Last week marked one of Pendle’s largest maturity events to date, with over $1.5B in TVL reaching maturity.

Yet despite that, @pendle_fi TVL climbed to a new all time high. 🫡

Interestingly, $1.3B (87%) of the matured TVL were from @ethena_labs assets.

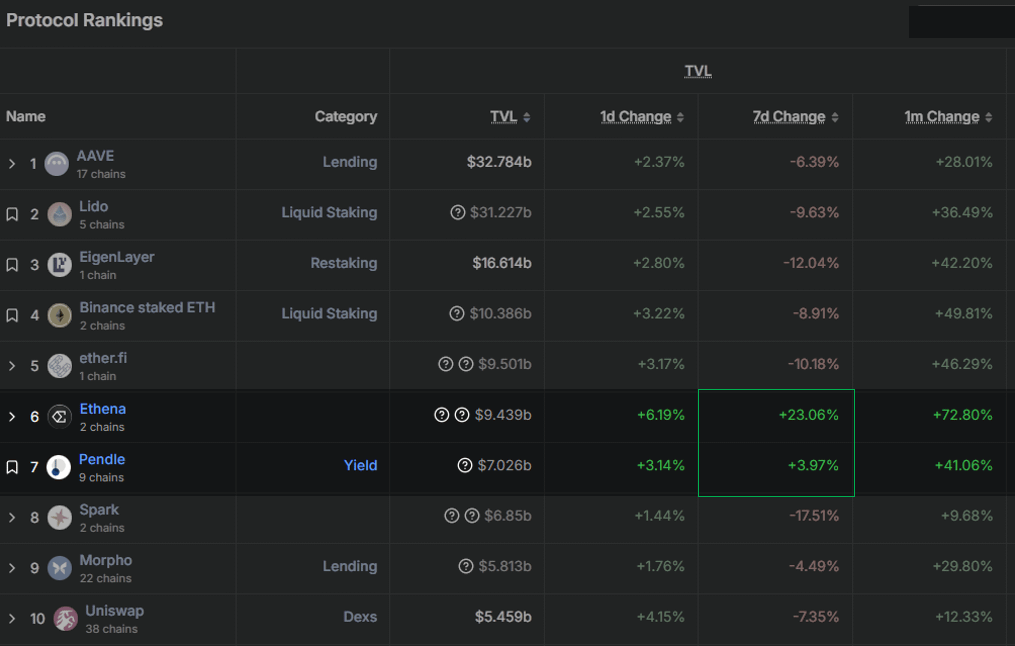

And during a weekend where markets took a hit, Pendle and Ethena are the only Top 10 protocols to post a positive 7D TVL change.

As of now, Pendle holds and contributes ~48% of Ethena's total TVL ($4.6B)

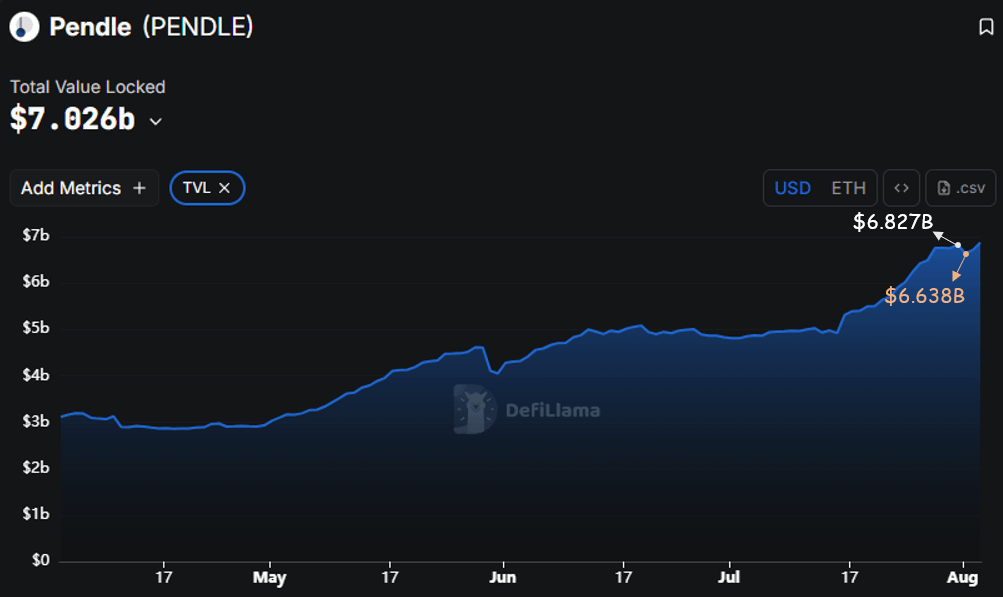

Even at that scale, the peak-to-trough TVL drawdown was minimal and only lasted for a day.

$6.827B → $6.638B, a dip of just $189M (-2.8%).

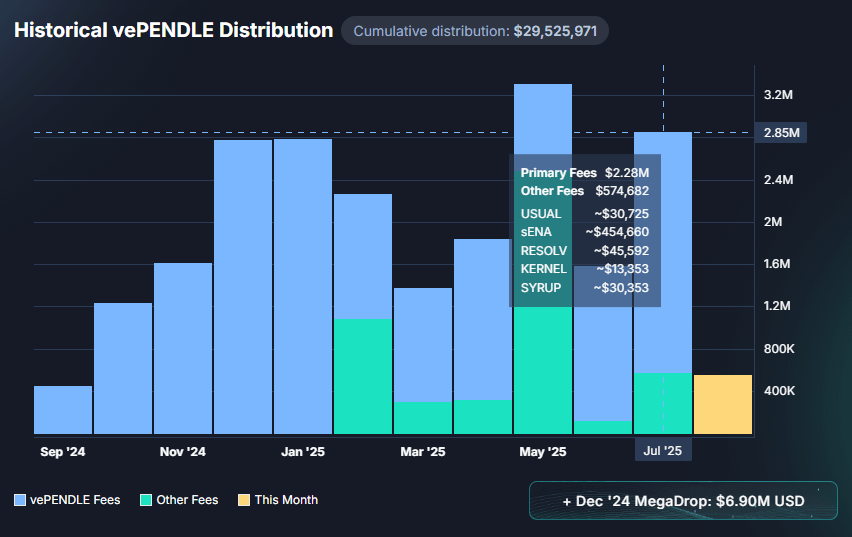

vePENDLE fees for July 2025 also surged 80% MoM, reaching $2.85M.

Even without airdrops, fees for July 2025 were healthy at $2.28M.

Over the past year, TVL retention has become dramatically more resilient, even as maturity events become larger and more frequent.

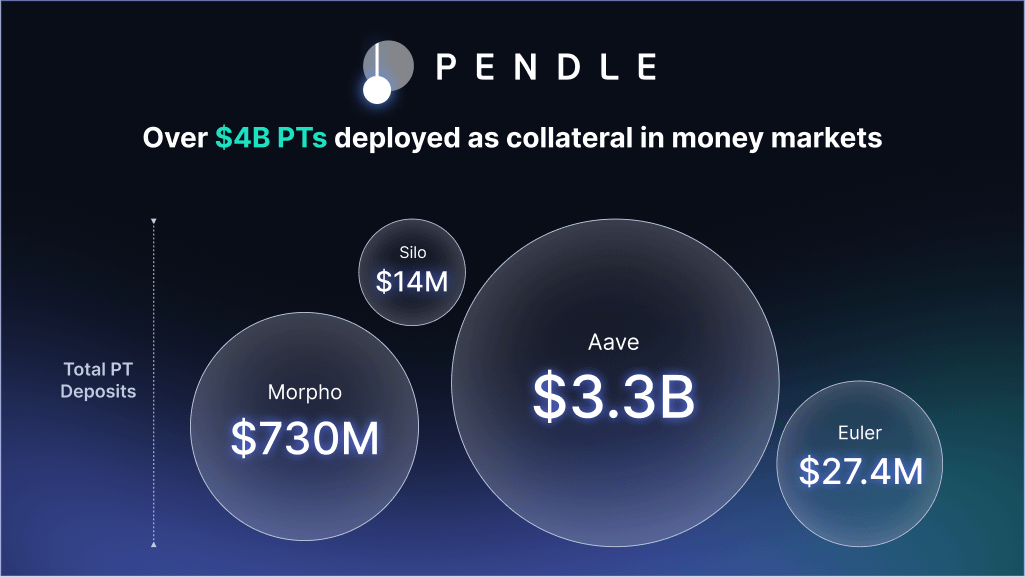

This shift reflects the deepening trust in Pendle assets, and the rise of Pendle PTs as DeFi’s go-to yield instrument.

A key driver behind this trend is the the growing synergy between Pendle x @ethena_labs x @Aave, a flywheel that’s unlocking new levels of "yieldtility" for Pendle PTs.

With PTs proving to be a reliable source of yield and wealth preservation, capital is sticking and staying.

In short, we’re seeing much more stable, reliable yield flows underpinned by real demand.

The foundation is already strong.

Now, it’s about scaling this confidence across the ecosystem, making Pendle adoption even broader and deeper.

With HyperEVM gaining good early traction ($80M in 4 days) and @boros_fi launching 𝑠𝑜𝑜𝑛, there’s plenty ahead.

And with every maturity event that passes, trust in Pendle compounds, as users see, time and again, that the system simply works.

Job's not done, but it'll be!

16.09K

140

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.