“We’re able to do very complex transactions across multiple chains, with multiple steps, jurisdictions, and pieces of data.”

At @blockchain_rio, @SergeyNazarov joins Bruno Grossi, Head of Digital Assets at Banco Inter (@interbr), a leading financial institution serving over 34 million customers, to discuss how Chainlink is powering the DREX trade finance initiative with Banco Inter and other major institutions, global tokenization trends, and the key catalysts for mainstream digital asset adoption.

Watch now ↓

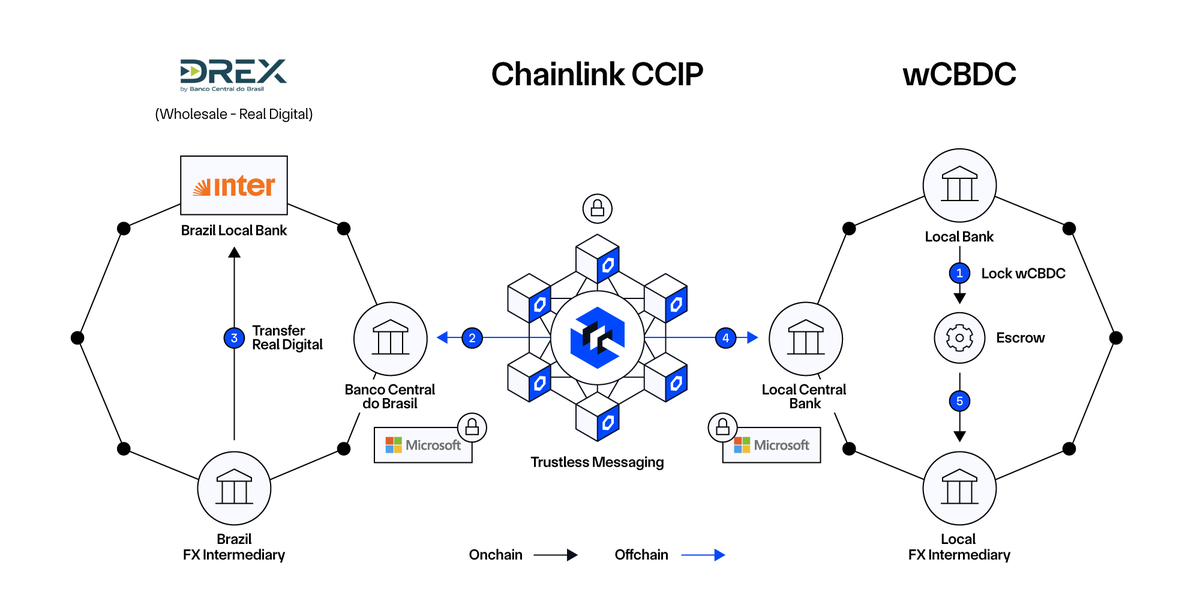

As part of the second phase of Brazil’s DREX initiative involving the Central Bank of Brazil, Chainlink powered a cross-border trade finance solution with Banco Inter, Microsoft, and 7COMm

The initiative leverages Chainlink CCIP to connect Brazil’s CBDC with a foreign central bank, trigger payments via supply chain data, and enable tokenized settlement of agricultural exports across currencies and platforms.

28.56K

416

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.