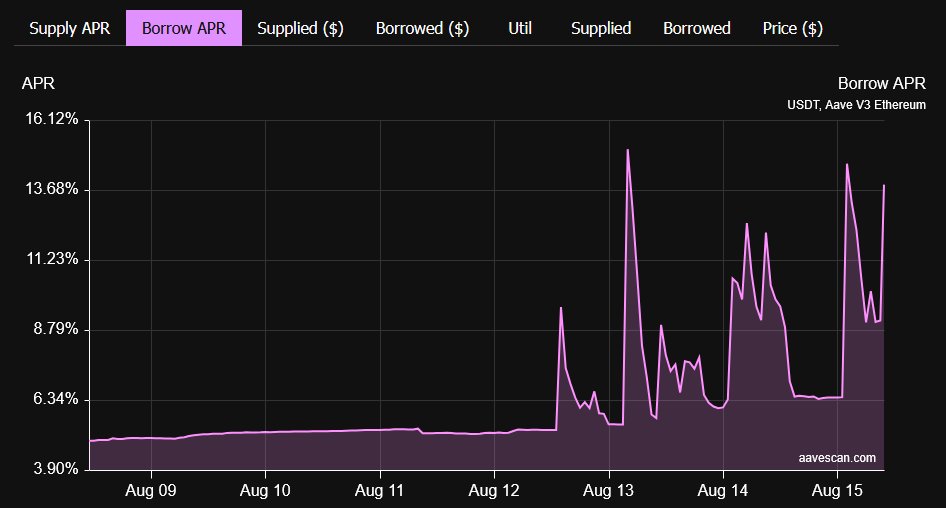

⚠️The $USDT borrow rate on @aave v3 keeps spiking and is currently at 10.8%.

This results in different looped strategies (such as @ethena_labs Liquid Leverage) to currently have negative net APYs - meaning these positions are slowly bleeding.

It's hard to say if the rates will stay high in the long run, for now it seems these are occassional spikes, potentially caused by a certain mr Sun gradually withdrawing their assets.

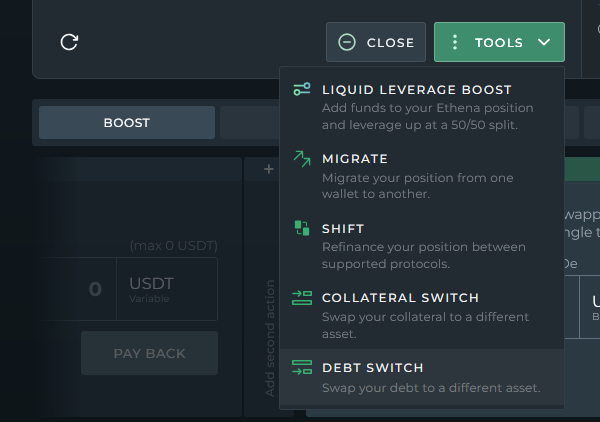

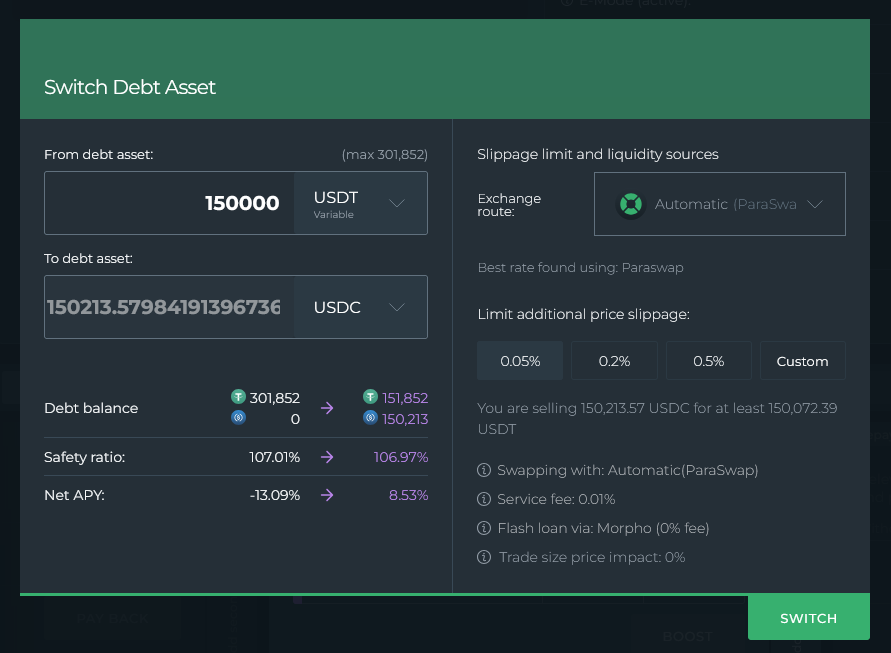

💡But if you do think USDT borrowing costs are not going down - you can use our Debt Switch to swap your debt asset to another one.

As of recently, this is available directly in our Aave dashboard, right under that Tools menu.

And keep in mind you can also do partial debt swaps, if you want to average things out, or if you have a large position that would be impacted by TSI with one large swap.

As a reminder, DFS looks for best swap routes for this from 6 dex aggregators, just like for any other transaction that includes a swap.

Those are @0xProject, @KyberNetwork, @1inch, @VeloraDEX, @odosprotocol and @bebop_dex.

5.74K

17

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.