I think there are broadly only two ways in which a new chain could succeed at this point in the cycle. Especially in the context of the new stable-coin L1s (@PlasmaFDN, @arc and @stripe 's Tempo) that are imminently rolling out.

The Sui Playbook:

Firstly, the @SuiNetwork playbook. For all intents and purposes, Sui does not have a burgeoning or strong on-chain eco-system (see below for a quick comp between HL, ETH, SOL on volumes/users/fees), yet there seems to be a relentless bid for it. The cynic in me would say that it's very much KOL driven: Its not a coincidence that @Grayscale announced their Sui Trust in Sept 2024 right after the major unlocks began, shortly followed by some of the larger heavy weights e.g. @HighStakesCap tossing their hat. One only needs to look at some of the marketing agencies that list Sui as a client. That's fine its an attention market and that's the name of the game.

Having said that I think there is another way for the these stablechains to win and that's via access to cheap cheap dollar leverage to max pump DeFi native TVL. I think this is actually what @berachain did extremely well. Perhaps too well. They rented out ~$3b for ~3 months at a cost of 2% of FDV which ended up being ~$40m at the time of unlock i.e. about 5% APR. The real issue with the chain was that it was 1. rented tvl with a clear end date and 2. aerodromesque tokenomics/emissions were designed for 2023 not the more sophisticated 2025 cohort.

The On-chain Native Playbook:

For @PlasmaFDN to win I would lean heavily towards giving the market what it wants: Cheap loops and cheap leverage:

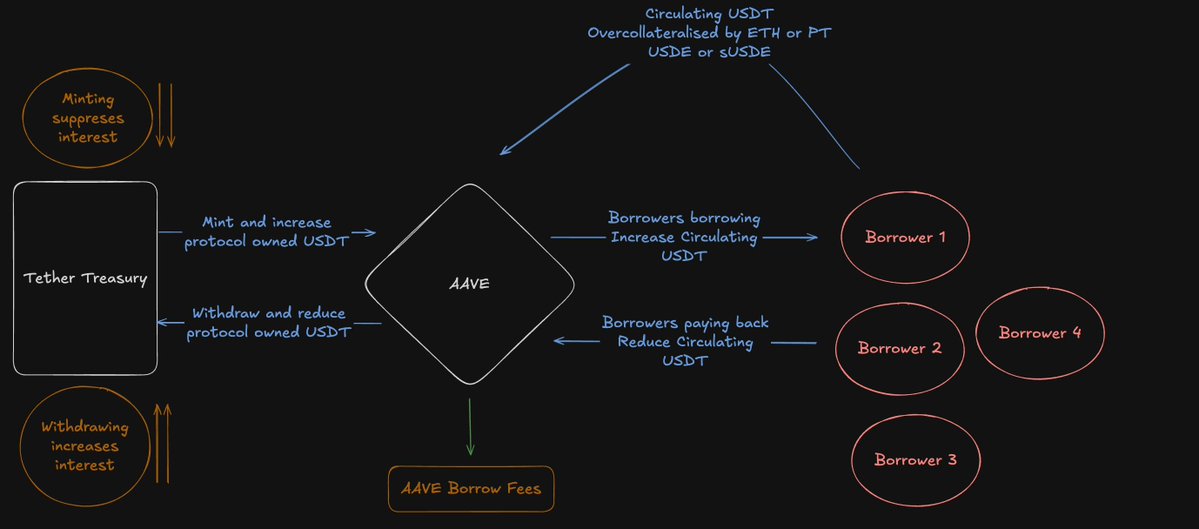

@Tether_to should giga mint USDT directly into @aave becoming the de facto supply side liquidity provider people borrow from rather than having to rely on third party degens/funds.

Just imagine Tether dropping $20b directly into @PlasmaFDN @aave day 1. If its not borrowed, its 'protocol owned' and thats fine. If it is borrowed, that USDT becomes circulating, it earns a yield, and its overcollateralised by ETH/USDE/PT deposits. Tether can then act like its very own central bank flexing the rate it wants to earn on its lends by tightening or loosening supply. (sketch below)

Why would this work?

1. @Tether_to wins because they would still earn a yield on these 'unbacked' lend positions so bigger absolute profits, they'd have way more AUM because of greedy loopers also they'd be sitting on a much larger XPL bag.

2. On-chain enjoyers win because.. well their carry margins are fatter too.

3. Lets also remember that @ethena_labs uses USDT so it doesnt necessarily even need to get redeemed (to the extent they dont swap for USDS or USDtb since tether dominates cexperp margin).

This type of composability at such a grand scale would be incredibly novel and is exactly why you'd want to own the entire value chain... cc @paoloardoino

h/t @chud_eth the defi goat w the original idea

26.45K

59

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.