The tenth edition of our newsletter, Where Money Moves, is live.

Twice a month, we unpack the key trends, developments, and data shaping the stablecoin industry.

Dive in.

The XPL public sale has concluded with a total of $373M committed to purchasing XPL.

The XPL public sale began on July 17 and concluded on July 28 with $323M+ overcommitted, representing more than a 7x oversubscription on the targeted $50M raise.

The $323M oversubscribed capital was refunded and all allocations were finalised one day later.

The next major milestone for Plasma is the launch of our mainnet beta. The network will launch with $1B in stablecoin TVL; Plasma will be the first chain to ever achieve this.

The Hong Kong Monetary Authority told a media briefing that the first Hong Kong stablecoin issuer licenses are expected to be granted early next year. This followed Hong Kong’s Stablecoins Ordinance going live on 1st August, providing regulatory clarity for issuers of stablecoins, offers of stablecoins and related market integrity and conduct; the Ordinance provides a transition period for issuance only.

The European Central Bank (ECB) has warned that the rise of USD pegged stablecoins could undermine the ECB’s control over monetary policy. It suggested the fast adoption of these stablecoins could leave Europe in a similar situation to “dollarized” emerging economies.

South Korean lawmakers have proposed legislation to allow companies with as little as KRW 500M ($360,000) in equity capital to issue won-based stablecoins, but its central bank is concerned this could trigger large capital outflows. Approximately one third of South Korea’s 52 million people invest in digital assets, making it one of the most thriving crypto markets in the world.

Other headlines:

- China Asset Management via its Hong Kong arm launches world's first renminbi tokenised money fund

- AllUnity launches EURAU: claimed to be the first Euro-backed stablecoin issued under the EU’s Markets in Crypto-Assets (MiCA) regulation and licensed as electronic money by Germany’s BaFin

- Over the last month, USDe, issued by @Ethena_Labs, surged by $4.4B, representing a 78.7% month on month supply increase.

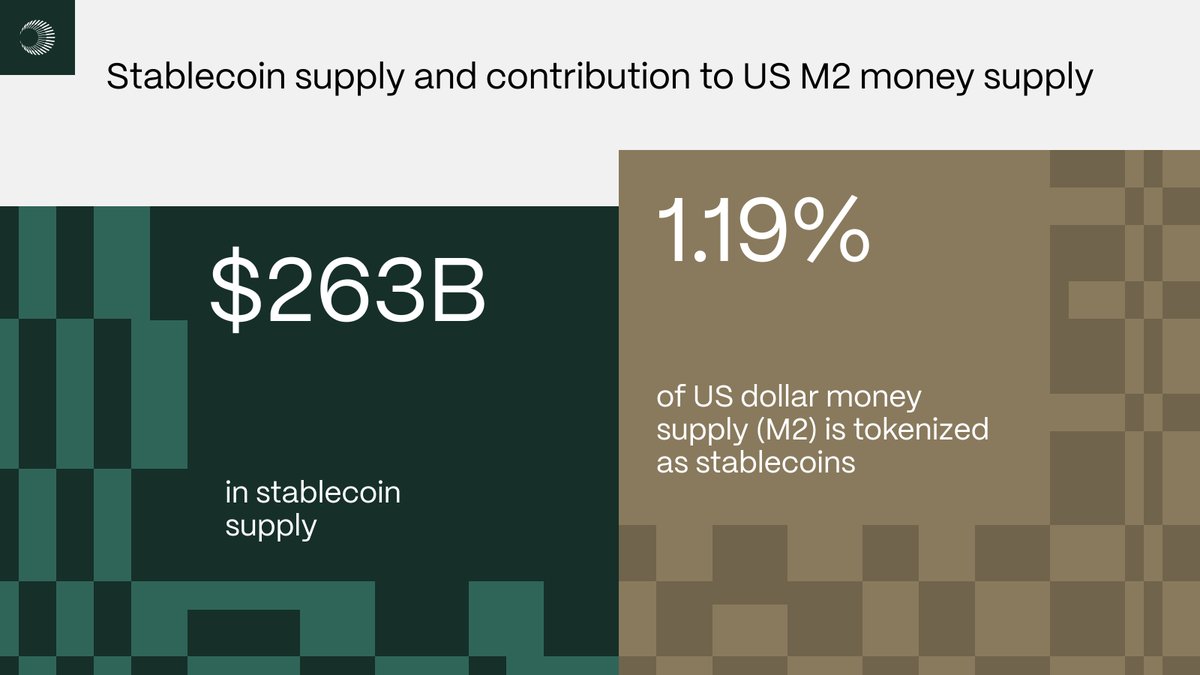

Stablecoin supply sits at $263B, with USD₮ staying dominant at a 63.1% market share ($164.2B). At this supply, stablecoins account for over 1.19% of the total US M2 money supply.

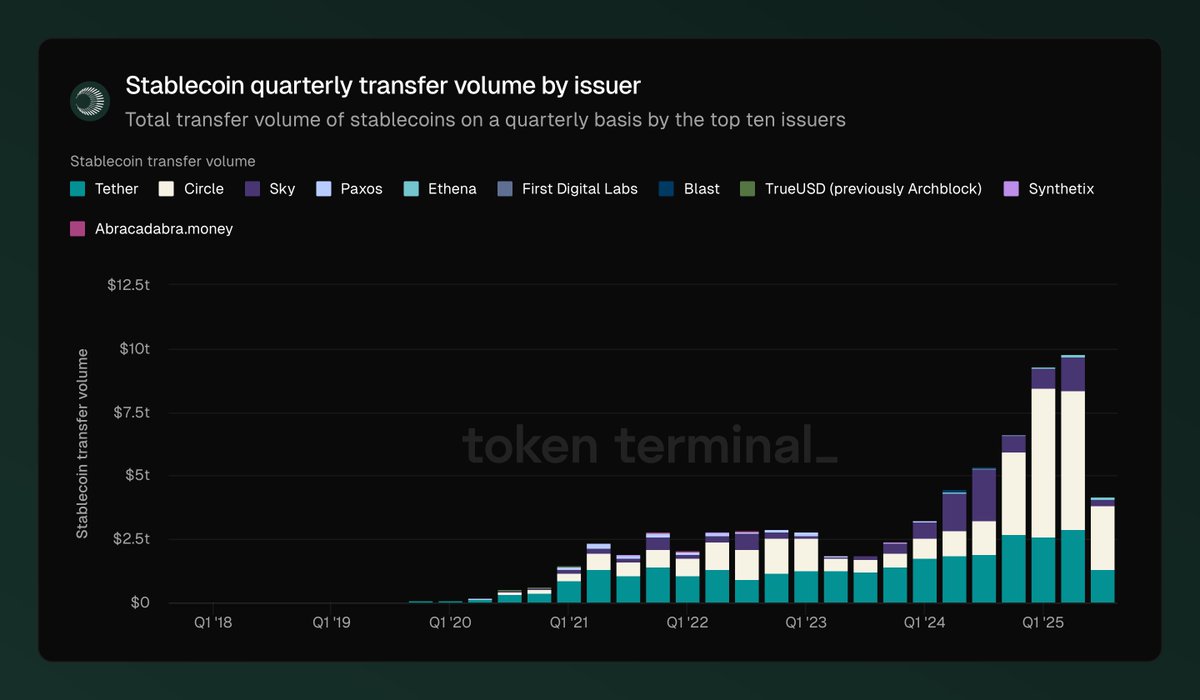

Global stablecoin volume continues to climb: monthly transfer volume is $2.6T across 1.3B transactions.

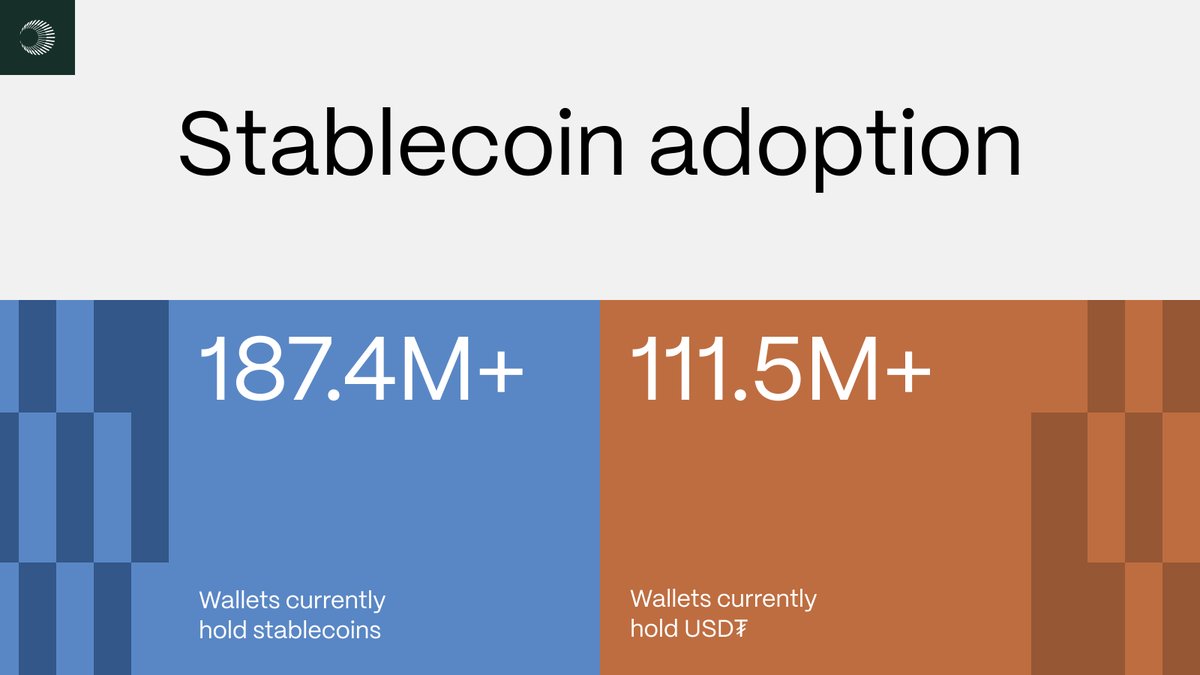

Adoption is growing: over 187.4 million wallets hold stablecoins, and USD₮ leads with more than 111.5 million holders.

Read the full Where Money Moves newsletter and subscribe to stay ahead of stablecoin trends:

9.69K

158

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.