XRP Army: Don't you deserve better than being charitable donors to Ripple elites?

Chainlink protocol revenue -> LINK token buyback

Aave protocol revenue-> AAVE token buyback

Hyperliquid protocol revenue -> HYPE token buyback

Ethena protocol revenue -> ENA token buyback

Maple protocol revenue -> Syrup token buyback

Jupiter protocol revenue-> JUP token buyback

Ripple dumps XRP -> Ripple buys companies for itself and does Ripple stock buy backs

XRP holders get nothing but the miniscule burn of .014% of XRP supply since 2012

>Every crypto community has hype, FUD, and misinformation, that’s not unique to XRP. BTC, ETH, SOL all have influencers spinning narratives daily.

They aren't even 1% of what XRP's is. I have never seen a larger mismatch of valuation vs fundamentals in history than what XRP is.

I have never seen anything close to the volume of misinformation around XRP that is peddled daily on every social media platform. Nothing is even 5% of what XRP misinformation is.

The **ENTIRETY** of XRP's marketcap stems from:

1. Misinformation and faux hype about non-existent partnerships

2. Conflation of having exposure to Ripple Labs by owning XRP

3. Unit-cost bias. Innumerate rubes think that a coin is "cheap" because it's $3.

The chain has ZERO fundamentals to support its valuation.

>They show a marketing team planning to use influencers and speculation around key announcements something literally every major crypto and tech project does.

No, they don't. It was to spread baseless rumors about parnterships that aren't real in order to pump the price of XRP.

Meanwhile, Ripple's CTO openly admitted this past year:

"Banks will never be Ripple's success story"

"We focused a lot of banks in the beginning just because the press releases were a big thing"

"Ripple: Hey, we want to move billions of dollars for you

Banks: Yeah, we kind of don't you to."

@xrpbreezy @tezos_jeff @versusdapp

I'm working on a long one of my own right now, but this covers it extremely well, too.

Chainlink’s dominance simply cannot be stopped

- Working with the largest financial institutions and market infrastructures in the world (Swift, DTCC, Euroclear, J.P. Morgan, Mastercard, Central Bank of Brazil, UBS, SBI, Fidelity International) on adopting tokenizing assets at scale, with a growing number of in-production use cases and more pre-production reaching live deployments

- Powers the DeFi economy with 68% market-share across all chains (84%+ on Ethereum) across hundreds of applications and 60+ public blockchain ecosystems, while expanding support for permissioned chains (Kinexys by J.P. Morgan, Canton Network by Digital Asset)

- Operates the only unified and modular platform that spans onchain data delivery, cross-chain interoperability, privacy-preserving compute, automated compliance, and legacy system connectivity (core requirements for tokenized assets and complex blockchain apps)

- Chainlink’s total value secured (TVS) in DeFi is $91B (incl borrows), which is directly monetized via MEV-recapture solutions like SVR, which has been adopted by the largest DeFi protocol (Aave w/ $65B TVL), capturing $450K so far with one user for one lending market on one blockchain (more growth to come)

- Has operated in-production for over 6 years with the highest level for security and reliability, even during extreme market volatility (e.g., FTX collapse, COVID dump) and blockchain network congestion (gas fee spikes in the thousands of USD), protecting DeFi for years

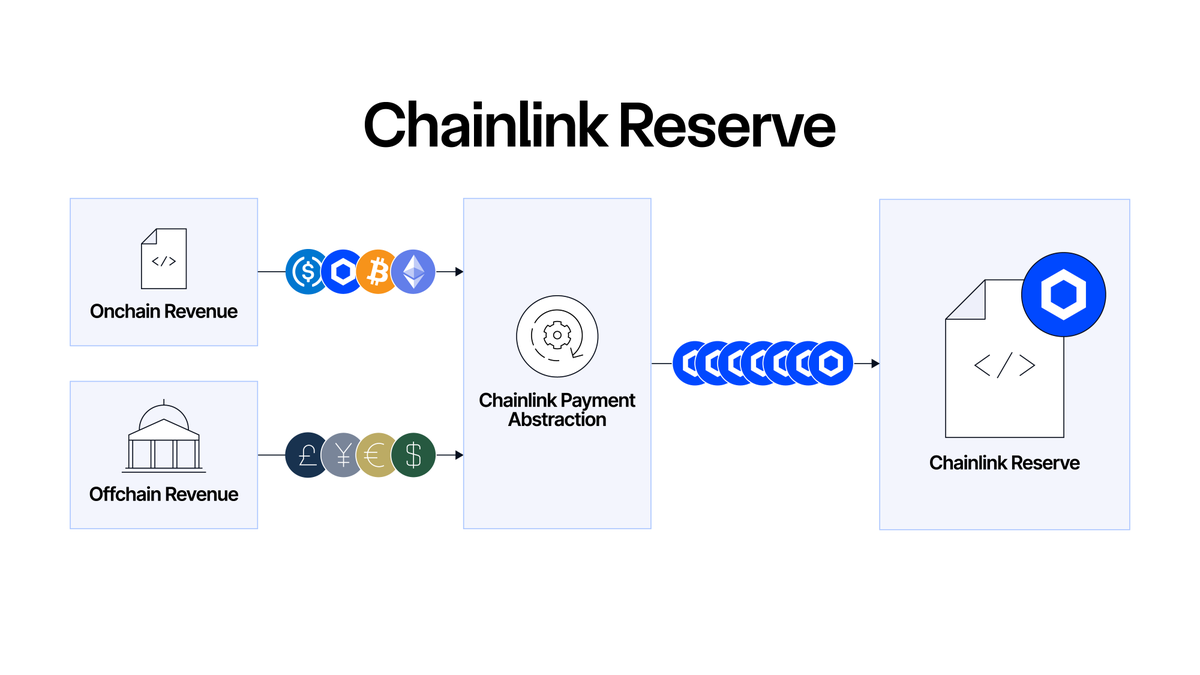

- Directly connecting protocol adoption with token value capture through the creation of the Chainlink Reserve which accumulates $LINK using offchain revenue from enterprise deals and onchain revenue from service usage (buybacks), with hundreds of millions of dollars in historical revenue

- Directly monetizes the integration of Chainlink into blockchain ecosystems via the Scale program and enterprise adoption via integration, usage, and maintenance deals, that fuel $LINK token buybacks from fiat and crypto fee payments

- Has been building oracle infrastructure since 2014 (before Ethereum) and working directly with Swift since 2016, with new protocols and services launched regularly to meet the growing demand from institutional users

- Working directly with the U.S. government officials and regulators, including meeting multiple times with the SEC, Treasury, and other departments, and met with Trump publicly multiple times, with the White House’s recent Digital Asset Report directly highlighting the importance of Chainlink and oracles

- Launched an automated compliance solution in collaboration with Apex Group (services $3.4T in assets), GLIEF (issuer of the only globally adopted & mandated G-20 initiated Legal Entity Identifier), and the ERC-3643 Association (widely adopted permissioned token standard), where ERC-3643 was just mentioned in a recent speech by the SEC chairman

- Directly powers many of the largest stablecoins, tokenized funds, and tokenzied equities with data/cross-chain/compliance as institutions are rapidly accepting their plans for issuing and adopting tokenized RWAs at scale

- Supported by one of the largest developer communities in the crypto ecosystem (tens of thousand of devs) along with vibrant active community that have an unlimited reserve of memes to deploy (memetic magik)

- Building a new architectural upgrade called the Chainlink Runtime Environment, which powers programmable workflows that enables the orchestration of complex applications/transactions that span onchain and offchain systems, serving as the operating system of crypto

And so more much

You just win $LINK

@xrpbreezy @tezos_jeff @versusdapp It was discussed in that bigger post.

This is a thread dedicated to just the newest tokenomics.

The adoption of the protocol means more revenue. The revenue buys back the token off the open market and stashes it away into a smart contract.

The revenue buys the token off the market and puts it away into a smart contract. The more revenue generation there is, the more buybacks of the token there are. There are also other complimentary things that can be done in conjuction with this around the nodes to create further supply sinks.

At the end of the day, the *ONLY* thing that creates sustinable, amazing tokenomics is having lots of revenue generation that is aligned with the token, which is what Chainlink the protocol has/will have and it is being pointed at the token.

@xrpbreezy @tezos_jeff Here is just one source of revenue generation that will massively scale up as it expands to more chains, more lending protocols, and all the lending protocols get more TVL into them from institutions.

The larger the TVL -> revenue to buy back tokens with.

I'm going to drop a little Sunday nugget that I guarantee you no crypto research firm, no crypto podcaster, no crypto VC, no crypto social media bro, has ever pointed out:

TVL of assets on a chain is not proportionately correlative to the value accrual of that chain's gas token.

Example:

Take 10 billion stablecoins/tokenized RWAs/ETH/whatever, dump it into Aave for a year, book $50 million in yield income, and withdraw it for $3 in ETH gas fees.

TVL: $10 billion

Yield income: $50 million

Value accrual to ETH: $3

But, in contrast, the TVS of Chainlink on lending protocols *IS* value accretive to Chainlink and that lending protocol in proportion to that TVS:

The more TVS in Aave (secured by Chainlink) -> Larger sized loans -> Larger sized liquidations -> Larger sized profit margins for searchers to liquidate those loans -> Larger sized bids that searchers will pay Chainlink to the buy the rights to the liquidation.

The money paid by the searchers is then split by Chainlink and Aave.

Hence, Chainlink's Smart Value Recapture (SVR, OEV solution) is how you directly monetize the TVS secured by Chainlink's price feeds.

The larger the TVS -> The more value accrual to both Chainlink and the lending protocols consuming its feeds.

In this attached example ( a $2.8 million dollar loan was liquidated and the searcher paid $100K to Chainlink for the rights to the liquidation, which is then split between Aave and Chainlink.

Food for thought.

42.41K

229

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.