Polygon first: fast tx on its own chain.

Every ~25–30 minutes, it posts a state root to Ethereum.

Staking for Polygon validators lives on Ethereum too.

So proofs and bridging rely on Ethereum for long-term consensus.

Celo now runs on OP Stack as an Ethereum-secured execution environment, also known as a Layer 2, but reliant on an external data availability solution instead of Ethereum's.

For data, it uses EigenDA.

EigenDA, while external to Ethereum, is secured by restaked ETH on EigenLayer (slashable on Ethereum).

The pattern is the same: custom, faster consensus up front, then a slower step onto Ethereum so the record is locked in at the highest security level and verified by the largest validator set in the world.

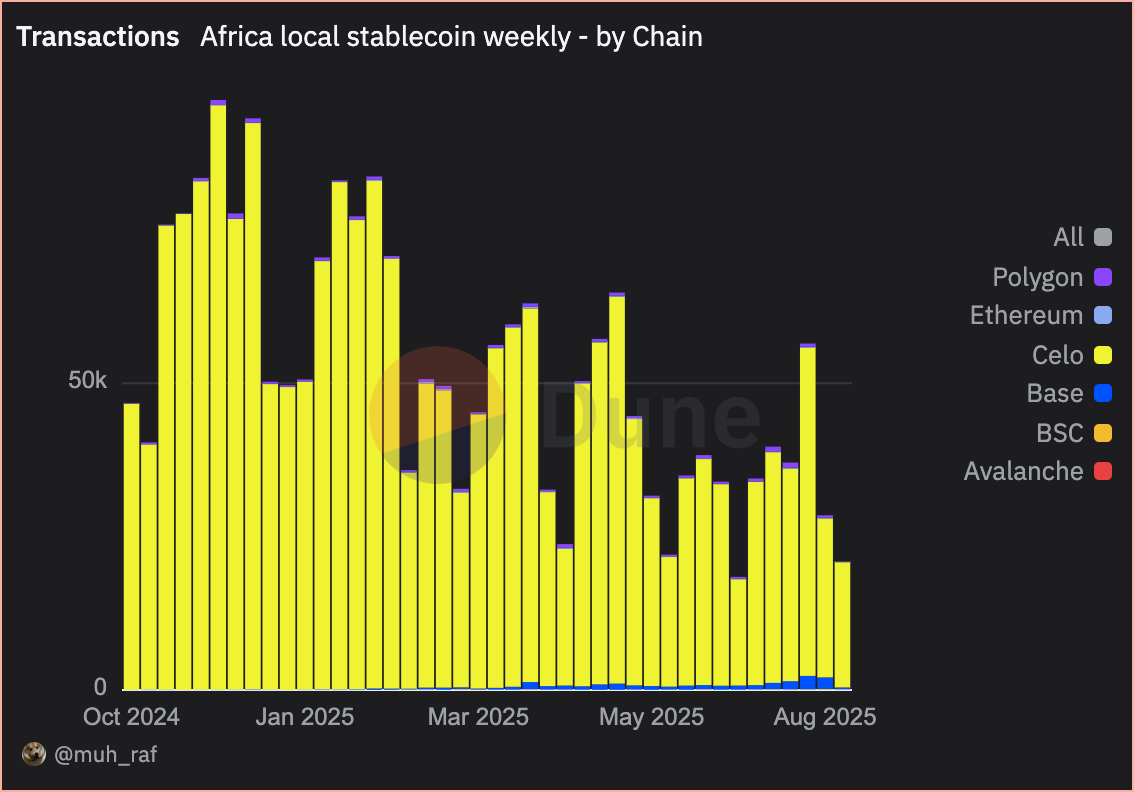

While Polygon dominates Latam and Asia, @Celo continues to gain traction in the African market with products such as @minipay, supported by @cLabs and @opera, and the stablecoin $cUSD.

Regional stablecoins such as $cGHS and $KES on @Celo account for 90% of the total volume in Africa.

thx for data: @_muhraf_

4.4K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.