A lot of you faded $DOLO very early on when the information was public and free.

Never fade the leading money market @Dolomite_io , and especially never fade @CoreyCaplan3 .

Dolomite is one of the most anticipated token launches this quarter.

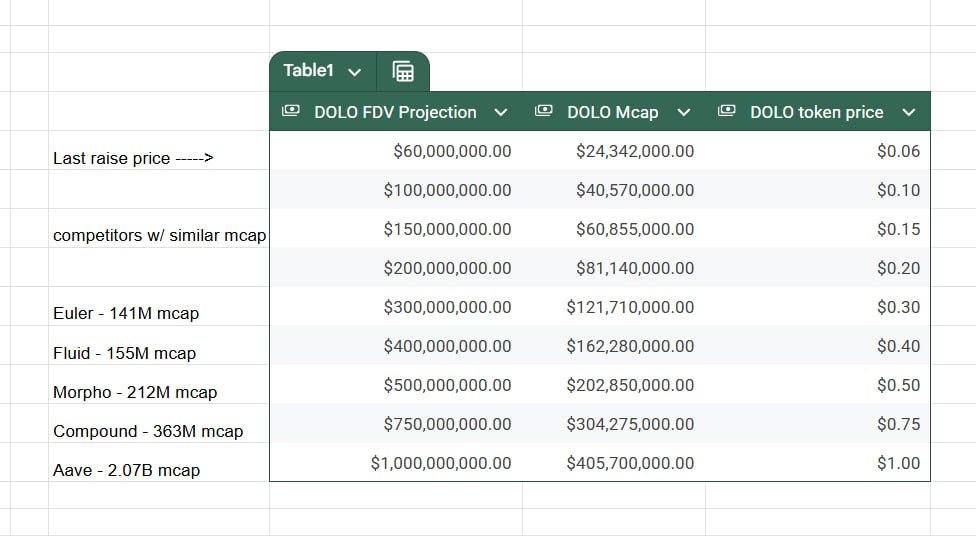

@Dolomite_io's last funding round valuation was $60m (prior to their successful @berachain launch and achieving over $1 billion in TVL) and approximately 40.5% of tokens are circulating at launch (including veDOLO which is locked).

If $DOLO were to open trading at this price it would have a $24.3M mcap.

Now, let's take a look at some similar lending protocols and where they currently trade for a comparison and do some moon math:

For context:

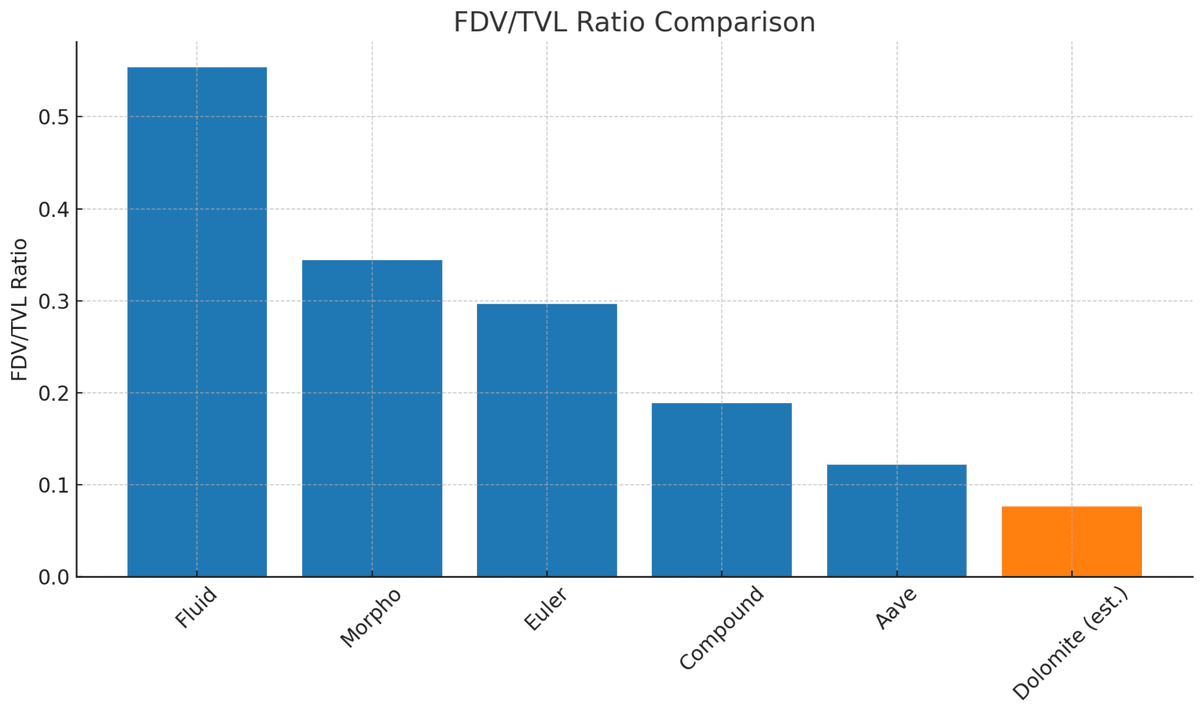

- @aave has ~$18B TVL and $AAVE sits at $2.07B mcap / $2.2B FDV

- @MorphoLabs has ~$2.6B TVL and $MORPHO sits at $212M mcap / $895M FDV

- @compoundfinance has ~$2.15B TVL and $COMP sits at ~$363M mcap / $406M FDV

- @0xfluid has ~$711M TVL and $FLUID sits at ~$155M mcap / $394M FDV

- @eulerfinance has ~$691M TVL and $EUL sits at ~$141M mcap / $205M FDV

Despite being valued significantly lower than less innovative competitors, @Dolomite_io stands out with an estimated launch mcap nearly 10x lower than comparable money markets—making it one of the most asymmetric opportunities right now.

Some moon math:

Unlike many legacy protocols that have stagnated, Dolomite brings fresh innovation to lending and capital efficiency with features others simply don’t offer:

• Dynamic Collateral – continue staking, voting, claiming rewards, and participating in governance while borrowing against assets.

• Smart Debt & Collateral – earn trading fees on both collateral and borrowed assets to offset borrow costs.

• Unlimited isolated positions – build complex, risk-managed strategies without cross-contamination.

• Modular architecture – rapidly ship new features and adapt to emerging DeFi trends (like Berachain’s PoL).

Dolomite isn’t just a money market. It’s a fully-fledged DeFi platform—and at these valuations, I felt like it was necessary to drop some numbers.

TLDR to the brainless apes who follow me:

Dolomite’s superior tech stack and potentially low FDV/TVL ratio, extensive integrations, innovative features like Dynamic Collateral and Smart Debt, and co-founder @CoreyCaplan3's advisory role with @worldlibertyfi, I am personally very optimistic about this launch.

12.27K

42

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.