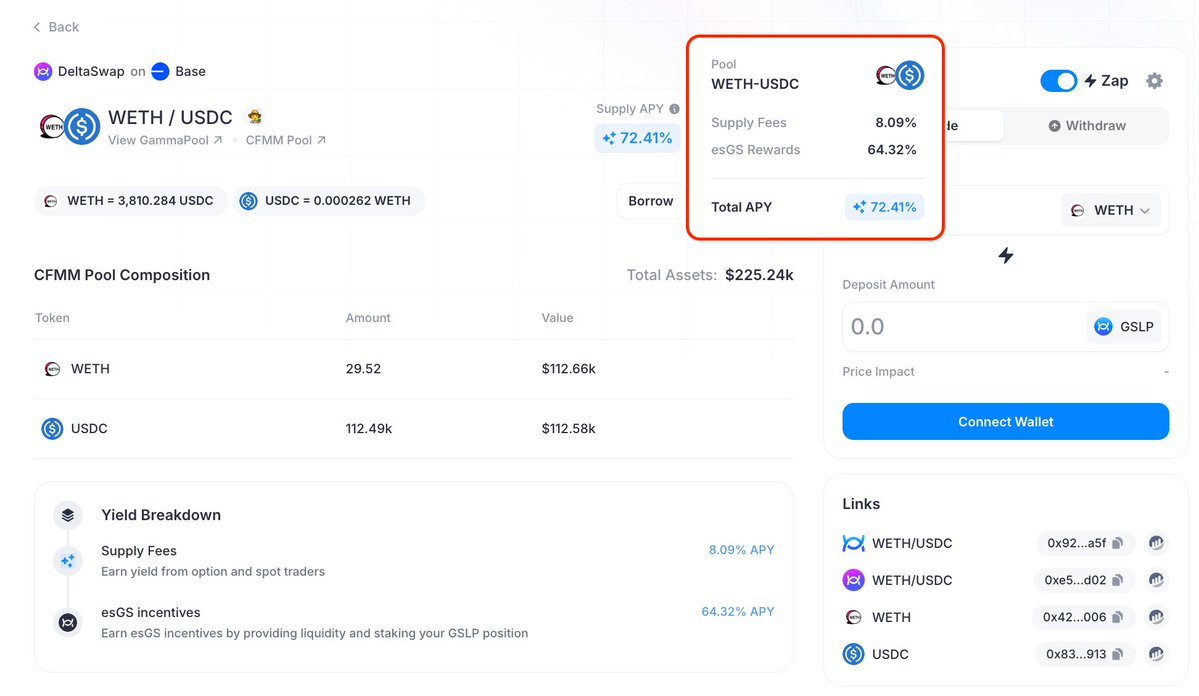

The GammaSwap WETH/USDC pool which the gETH token is using to hedge IL is paying 8% in real yield and 64% in esGS rewards (GS with a 30 day vest). It has the same IL risk as UniV2 with utilization risk similar to lending markets

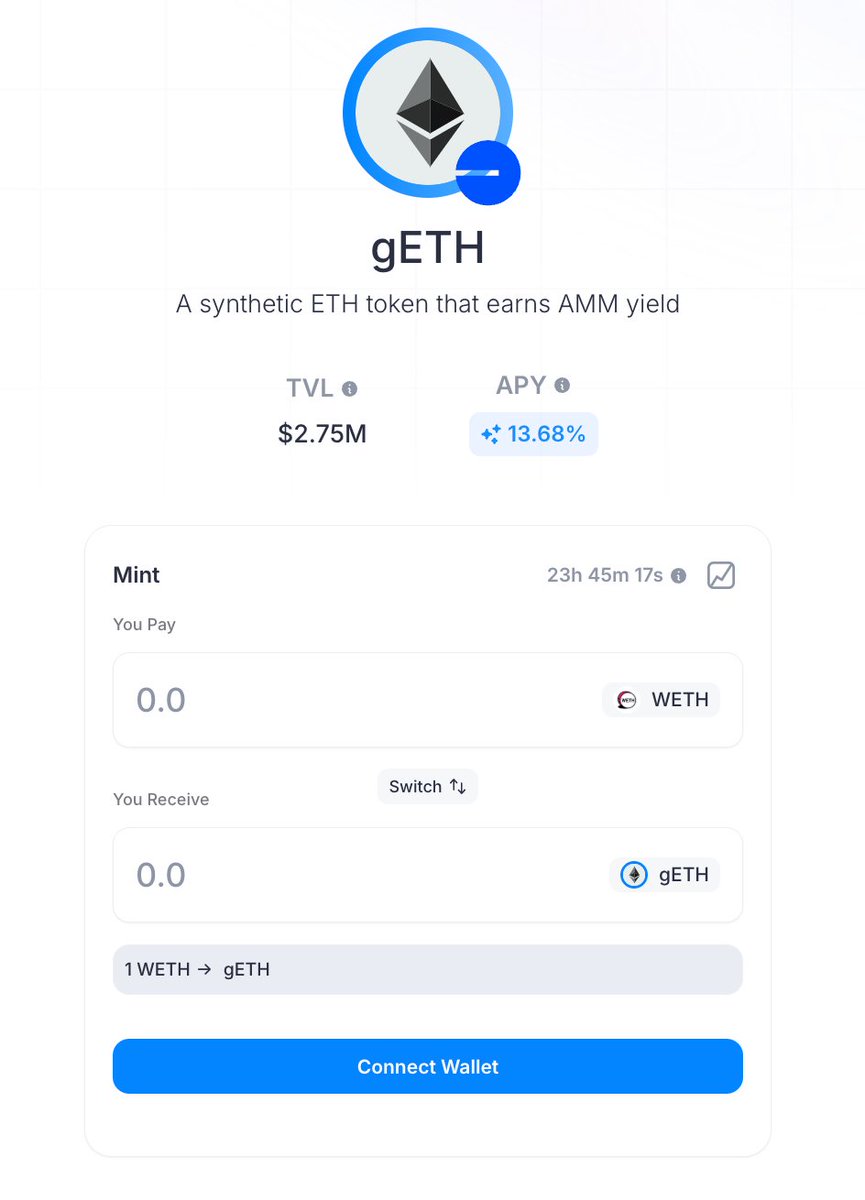

gETH is paying 13.68% yield on gETH with 2.75M

WETH/USDC Base pool available here:

3.34K

48

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.