a flywheel. Risks include competition with Chainlink.

Pyth represents "core infrastructure" with high beta; usage and chain coverage are core fundamental indicators.

I believe Pyth represents the "core of the track," Arbitrum represents "traffic and nation," NEAR represents "user experience and applications," and Aptos represents "potential and capital story." In the future, who holds the most value will depend on who can truly translate the narrative into applications and users.

Show original

51.04K

81

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.