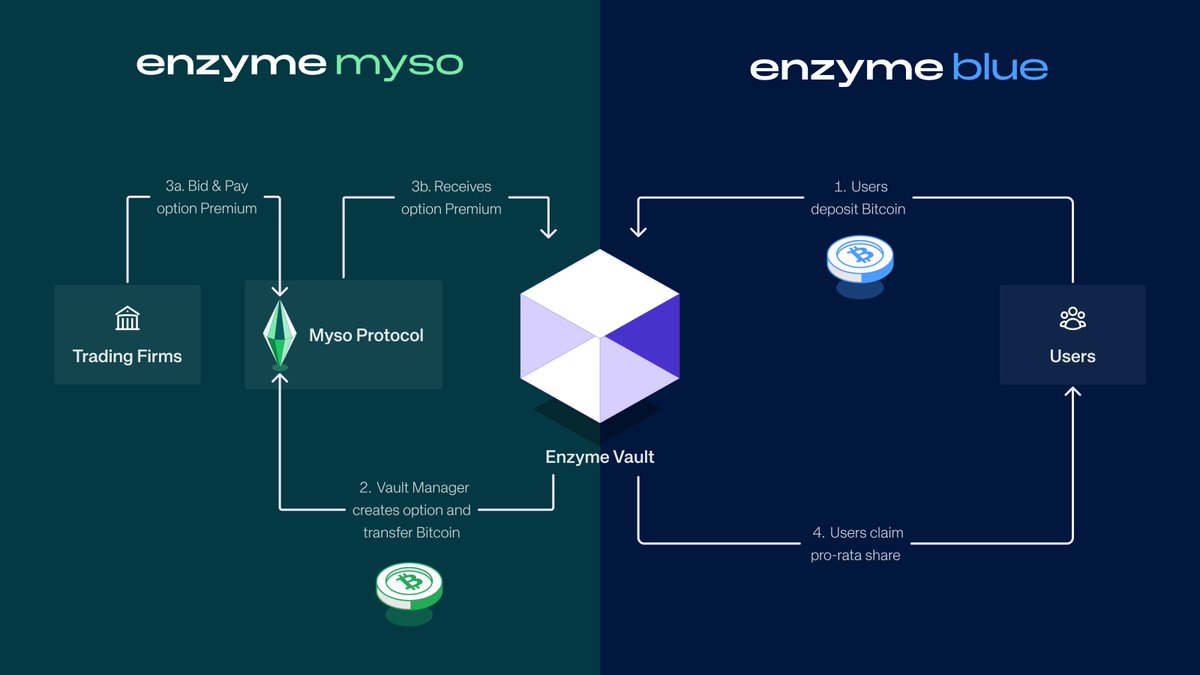

Looking for a smarter way to generate yield on BTC and unlock more flexible strategies for your treasury or fund? Meet the Bitcoin Options Vault on Enzyme.

This approach lets you generate yield through premiums by selling options on BTC, a non-dilutive way to earn extra return on your assets. By leveraging BTC derivatives like Lombard’s LBTC as collateral or exposure, and consolidating liquidity into a single, tokenized vault, you keep things streamlined and efficient.

📈 You also have full control over your risk/return profile. Choose the strike, expiry, and frequency that match your strategy, all with on-chain execution and valuation for transparency and auditability.

Enzyme’s delegation system lets you split responsibilities, so you can set up your vault to align with legal and regulatory requirements. And for investors, it’s as simple as 1-click access to a structured BTC product, no direct custody, but full exposure to BTC price action, volatility, and yield.

Explore how you can put BTC to work in a new way:

9.42K

13

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.