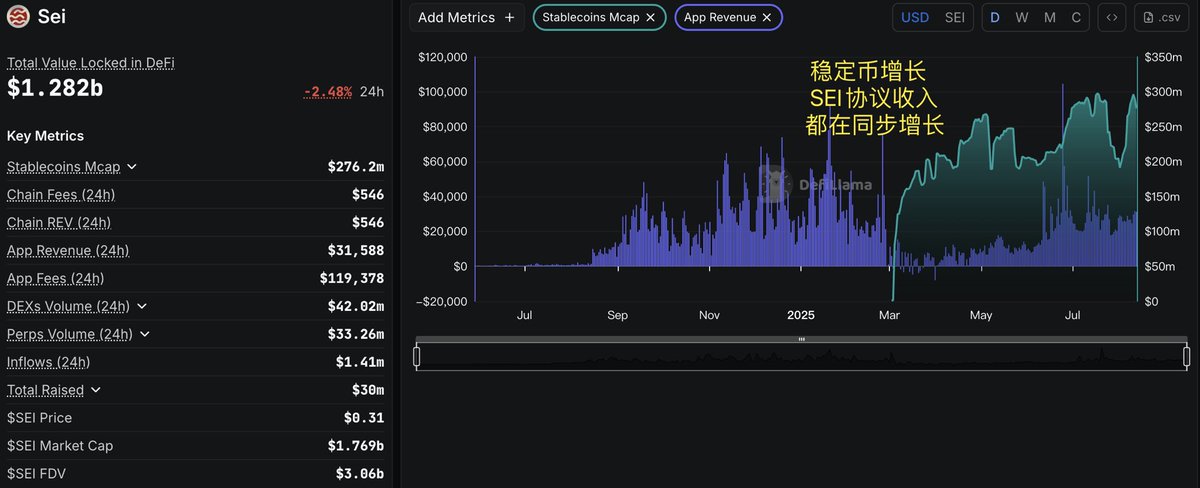

After the Genius stablecoin bill, who is the fastest public chain in the growth of stablecoins? It has to be @SeiNetwork. #Sei has hitched a ride on #Circle's native USDC express lane and is rapidly rising!

#Circle not only invested in #Sei but also listed #Sei tokens as its largest crypto asset holding in its IPO documents. What does this mean? It means #Circle is not just casually buying coins for investment; it has placed a significant bet. In this case, it will naturally push for #USDC's implementation on #Sei with full force.

The results are clear—just two weeks after launching the native #USDC on #Sei, it minted $160 million. This speed is rocket-like in the industry, directly outpacing a number of established public chains like Hedera, Polkadot, Tron, and Algorand. It's important to note that these chains have had stablecoins for a long time.

Moreover, and more crucially, this growth rate translates to a potential annualized stablecoin trading volume of over $1 trillion. This is not a small number, indicating that #Sei is quickly aligning itself from a "high-performance public chain" to a "stablecoin settlement layer".

Therefore, #Circle views #Sei as a strategic partnership chain, which should not be understood simply as a financial investment; rather, it aims to make it a "highway" for USDC in the high-performance trading field. The original trading performance advantages of #Sei (sub-second block times, parallel processing) naturally match with future potential tracks like stablecoin payments, #DeFi settlements, and #RWA, which will attract core financial players involved in high-frequency trading, cross-border payments, and TradFi institutions.

Currently, #Sei's early adoption curve is steep—under these circumstances, if the #Sei ecosystem can quickly fill in the application scenarios for stablecoins (DEX, lending, RWA, payment gateways), I believe the speed of capital accumulation may far exceed that of similar chains. 🧐 This is worth long-term attention and anticipation!

After the recent implementation of the Genius Act, the stablecoin track has become the focus of market attention, with stablecoins looking at #Circle first, and among #Circle's partners, #SUI and #SEI, and #SEI, as a player with stronger growth, has become the core of our focus. Therefore, we have carefully studied and analyzed #SEI's every move, and recently noticed a phenomenon: "The institutionalization speed of SEI is accelerating", and #CoinShares's latest staking SEI ETP can be said to be the "timpani" of this trend.

✅ What is a popular science ETP? More potential for staking!

Let's briefly talk about what ETP (Exchange-Traded Product) is:

It is a crypto asset investment product that you can buy on the stock exchange, similar to Bitcoin ETFs, but usually more common in European or Asian markets.

This time #CoinShares launched a "staked SEI ETP", which means:

• Investors are buying compliant #SEI exposure;

• At the same time, #CoinShares take this part of the #SEI to stake on-chain;

• The staking yield generated will be returned to the holder, not eaten by the platform itself.

That is: you are holding an "interest-bearing" compliant #SEI exposure. This is more attractive than traditional ETPs and offers better value for money for institutions seeking yield.

✅ Who is #CoinShares? Why is this ETP reliable?

Who is #CoinShares? In a word, make it clear:

One of Europe's oldest crypto asset managers, with an AUM (Assets Under Management) of over $4 billion, and is a compliance agency under the MiCA regulatory framework.

It already has multiple ETPs for mainstream assets, including #BTC, #ETH, #SOL, #DOT, and now it's #SEI's turn.

What does this mean? It shows that #CoinShares really regards SEI as a "next-generation infrastructure asset" and is willing to build an entrance for institutional investors for it.

✅ Why #SEI? What is its ability to attract institutions?

We've been following #SEI since #Circle hit the market, and we've done a lot of detail before:

• Designed for trading, with integrated order book functionality at the chain level for extremely strong performance;

• Native support for parallel trading, excellent TPS and terminal latency;

•SEI V2 directly supports Ethereum smart contract compatibility.

In other words, it is fast, can run Ethereum stuff, and focuses on financial scenarios, making it TradFi friendly. If institutions want to enter the market, they must find a public chain that can carry "transaction volume" and "compliance", #SEI just in line with this characteristic.

✅ #SEI's compliant financial route has taken shape

Don't forget, Valour has already launched its first SEI ETP some time ago, and this time CoinShares is equivalent to relaying.

This creates a very clear signal: #SEI is being treated as a "compliant and investable infrastructure asset" by traditional European financial markets.

In other words, #SEI is no longer just a speculative coin in the Web3 circle, but has begun to enter the whitelist of pension, family office, and institutional ETF portfolios. And once these "long money" come in, the valuation system of #SEI is different.

Overall, the launch of the staked SEI ETP by #CoinShares is an important node for #SEI to move towards mainstream financial asset pools and a major step forward in the compliance path. #SEI is increasingly positioned as a "transaction infrastructure layer", somewhat similar to Solana's development path.

Personally, I will continue to pay attention to the spot trend of #SEI and changes in on-chain TVL, and at the same time start preparing to consider incorporating medium- and long-term allocation. Because when an asset management company is willing to "package you to buy for institutions", its identity is different. 🧐

27.68K

25

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.