galaxy generated $55m net profit in otc and derivatives business in q2 '25

they expect the number to be $200m for q3 (we know they did the 80k btc whale's deal)

looks like otc brokerage is a way more profitable business than market making / trading now

Galaxy Digital Q2 2025 Earnings Report: Comprehensive Analysis 🪙🪙

$GLXY's second quarter 2025 earnings report happened yesterday morning and they had revealed not only a dramatic financial turnaround on a QoQ basis, but also strategic diversification across digital assets and artificial intelligence infrastructure. The cryptocurrency investment firm delivered a remarkable recovery from first quarter losses while expanding its Bitcoin holdings and VASTLY accelerating its data center initiatives.

I wanted to give a quick rundown of some of the most important points made yesterday, specifically highlighting financial strength and progress on the HELIOS Data Center.

$GLXY, now with their first official quarter achieved as a NASDAQ listed company, investors saw a clear financial recovery in Q2 2025, posting net income of $30.7 million compared to a devastating $295 million loss in the previous quarter. This represents one of the most significant quarterly turnarounds in the company's history, driven primarily by appreciation in balance sheet digital assets and strong operational performance across core business segments.

The company's adjusted EBITDA swung from negative $290 million in Q1 to a robust positive $211 million in Q2, marking a $501 million improvement quarter-over-quarter. This dramatic shift was fueled by mark-to-market gains on digital asset holdings and investments - with some highlighted in $SBET and $BMNR, alongside a small position in $BLSH that is going public later next week - coupled with positive operating business performance across the Digital Assets segment.

Earnings per share (diluted) reached $0.08 for Q2 2025, a significant improvement from the negative $0.37 recorded in Q2 2024. Despite the strong quarterly performance, six-month results remained negative with a year-to-date net loss of $264.7 million.

Galaxy Digital's balance sheet totaled to assets expanded 43% quarter-over-quarter to $9.086 billion, while total equity increased 38% to $2.624 billion as of June 30, 2025. This growth was primarily driven by a $639 million increase in digital intangible assets and appreciation in cryptocurrency holdings.

The company maintained exceptional liquidity with $1.181 billion in combined cash and stable coins, including $691 million in cash and cash equivalents and $489 million in stable coins. Cash holdings increased 50% since December 31, 2024, providing substantial financial flexibility for operations and strategic investments. This is a CRUCIAL investment thesis point that allows the company to continue with the scale of the Helios Data Center without the need to dilute shareholders rapidly.

However, leverage metrics showed increased risk exposure. Digital assets borrowed nearly doubled to $2.84 billion, while collateral payable grew to $1.87 billion. Balance sheet net digital assets reached $1.274 billion, representing a 40% quarter-over-quarter increase. Venture, fund, and other investments totaled $718 million, marking a 15% quarterly growth.

$GLXY significantly expanded its Bitcoin exposure during Q2 2025, adding 4,272 BTC to reach total holdings of 17,102 Bitcoin valued at approximately $1.95 billion at quarter-end. This strategic accumulation represented the company's confidence in Bitcoin as a store of value and hedge against market volatility. The firm simultaneously reduced exposure to other major cryptocurrencies as part of a risk management strategy. Ethereum holdings decreased from 155,026 to 90,521 ETH during the quarter, while XRP positions declined from 16.9 million to 15.4 million. Solana exposure increased marginally from 995,072 to 1.1 million SOL, and the firm initiated a new position in SUI.

The total digital asset portfolio reached $3.56 billion in carrying value, with Bitcoin comprising over half of the firm's fair value-measured digital assets.

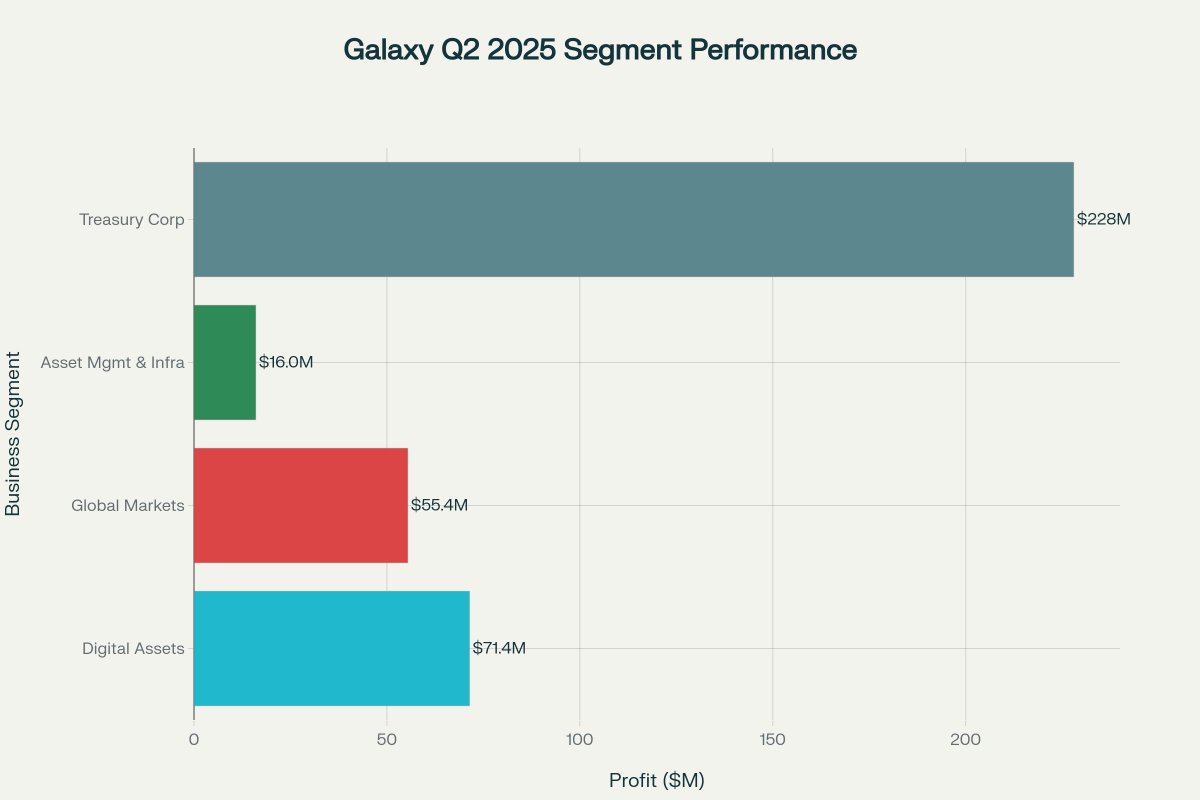

The Digital Assets segment delivered solid performance with adjusted gross profit of $71.4 million, representing a 10% quarter-over-quarter increase. However, adjusted EBITDA remained flat at $13.0 million as higher compensation and general administrative expenses offset profit gains. Global Markets emerged as the standout performer, generating $55.4 million in adjusted gross profit, a 28% quarter-over-quarter increase. This exceptional performance occurred despite a 22% decline in digital asset trading volumes, demonstrating Galaxy's ability to outperform broader market trends that saw industry-wide spot trading volumes fall approximately 30%.

Now, for arguably the best points made throughout the entirety fo the earnings call, we got a flurry of positive news regarding ERCOT status on the Helios Data Center.

$CRWV exercised its final option for an additional 133 MW of capacity, bringing total committed power to 800 MW under their 15-year lease agreement.

The company also acquired 160 acres of land and secured a 1 GW load interconnection request adjacent to the Helios campus, expanding total controlled land to over 1,500 contiguous acres. This expansion increases potential power capacity to a WHOPPING 3.5 GW, positioning Galaxy as a major player in AI computing infrastructure.

$GLXY expects to begin generating data center revenue in the first half of 2026 when it starts delivering critical IT capacity to CoreWeave under Phase I of the lease agreement. At full operational capacity, the company projects annual revenue exceeding $1 billion from the data center business.

Q2 2025 revenue totaled $8.66 billion, remaining essentially flat compared to $8.88 billion in Q2 2024. However, operating performance improved dramatically as gains from operations swung to a $395 million profit from an $18 million loss in the prior year quarter. Transaction expenses closely matched revenue at $8.63 billion, down significantly from $12.95 billion in Q1 2025. This represented the largest component of operating expenses and directly corresponded to trading volume activity.

$GLXY Digital's Q2 2025 earnings report demonstrates the company's successful transformation from a pure-play cryptocurrency firm to a diversified digital assets and AI infrastructure leader. The dramatic financial turnaround, strong balance sheet position, and strategic expansion into data centers position - emphasized by their partnership with $CRWV - Galaxy seems ready to capitalize on both crypto market recovery and artificial intelligence demand growth.

Oh, and Michael Novogratz (CEO) owns 53% of the share float. A beautiful cherry on top to an already phenomenal executing company.

If you have read this far, thank you for reading! I am beyond exited for the future of this company and am looking to continue adding shares as time continues.

Best of luck to all $GLXY bulls, let this ride continue 🙌🙌

9.81K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.