The @LiquityProtocol V2 tech stack is underrated.

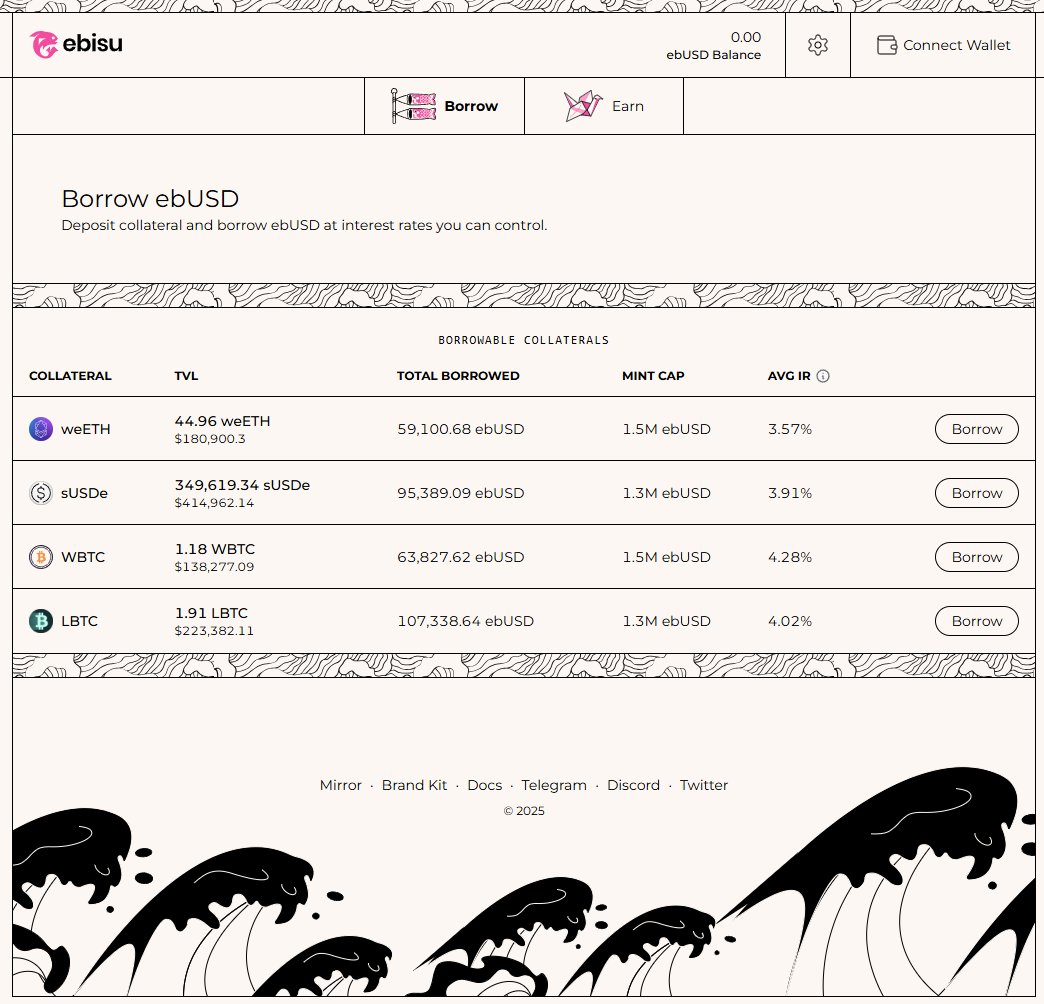

@ebisu_finance just launched and allows you to borrow against $sUSDe AT A FIXED RATE.

I repeat: you can borrow against sUSDe AT A FIXED RATE.

TL;DR 31% APR on sUSDe w/ fixed borrow.

This is a game changer. Let's look 🧵👇

The way the Liquity V2 stack works is that you choose your borrow rate.

In doing so, you place yourself within the redemption queue according to how low your fixed rate is.

The lower the fixed rate, the higher up on the queue you are.

The redemption queue is also simple. When ebUSD (or BOLD for Liquity V2) depegs, people can redeem it for underlying collateral.

This is a great PSM (peg stability module).

Borrowers set their queue tolerance, and ebUSD users can rest assured they can always redeem if need be.

Some looping math...

At 4.9x leverage at 3.8% fixed borrow cost and an 10.31% APY on sUSDe...

4.9 * 10.31 - 3.9 * 3.8

= 35.7% net APR

And remember, that borrow cost is fixed.

BUT, if you wanted to be protected from redemptions, you could always go to the left of 4.7% borrow cost, having a huge redemption buffer before you.

In that case, you'd get 32% net APR and rest easy.

Note: I'm a Liquity enthusiast and ambassador, as well as a loop afficionado.

25.94K

155

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.