Market Feedback on Tokenized Stocks: A Data-Driven Perspective

Since H2 2025, tokenized stocks have drawn renewed attention following moves by Robinhood and xStocks. While this narrative has already cycled twice, maturing infrastructure and a friendlier regulatory landscape have users asking whether “this time is different.” We’ll continue to track this narrative through on-chain data and provide forward-looking insights.

1.Tokenized Stock Value Chain

Tokenized stocks are a classic B2C model, covering the full stack from blockchain infra to retail frontends:

-Infra & Middleware: The infra layer refers to public chains providing trading, validation, and settlement for on-chain stock assets—think Solana, Ethereum, Base, Injective, and L2s like Arbitrum. Middleware, especially oracles like Chainlink and Pyth, are essential for real-time market data and price feeds, ensuring accurate linkage to underlying assets.

-Issuers: Platforms like Backed Finance, Dinari, Swarm, and Securitize handle on-chain issuance. Previous cycles saw more issuers, but few achieved scale due to market conditions.

-Retail Frontends: This cycle features a diverse range of retail access points, from Robinhood’s integrated fintech app to xStocks’ native interface and CEXs like Kraken, Bybit, and Gate. Users with varying profiles can trade via their preferred venue.

-Ecosystem Expansion: As asset count, volumes, and derivatives grow, we’ll see more market makers, native DEXs, and middleware, all boosting issuance, liquidity, and user experience.

2.Key Issuers, Models & Data

Backed Finance (xStocks)

-xStocks uses a 1:1 mapping—one token equals one share. KYC’d users can buy US stocks via a Backed Account. Backed acts as the primary investor, purchasing stocks via brokers and holding them with third-party custodians, then minting tokens backed by actual holdings. Users can redeem tokens for real shares at any time.

-Backed doesn’t restrict bSTOCK token flows—users can buy bSTOCK with USDC, sDAI, etc., no KYC needed, lowering entry barriers and aligning with Web3 UX. The trading experience is pure crypto-native.

-xStocks is highly composable and open; over 60 stocks are supported, widely adopted in the Solana ecosystem. With Bybit and Kraken integrating, volumes are set to climb.

Robinhood

-Offers 200+ tokenized US stocks, zero-fee 24/5 trading on Arbitrum.

-Robinhood’s contracts are closed-loop: only Robinhood Europe can issue and sell, serving EU app users. All liquidity is internal. These tokens are digital IOUs—underlying stocks are held by US partner brokers as hedges.

-Tokens aren’t freely transferable or DeFi composable due to strict whitelisting.

Dinari

-Non-US users (KYC required) can buy US stocks using Dinari’s USD+. Orders are routed to partner brokers, with shares custodied by banks. Dinari mints dShares 1:1 with real stocks.

-dShares aren’t freely tradable on-chain; all actions are limited to Dinari’s platform. Crypto is just a funding/payment rail here, making it closer to a Web2 brokerage than a true crypto-native product.

Other notable players include Securitize ($BUIDL, tokenized US Treasuries) and Injective (25x leveraged tokenized stock perps). Issuers and verticals are quickly diversifying.

Trading Data Insights

-TVL: $406M, up 15.83% MoM; steady growth signals rising market conviction.

-Monthly Volume: $381M, up 283.07% MoM.

-Monthly Active Addresses: 78k, up 694.24% MoM; holders: 586k, up 1217.42% MoM. User demand and liquidity are exploding from a low base.

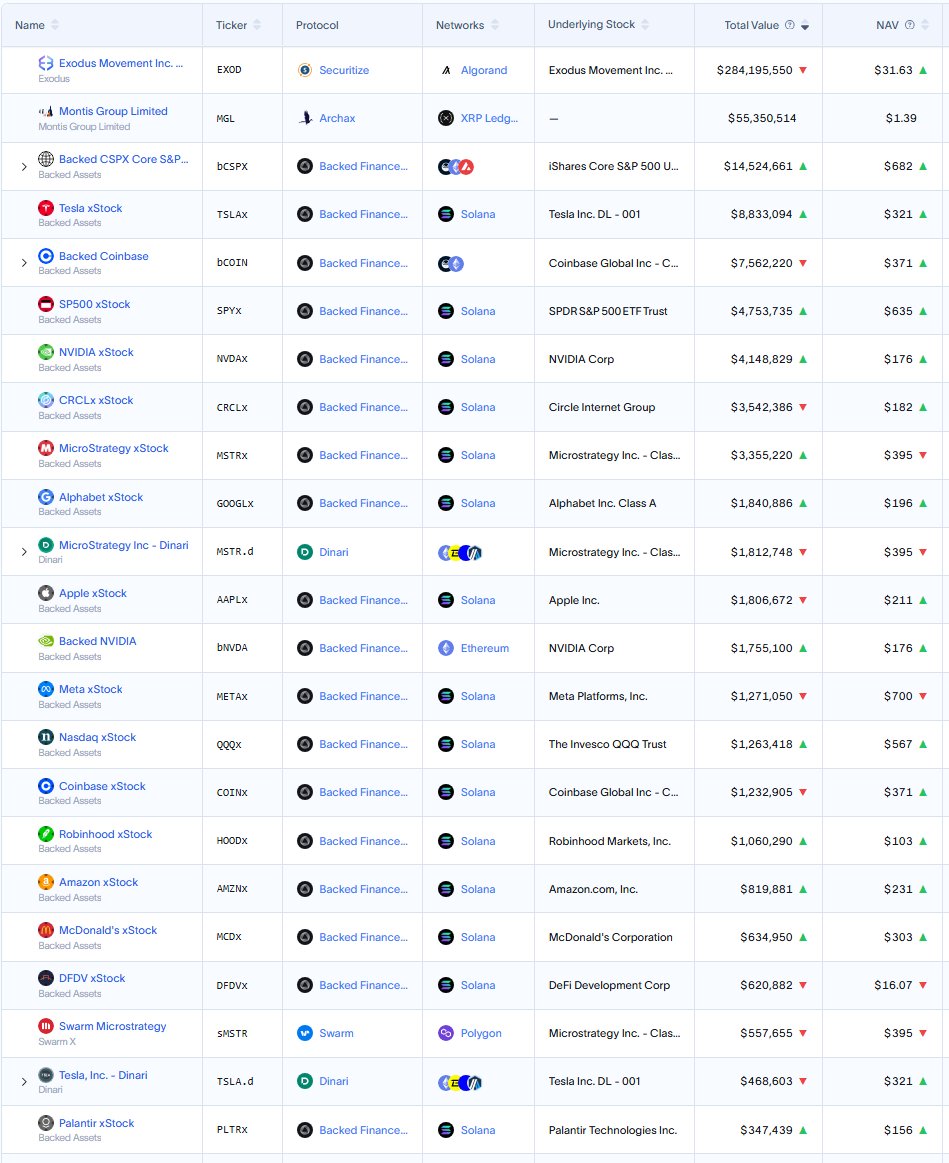

Asset Data Insights

-Top Assets: $EXOD dominates with 81.03% share, $284M market cap. It’s the first SEC-approved stock for tokenization, listed on NYSE in Dec 2024, and the main driver for Algorand’s RWA TVL. But $EXOD is a single asset, not a platform—expect this monopoly to fade as the market matures.

-Other Majors: Familiar names—$TSLA, $COIN, $NVDA, $MSTR, $APPL, $CRCL, $META. Index tokens like SP500 and QQQ are also live.

-Protocols: Besides Securitize for $EXOD, Backed Finance leads for blue chips, mostly on Solana. Dinari, Swarm, Gnosis, Ethereum, and Avalanche also have TVL, with some assets like $COIN, $MSTR, $TSLA issued cross-chain.

-Scale: Most tokenized stocks are still <$10M TVL, with the majority under $1M—still early innings.

3.Forward Outlook

After two months of debate, the market is bullish on the potential of tokenized US stocks:

-Frictionless Trading: Not just lower entry (as little as €1), but a >70% cut in brokerage, settlement, and admin fees. No FX or cross-border costs for global users.

-Open Funnel: Relaxed KYC and 24/7 trading could be 10x user base and 100x liquidity. Anyone, anywhere, can trade the world’s best stocks, anytime.

-DeFi & Derivatives: Tokenized stocks should be DeFi money-legos: collateral for lending, AMM-based options, LP strategies, and perpetuals for pro traders—all without selling the underlying.

Looking 5 years out, if just 1% of global equities are tokenized, that’s a $1.5T market—over 1,000x from today. We remain long-term bullish on tokenized stocks as the future backbone of RWA and on-chain assets.

33.6K

14

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.