I modeled an economic attack on Dogecoin.

Just like the one Qubic used on Monero.

Here’s what it would cost and why it could work.👇

1) Monero was attacked without malware.

Qubic offered better rewards to miners.

Miners followed profit.

Hashrate shifted.

Control centralized.

That same playbook can be used again.

And Dogecoin is a prime target.

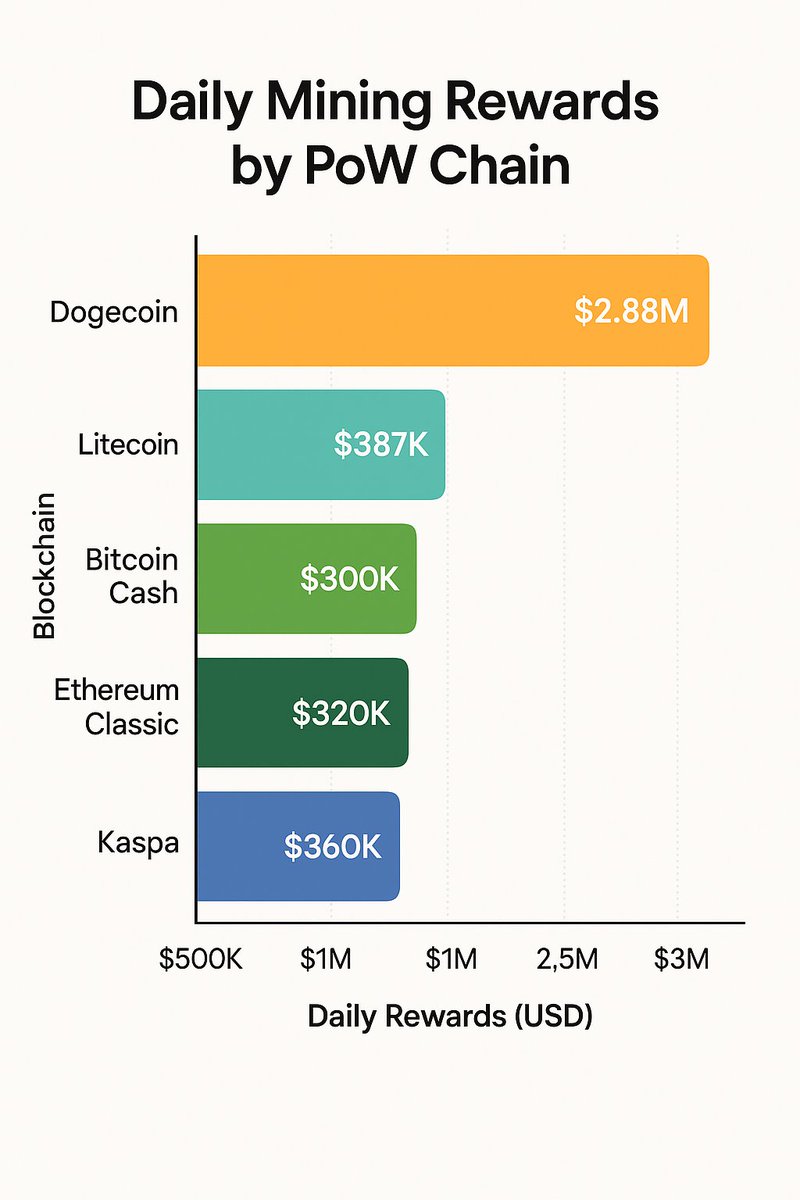

2) Let’s talk numbers.

🟠 Dogecoin emits 14.4M DOGE/day

💵 At $0.20/DOGE → ~$2.88M/day security budget

🧱 1 block per minute

🌀 No halving, no cap → infinite inflation

The network pays to survive.

What if someone pays more?

3) A small miner bribe is all it takes:

+5% → $144K/day

+10% → $288K/day

That’s what it costs to start buying Dogecoin’s hashpower.

Not with ideology.

Just with money.

4) “But Dogecoin is merge-mined with Litecoin that’s secure, right?”

Kind of.

But the hashpower is shared.

So are the incentives.

If someone offers more than DOGE + LTC rewards combined…

Miners move.

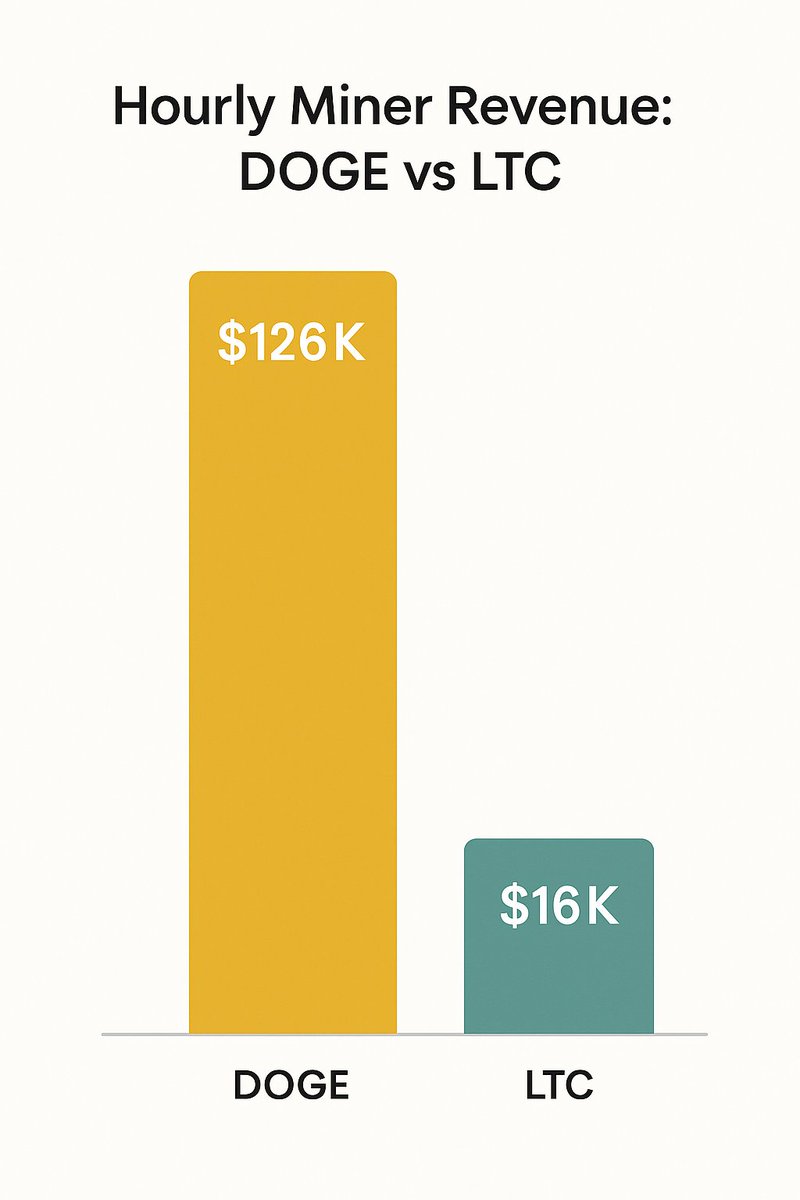

5) Let’s do the math:

• DOGE block → 10,000 DOGE ≈ $2,000

• LTC block → 6.25 LTC ≈ $672

• 1 hour ≈ 60 DOGE + 24 LTC blocks

• Miner revenue ≈ $142K/hour

Offer $155K/hour → you begin to win.

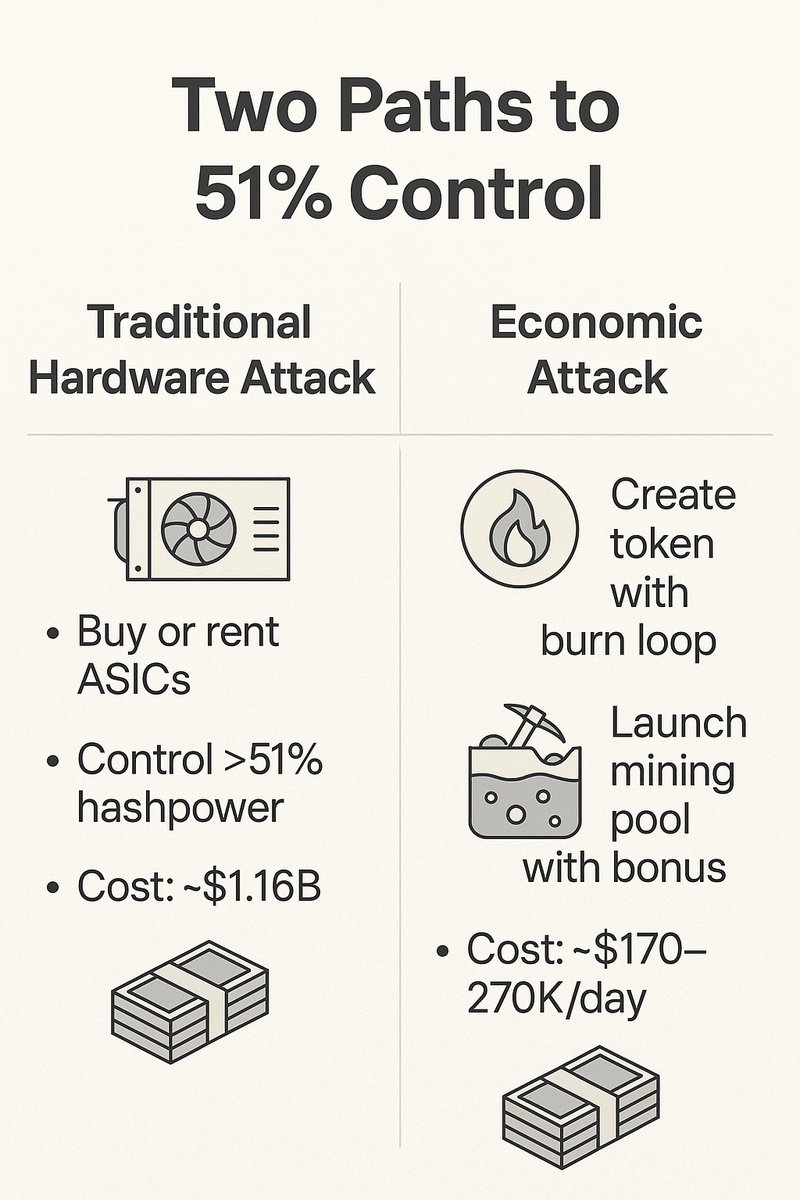

6) Can you rent that hashrate?

❌ No. Only ~5% of Scrypt hash is rentable.

✅ But you can buy it.

• 51% ≈ 1.3 PH/s

• Antminer L7 (9.5 GH/s) → need ≈ 137,000 units

• At $8.5K each → ~$1.16B

Big, but not impossible.

7) But Qubic didn’t rent or buy anything.

They used Monero miners.

Paid them in $QUBIC.

Sold their mined XMR.

Burned $QUBIC to pump it.

Looped it again.

All economic.

All legal.

And it worked.

8) The same could happen to Dogecoin.

• Create a Scrypt-compatible token

• Launch a high-reward pool

• Pay miners a bonus

• Slowly dominate block production

With enough incentives, honest mining becomes… unprofitable.

9) Once a hostile pool hits 51%:

– Orphans other miners

– Delays or censors txs

– Pushes soft forks

– Rewrites history

And nobody has to know.

It still looks like Dogecoin.

Just under new management.

10) Merge-mining is Dogecoin’s greatest strength.

But also its greatest weakness.

Because the security is rented.

And rentals go to the highest bidder.

11) This isn’t just about Doge.

Any PoW chain with:

– Fixed emissions

– Mobile miners

– Weak on-chain demand

– No finality mechanisms

…can be economically bought.

12) Qubic proved the model on Monero.

Dogecoin has higher hashrate

But also bigger daily rewards.

And here’s the danger:

The bigger the reward…

The cheaper the bribe (as %).

That’s why capital loves PoW.

13) Miners don’t need to be evil.

They just need someone slightly more generous.

No takeover.

No warning.

Just a quiet fork

Where you’re not invited anymore.

14) Decentralization isn’t code.

It’s coordination.

And if you don’t pay your base layer…

Someone else eventually will.

15) If this thread made sense:

🔁 Retweet it

🧠 Share with someone mining DOGE

📉 Or just… check who’s producing your next block

Because the next attack won’t shout.

It’ll just offer… +10%.

38.66K

215

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.