Synchronizing several key changes:

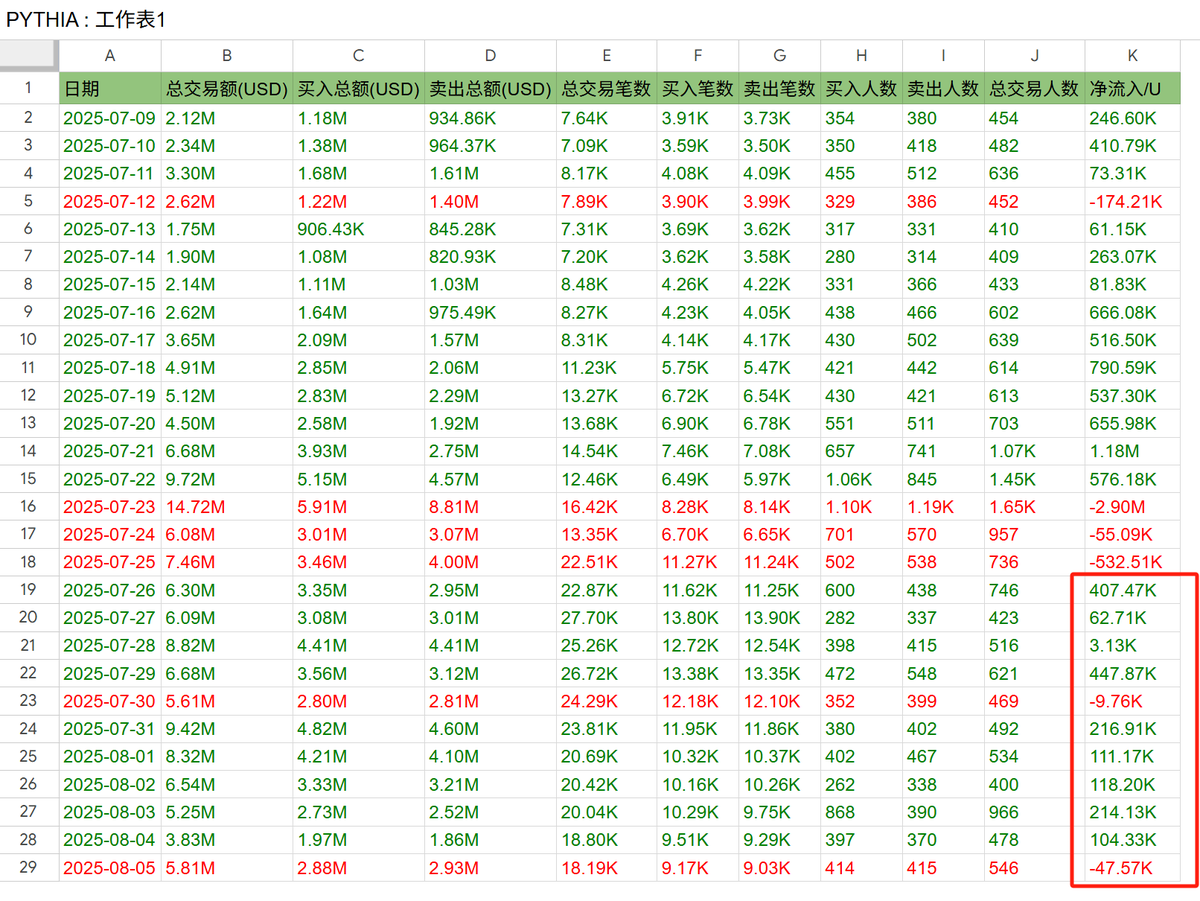

1. From the data of the past ten days, it can be seen that the market makers are not very willing to create large fluctuations for liquidation; they have been consistently supporting the market, with a net inflow of 1.6M over the last ten days.

2. The reason for such a large net inflow without much price increase is partly due to the previously added unilateral pool of coins. Currently, the ratio of coins in the unilateral pool to SOL has decreased from 4.5:1 to 2.7:1. On the other hand, SOL has dropped in price.

3. The original project team dumped 1.3M ten days ago, and there is currently about 1% of the chips left, with the remaining chips added to the pool.

4. The most turbulent times are probably over; let's wait for the flowers to bloom.

Update on the latest views of $pythia:

1. Last week, $pythia experienced a lot of turnover at the 100M position, with many people's take-profit points set at 100M. It seems the market makers got a bit anxious; just two days after breaking through 100M, they were still buying, probably accumulating a few million.

Despite so many people selling on the 21st and 22nd, there was still a net inflow of nearly 2M. By the 23rd, the market makers changed their strategy and started to wash the market, likely feeling that they had spent too much ammo, having already spent over 10M by now.

The wash led to a lot of retail investors fleeing, and it was evident that the wash was quite aggressive. I thought it would at least take a day or two, but instead, they pulled the liquidity and then quickly pushed it back to 100M.

The reason for such a rapid wash and quick recovery, as @druzbtc told me, is that many players in this market can't handle too much volatility, so the wash won't go too deep.

2. This month is likely to be dominated by washing and consolidation; it won't drop much, nor will it rise significantly. This time is meant to wash out those who can't hold on, as they have set up a one-sided pool, so many people probably won't buy and may even sell.

Interestingly, it seems they don't need many crypto players to buy into this market; it's mostly the market makers pulling it up and offline clients buying. The advantage of this is that the volatility is smaller and more stable.

I have always believed that the strategy of pulling the market without regard to cost is something we may not understand, as there could be someone waiting to buy at a higher position. We just need to hold steady and hope that after this wash, we can reach a new height in August. 🤣

4.04K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.