“Teller’s loan model is built for long-term users who want flexible debt without forced liquidation risk.”

Learn more from @defi_mago 🧵

1/ How it works

@useteller’s loan model is built for long-term users who want flexible debt without forced liquidation risk.

1️⃣ Deposit collateral (ETH, WBTC, stables, etc.)

2️⃣ Borrow USDC or WETH

3️⃣ Keep the loan forever, perpetually, no expiry, no margin calls.

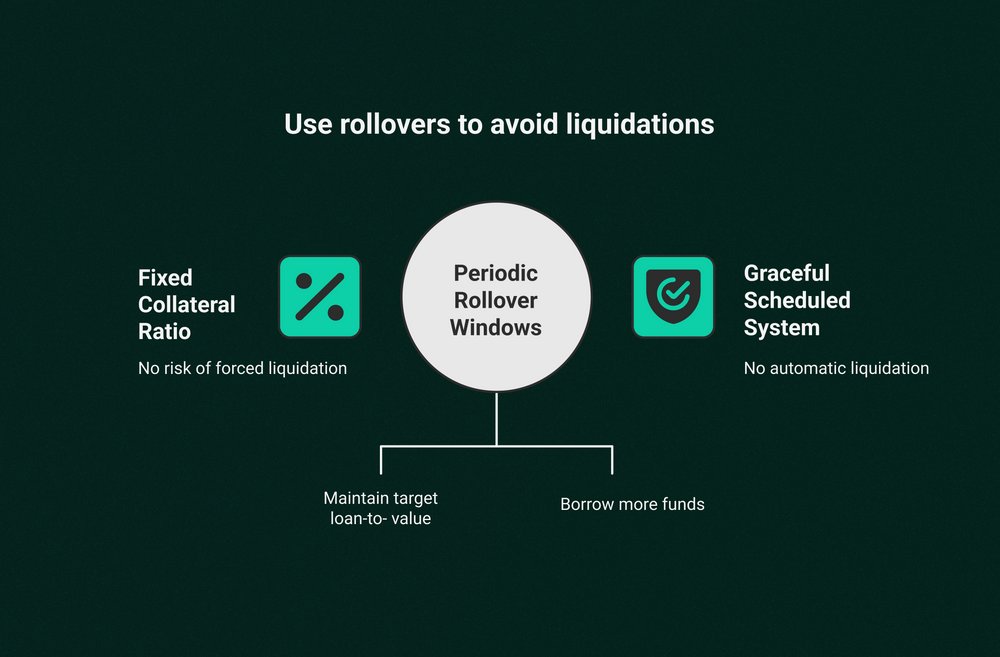

All you need to do is periodically “roll over” the loan to keep the Loan-to-Value (LTV) healthy.

The magic is: you don’t even need the collateral in your wallet to roll over.

You just pay the current interest due (like paying your credit card bill), and Teller handles the rest using a flash loan behind the scenes to front the collateral and open a fresh loan automatically.

• If collateral grew → withdraw or borrow more

• If collateral dipped → top it up

No auto-liquidations ever. Just scheduled adjustments.

3.99K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.