Update on @NEARProtocol on-chain data still requires attention to the overall market trend.

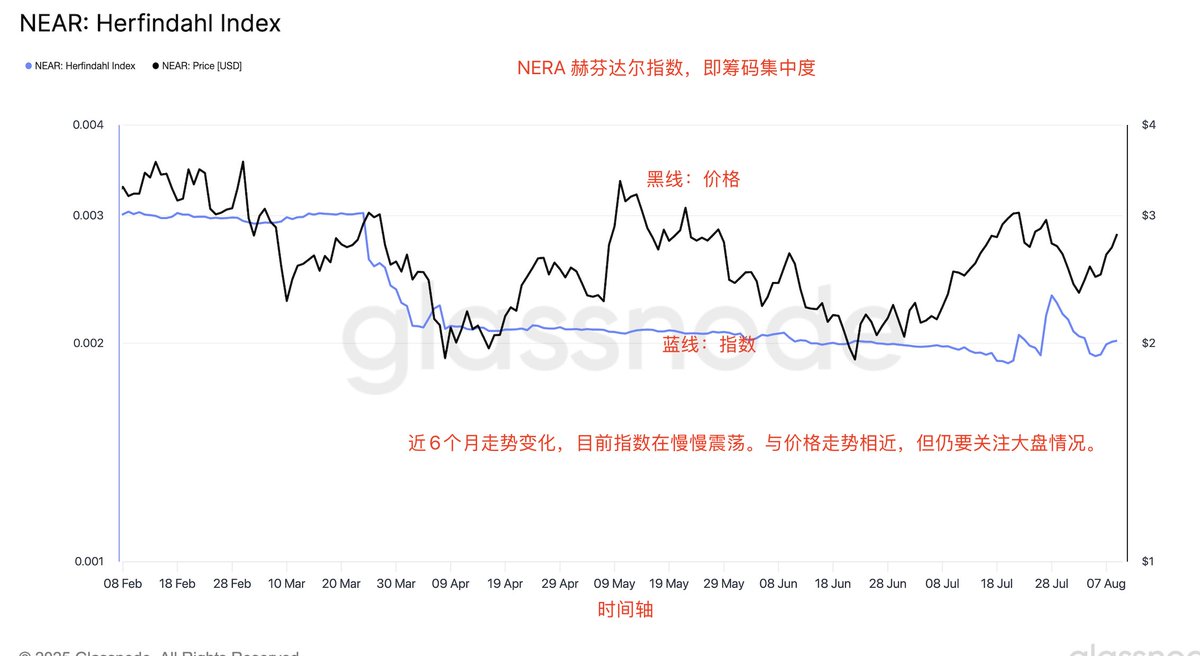

The Herfindahl Index, which measures the concentration of chips, is used to assess the share of network addresses in the current supply, indicating the level of concentration. A high index indicates that a few large holders are dominating the market, while a low index suggests a more even distribution of chips.

As shown in the figure. @NEARProtocol

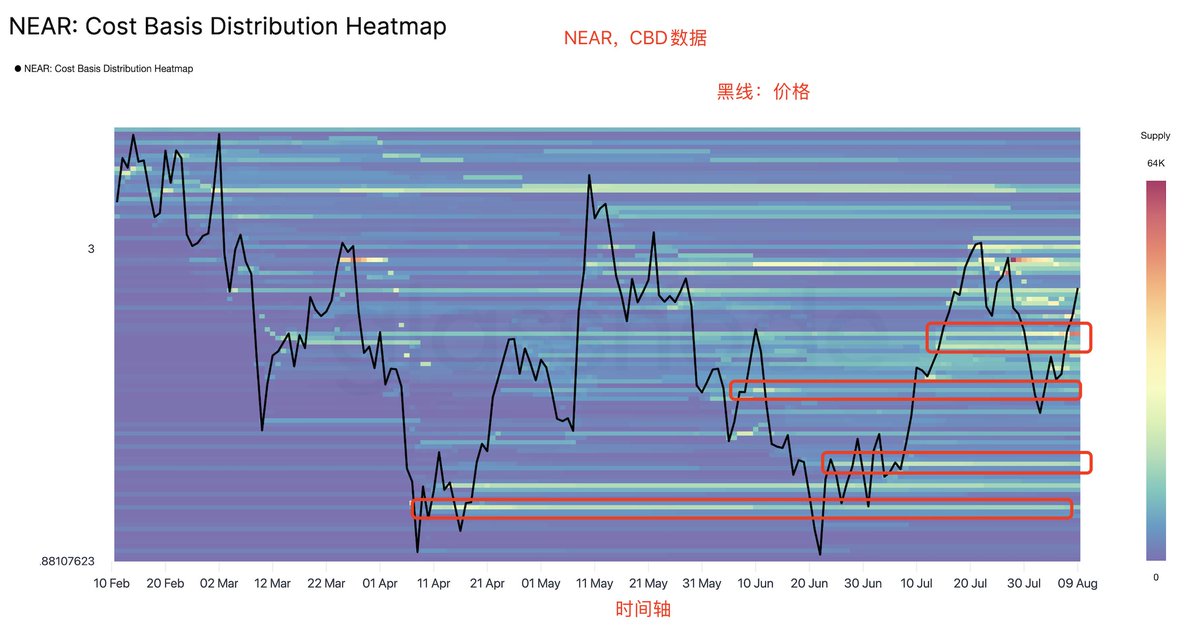

Cost Basis Distribution (CBD) data

The Cost Basis Distribution (CBD) heatmap provides a detailed visualization of supply density at price levels over a specific time period (e.g., 1 month, 1 year). By selecting a time range, this indicator displays a heatmap where the y-axis represents the cost basis on a logarithmic scale, ranging from below 1% of the lowest price in the selected time period to above 1% of the highest price.

The color intensity of each pixel reflects the concentration of supply at that price level, allowing investors to identify key acquisition points corresponding to significant portions of asset supply.

This helps to better understand the relationship between price levels and cumulative supply density, thereby gaining insights into potential support and resistance areas based on historical acquisition levels.

As shown in the figure. For reference and learning, not investment advice.

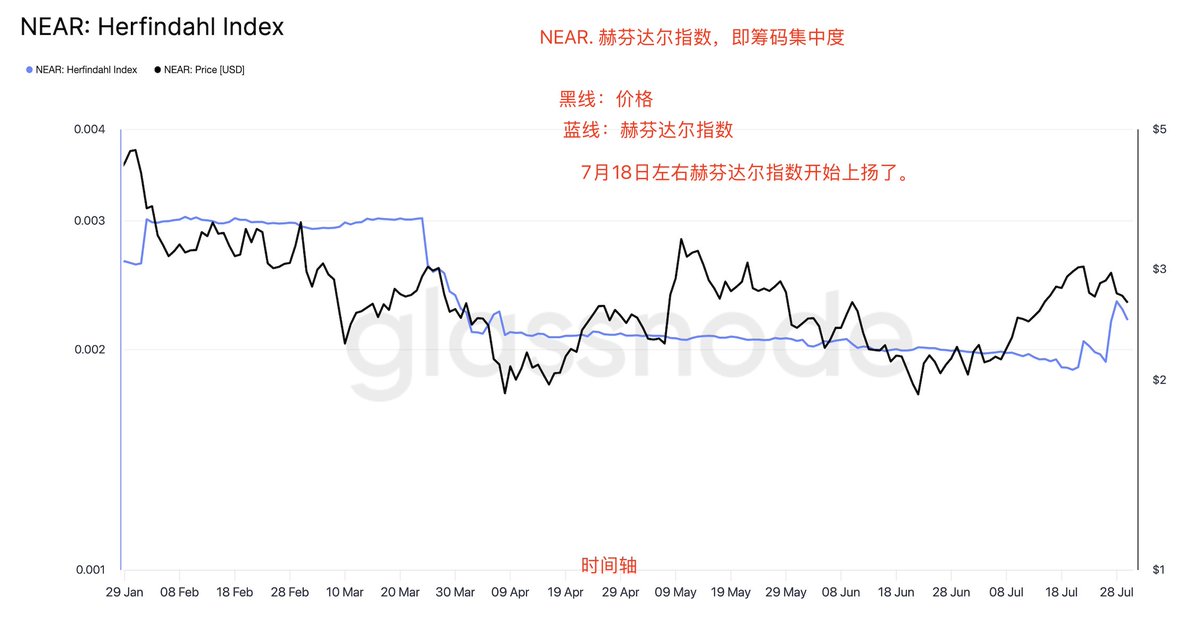

Continuing to update @NEARProtocol on-chain data.

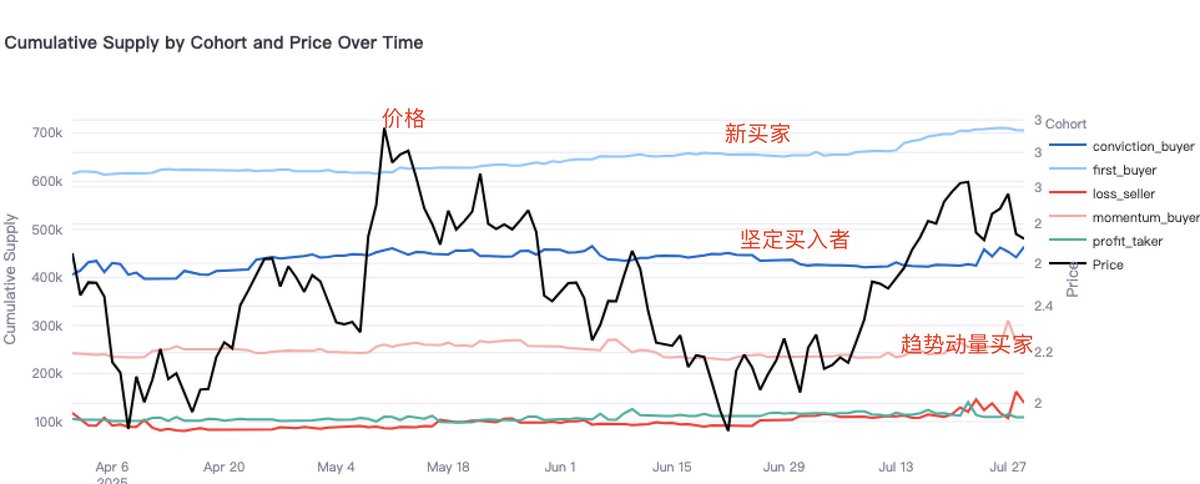

Recently, @NEARProtocol has indeed shown good development momentum, with new buyers and momentum buyers seemingly building up recently, combined with the recent actions of Near. However, on a larger scale, we still need to look at the overall market situation. There was no interest rate cut in July, and no monetary policy meeting in August. If there is a rate cut in September, there is still more than a month to go. We can only continue to pay attention.

The NEAR Herfindahl index measures the share of network addresses in the current supply, indicating the concentration of chips. A high index indicates that a few large holders are dominating the market, while a low index indicates a more even distribution of chips. As shown in the figure.

When a TOKEN is first issued, early holders often concentrate a large supply, leading to a high Herfindahl index due to high control. As these early holders sell off, the index begins to decline, reflecting a gradual shift from concentrated to dispersed token distribution.

While a more concentrated chip does not necessarily mean a price surge, it is certainly more favorable for control, and volatility will be amplified. Recently, the concentration of chips has indeed been rising, but it is not strong and needs to be observed further.

Then @NEARProtocol - supply mapping, as shown in the figure, the logic has been explained in detail before.

For reference and learning, everyone. Not investment advice.

14.1K

44

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.