I think we have been waiting a #Defi summer for a pretty longtime since the last one in 2021.

This time I’ve been feeling the signs that DeFi is coming back are getting clearer every day.

The numbers don’t lie:

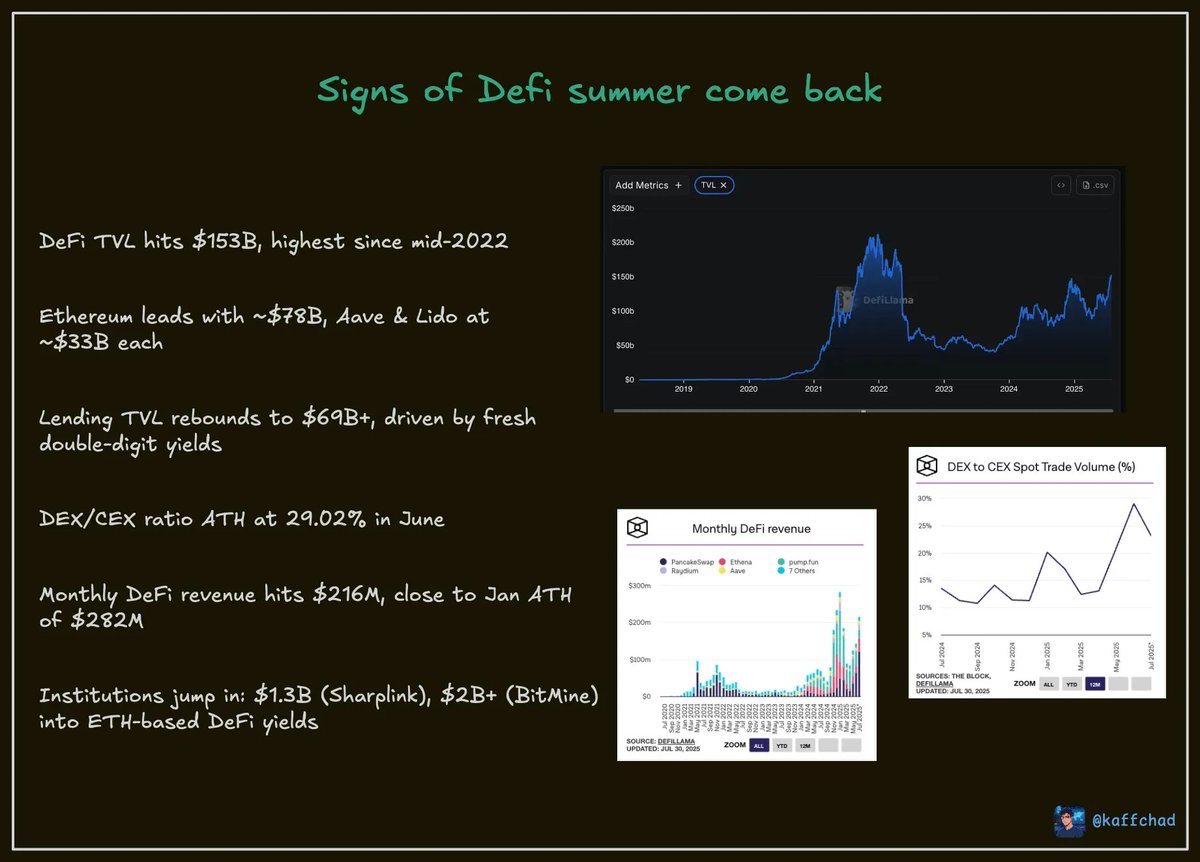

✨ TVL across DeFi has surged to $153B (July 2025), the highest since mid‑2022. That’s a massive +57% recovery in just 3 months.

✨ Ethereum dominates with ~$78B locked, and big names like Aave & Lido each sit at ~$33B.

✨ Lending protocols alone crossed $55B TVL, a major bounce from previous lows.

Meanwhile, fresh double‑digit yields are back in platforms like Aave and Compound, making DeFi yields look even better than Treasuries again

✨ DEX/CEX volume ratio hit an all-time high of 29.02% in June, signaling a major shift from centralized to decentralized trading.

✨ Monthly DeFi revenue is booming, $216.3M in July, climbing close to the Jan ATH of $282M. Dominated by PancakeSwap, Ethena, and

✨ Institutional flows are significant, with $1.6B+ from Sharplink and $3B+ from BitMine going directly into DeFi yield strategies through ETH.

And underpinning all of this is progress in infrastructure: Layer‑2, cross‑chain bridges, and AI‑powered liquidity tools are making DeFi smoother and more efficient.

The recent AI-powered liquidity protocol that drew my attention is #INFINIT, one-click agentic defi activated.

Cool product by Infinit where users can create their own DeFi strategy and earn a fee every time someone else uses it.

So, Defi is coming back with something more intelligent, more personal, and way more aligned with users, I believe.

28.21K

160

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.