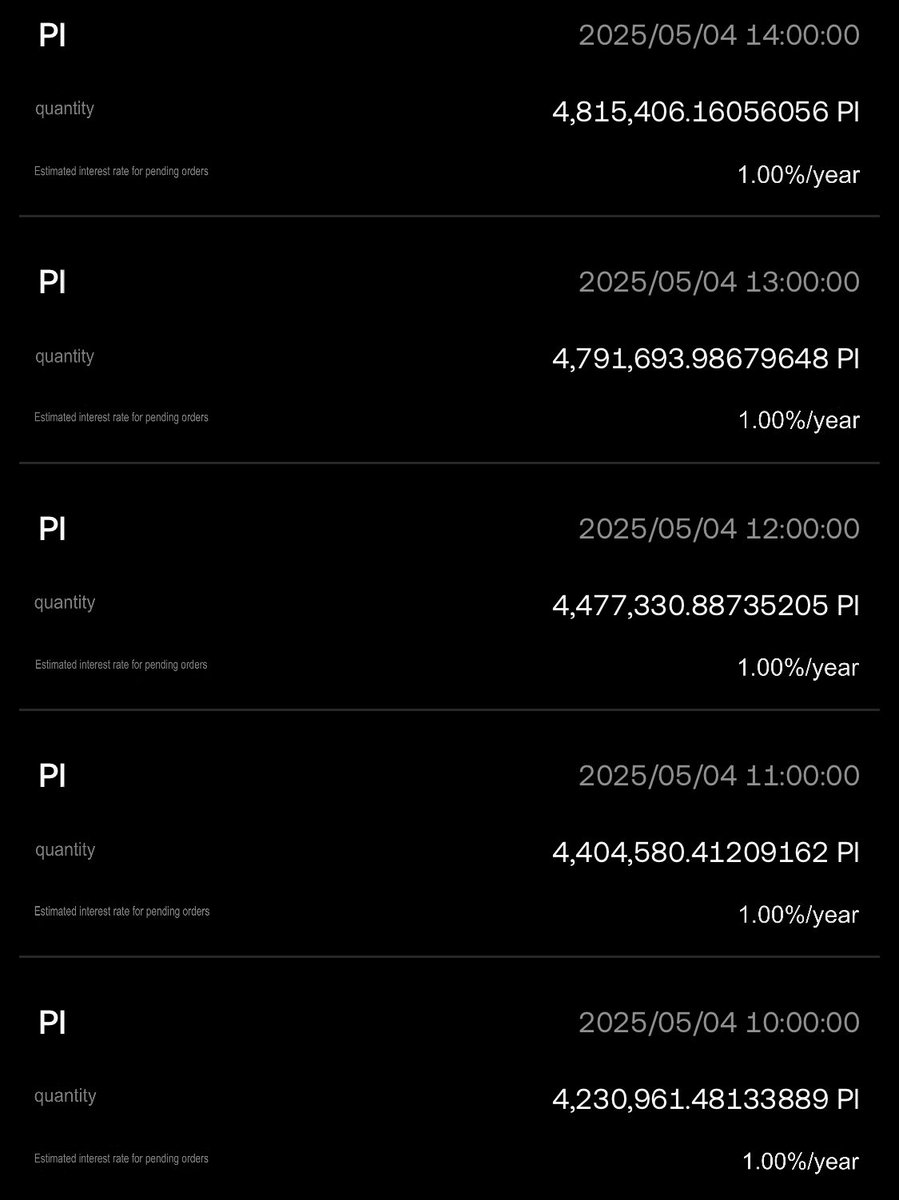

市場投資人不願重視借幣鯨魚一次借幣一百萬顆藍代替你拋售。

Market investors are reluctant to pay attention to borrowing whales who borrow 1 million LAN at once to sell on your behalf.

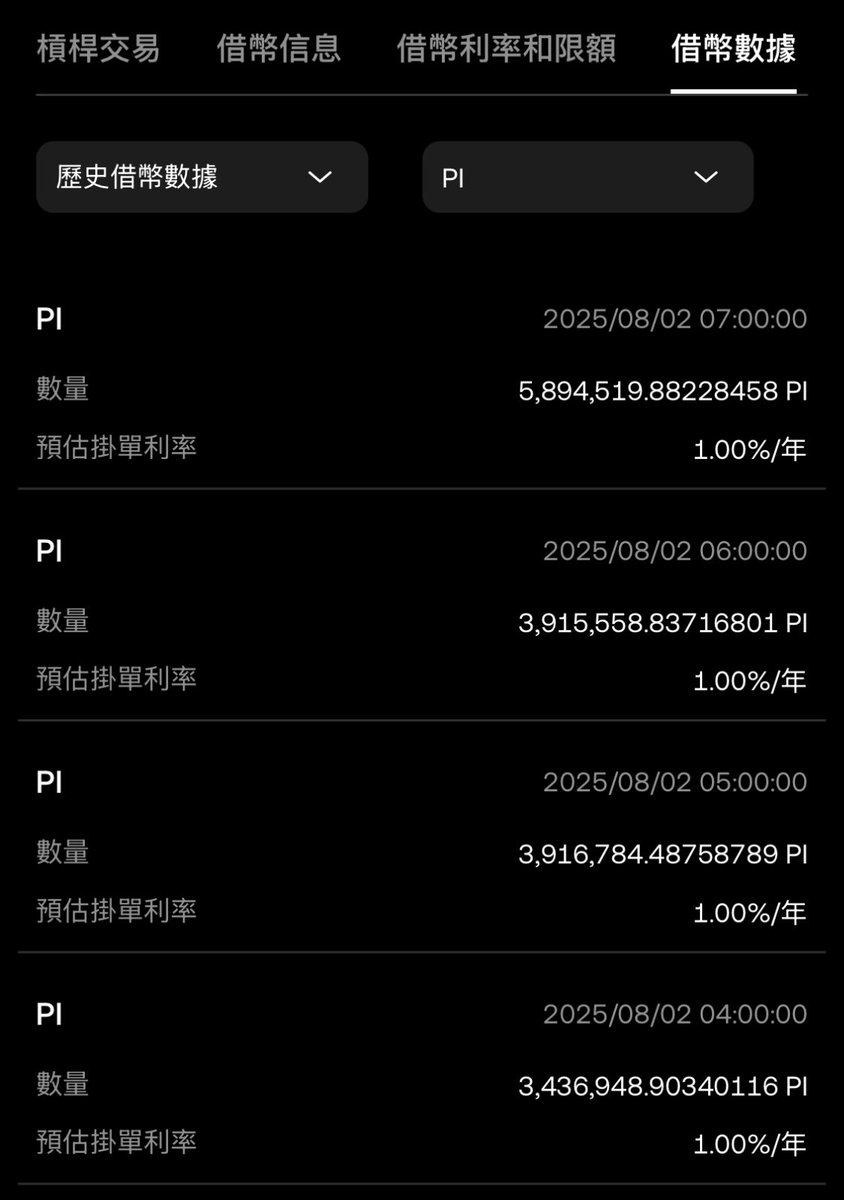

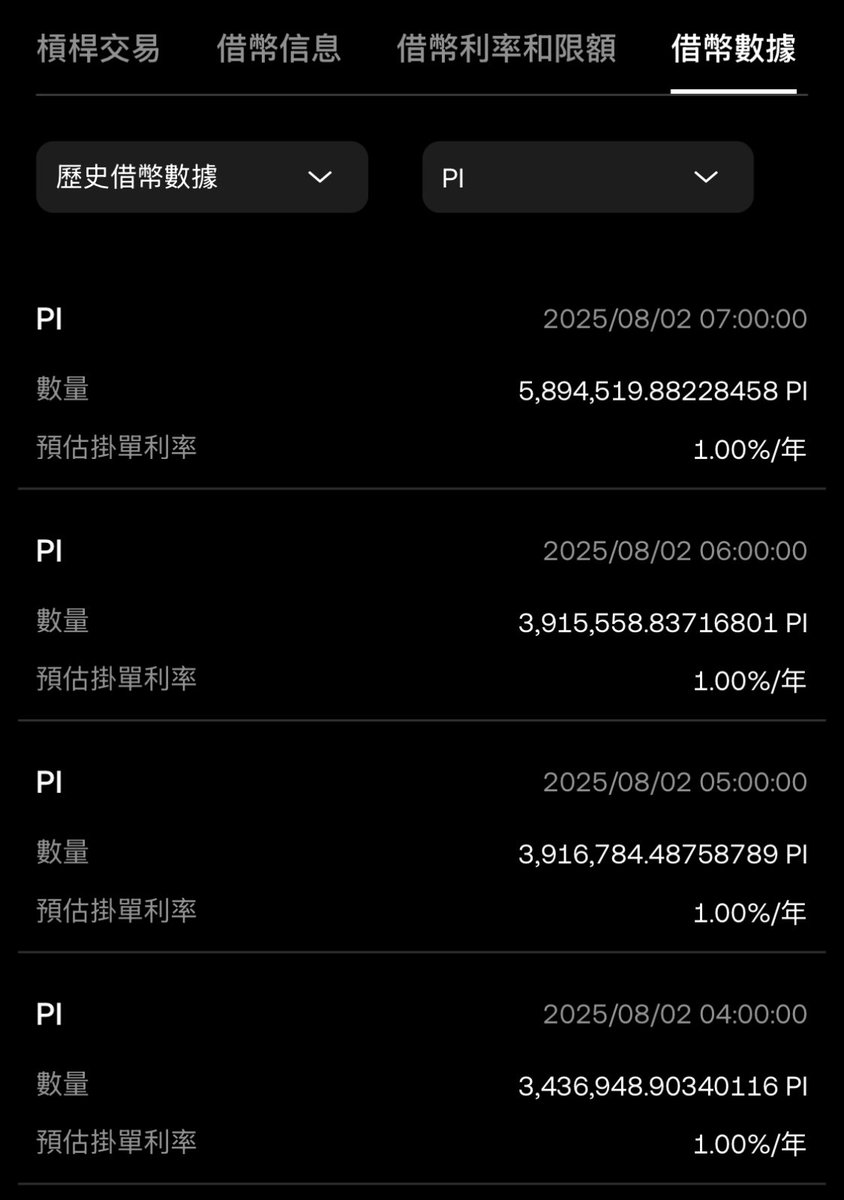

Just now, a borrowing whale seized the opportunity, borrowing 1.9 million PI from an exchange to sell on your behalf.

Yet, it’s clear the market will blame PCT for this issue again, and the bad actors will ultimately go unpunished. Because those staking on exchanges are complicit in the selling.

If community investors are unwilling to confront borrowing whales, they have no right to complain.

Should we demand that PCT ban exchanges from offering borrowing functions, and revoke their KYB status if they provide such functions?

If the community fails to consistently respond to countering whales, just wait for 0.1 to arrive.

在剛剛的借幣鯨魚逮到機會,從交易所一次借入190萬顆pi來代替你拋售。

然而可知市場又會將這個問題怪罪PCT,壞人終究不會受到懲罰。因為質押在交易所的人都是拋售的共犯。

如果社區投資人不願採取對抗借幣鯨魚,那麼就沒資格抱怨。

是否應要求PCT禁止交易所提供借幣功能,如果使用借幣功能應下架其KYB資格。

如果社區才不長期響應對抗鯨魚,就等著0.1的到來。

#PI

#pi

借貸pi的鯨魚正在從借貸池一次借百萬顆pi來代替你拋售。

Thank you to GCV for taking this issue seriously and actively promoting it.

Do not stake Pi on exchanges or use Yu’ebao, as whales are borrowing millions of Pi from lending pools to sell on your behalf.

You invest in Pi hoping for price increases to gain profits. However, the more you stake, the more you enable whales to suppress the price.

Many believe long-term investment means expecting the ecosystem to bear merchants’ costs indefinitely to support the price. Merchants cannot withstand long-term price losses and will eventually exit entirely, causing the ecosystem to collapse.

Like now, if Pi’s price is lower than electricity costs, miners have no reason to pay 1 yuan to the power company for 0.5 yuan worth of Pi.

Smart people know they can buy 1 Pi directly instead of halving their returns. Thus, miners will also collapse, and the ecosystem will die.

Methods to counter whales:

1. Do not stake Pi on exchanges. Do not use Yu’ebao to stake Pi.

2. Drain the exchanges’ lending pools. Convert 1% APY low returns to 34% accelerated mining rewards.

3. Whenever data shows whales borrowing and selling Pi, causing price dips, it’s an opportunity to buy low. Let’s agree to buy at low prices, pull the price up, and make the whales lose money.

感謝GCV也重視這個問題來大力宣傳。

不要在交易所質押pi,也不要使用餘幣寶,因為鯨魚正在從借貸池一次借百萬顆pi來代替你拋售。

你看好pi而投資pi是希望價格上漲來獲得收益。然而,你質押的越多,就讓鯨魚幫你把價格壓的越低。

大多人認為的投資長期,是期望生態長期消耗商家成本來替你扛著價格。商家是無法抵抗長期價格虧損,最終會全面退出,生態會崩潰。

如同現在pi價格低於電費,那麼,礦工根本不需要繳費給發電廠1元才獲得0.5元的pi。

聰明人都知道直接購買pi可以獲得1pi,為什麼要自己減半。因此礦工也會崩潰,最終生態會死亡。

對抗鯨魚的方法:

1.不要在交易所質押pi。不要使用餘幣寶質押pi。

2.清空交易所的借幣池。1%apy的低收益轉為選擇34%挖礦增速。

3.每當從數據上看見鯨魚借貸pi並且拋售而產生價格下衝時,這是低價買進的機會。讓我們共識低價購買,拉起價格,讓鯨魚虧錢。

#pi

你們爆倉的金額,是借幣鯨魚全部給你拿走的。而你們還在罵PCT。

借幣鯨魚拍拍屁股跟你說謝謝,然後謝謝交易所提供借幣功能讓你們爆倉。

借幣鯨魚總共借了五百萬顆拋售,這些都是投資人喜歡質押賺點小利息的結果。

質押的投資人,全都是砸盤的共犯,然後還在怪罪PCT。

61.91K

19

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.